How to Calculate Property Tax Online in India?

Government of India charges property tax from the landowners through the municipal corporation or local government. According to Income Tax Act, 1961, individuals owning property, or any building is liable to pay property tax.

What is Property Tax in India?

Property Tax defined as every landowner or real estate owner of tangible assets such as residential buildings, office buildings, and others are liable to pay property taxes to the government bodies such as the municipal corporation or panchayat.

Property tax is mandatory for a person possessing residential, commercial or let-out property, and is payable either on a yearly or half-yearly basis as per convivence. The tax amount is determined depending upon the property location, current valuation, and law of the particular area.

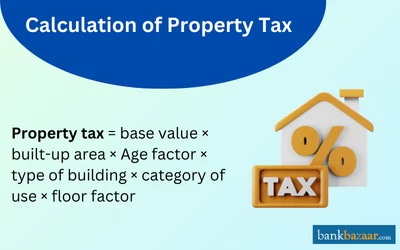

Calculation of Property Tax

The formula used for calculating property tax is given below:

Property tax = base value × built-up area × Age factor × type of building × category of use × floor factor.

Property tax in India depends on the location of a property in question, with taxes varying from state to state. Different civic corporations use different methods to calculate tax, but the general overview of such calculations remains the same and is explained below.

An assessment of the property is first carried out by determining the following:

- Area it is in

- Occupancy status (whether it is self-occupied or rented out)

- Type of property (residential, commercial or land)

- Amenities provided (car park, rainwater harvesting, store, etc.)

- Year of construction

- Type of construction (multi-storied/ single floor/ pukka or kutcha structure, etc.)

- Floor space index

- Carpeted square area of the property.

Once these parameters are determined the civic agency can use a formula it deems fit to calculate tax. Different agencies use different formulas.

The tax on a property will vary according to the factors mentioned above and can be easily computed online, through the official website of the municipal corporation concerned.

Related Articles on Property Tax

- BBMP Property Tax

- MCD Property Tax in Delhi - How to Pay MCD House Tax Online

- SDMC Property Tax 2023-24

- A Khata and B Khata Property Tax

- East Delhi Municipal Corporation (EDMC) Property Tax

- Chennai Corporation Property Tax Online Payment

- North Delhi Municipal Corporation Property tax

- GHMC Property Tax in Hyderabad 2023

- Ghaziabad Nagar Nigam House Tax

- Kolkata Municipal Corporation (KMC) Property Tax

- Property Tax Mumbai 2023-24

- Pay Property Tax Online

- Coimbatore Property Tax

- Kanpur Nagar Nigam House Tax

Types of Property

Property in India is classified into four categories, which help the government estimate tax based on certain criteria. The different property divisions in the country are mentioned below.

- Land - in its most basic form, without any construction or improvement.

- Improvements made to land - this includes immovable manmade creations like buildings and godowns.

- Personal property - This includes movable man-made objects like cranes, cars or buses.

- Intangible property - In the form of licenses, patents, etc.

How to Pay Property Tax?

The property tax can be paid both offline and online. To pay through offline mode, an individual needs to visit the local municipal office and submit the amount at the specific counter accepting property tax.

After completion of the process, payment receipt will be provided to the taxpayer for future reference.

Steps to Pay Property Tax Online

Most municipal corporations provide the option of paying property tax online, streamlining the process and saving valuable time. The following are the steps for paying property tax online:

Step - 1: Log in to the official website of their municipality/city corporation.

Step - 2: Choose the tab indicating property tax and navigate to the payment option.

Step - 3: Choose the property tax online application form depending upon the category under which the property falls.

Step - 4: Fill in the required details such as location, property types, and others

Step - 5: Select the assessment year and also select the previous year to clear the dues, if any.

Step - 6: Provide some other essential details such as plot number, identification number, Revenue Survey number, etc.

Step - 7: Select the preferred payment option to complete the online tax payment which could be credit/debit cards or internet banking.

Note: These are the basic steps involved in paying property tax online and could vary depending on the city/town corporation.

How to Download Property Tax Receipt or Challan Online?

The following are the steps to download the property tax receipt or challan online, after payment of tax:

Step 1: Visit the official website of your concerned Municipal Corporation

Step 2: Log in with OTP to access the citizen account

Step 3: The details of property tax payment will be displayed on the screen

Step 4: Select ‘Action’ option and click on ‘tax paid details’

Step 5: Select ‘download receipt’ option and click on ‘download’ option to complete the process.

Different Methods of Calculating Property Tax

In general, the municipal authorities use one of the following three methods for the purpose of calculation of property tax:

- Capital Value System (CVS): The property tax is calculated as a percentage of the market value of the property depending on the locality, under CVS. This is the system of property tax evaluation followed in Mumbai.

- Unit Area Value System (UAS): In this system, the municipal authorities in India first determines the property value depending upon location, land price, and usage. Then multiplies this amount with built-up area to get the actual tax value. This system is followed in cities such as Kolkata, Delhi, Hyderabad, Pune, and Bengaluru.

- Annual Rental Value System or Ratable Value System (RVS): Under Annual Rental Value system, first the property’s rental value is calculated considering the property’s proximity to landmark and other amenities, and its condition, size, and location. Finally, the tax payable is calculated on the rental value of the property. This system is followed in Chennai and some parts of Hyderabad.

How to Get a Property Tax Application Number?

The following are the steps to obtain the tax application number:

Step 1: Visit the official portal of your concerned Municipal Corporations

Step 2: Open the property tax page

Step 3: Click on ‘GIS-based New PID’ option

Step 4: Click on ‘To Know Your New PID Click Here’ and enter old application

Step 5: Click on ‘Search’

Step 6: Select the name and click on ‘Fetch’

Step 7: Check the details displayed on the page for any discrepancies

Click on ‘View your property in Map’ for more information, spot the property on Google map and download or save the detail for future references.

Interest on Property Tax

Late payments towards property tax can attract a fine, generally equivalent to a certain percentage of the amount due. This interest varies from state to state, with some states choosing to waive off such interest and others charging rates from 5% to 20%, depending on their individual policies.

For Example:

Some states waived off penalties on property tax while Bangalore decided to slash interest for late payments from 20% to 10%, in a bid to get more people to pay their dues.

Tax Deductions against Income from Property

Section 24 is titled as "Deductions from income from house property". 'Income from house property' is applicable in the following cases:

- If you are renting out your house(s), then the rent received will be considered as part of your income

- If you have more than 1 house, then the Net Annual Value of the houses, except the house you are living in, will be considered as your income.

- If you own only 1 house and you are living in it, the income from house property will be considered as NIL. Any income derived from rent and annual value of additional houses, will be subject to tax after deductions made under Section 24.

Deductions under Section 24

There are 2 types of deductions under Section 24 of the Income Tax Act:

- Standard deduction: Under this system, an individual is exempted from tax payment of up to 30% of the net annual value and this system is not applicable for those individuals occupying the only house that they own.

- Interest on loan:

(i) Interest paid on the principal amount of the loan availed for construction, renovation, or to fund a purchase of house, is exempt from tax payments.

(ii) An individual can avail themselves of tax exemption of up to Rs.2 lakh if they take a loan for their self-occupied property.

(iii) No deduction can be availed for commission or brokerage to arrange the loan or tenant.

(iv)The purchase of house, construction or renovation should be completed within 3 years of the loan tenure, otherwise an individual can only avail themselves of tax exemption of Rs.30,000 instead of Rs.2 lakh.

Deduction under Section 80C

The following are points to remember to avail tax deduction under Section 80C on property:

- Under Section 80C of Income Tax Act 1961, homeowners possessing only one house property on the date of sanction of the loan can avail themselves of tax deductions.

- Home loan amount should be less than Rs.35 lakh and the property value should be less than Rs.50 lakh.

Capital Gains Tax on Property

The tax charged on the profit made from the sale of a property is known as capital gains tax. If not handled properly, Capital gains tax can be a significant cause of wealth loss. An easy solution is to buy a new house using the profits of a property sale; however, such property must be purchased within two years of the selling date.

The proceeds from a property sale can also be used to build a dwelling, reducing the amount of capital gains tax on property.

Present State of Property Tax

In India, property tax is levied on 'real property', which includes land and improvements on it, with the government valuing each property and charging the tax in proportion to its monetary value.

The municipality of a certain area is responsible for this assessment and determining the property tax, which can be paid annually or semi-annually.

This tax revenue is utilized to improve local amenities such as road repairs, park and school maintenance, and so on. Property taxes range from one location to the next, as well as between cities and municipalities.

FAQs on Property Tax

- Is property tax decided by the central government?

No. Property tax is determined by your local administration - that is, urban local bodies such as Municipal Corporation and similar organizations.

- My house owner says I as a tenant should pay the property tax. Is that legal?

No. In certain countries tenants are liable to pay property tax but in India the house owner has to pay the tax. If your house owner is forcing you to pay this amount, then you can sue him in the civil court.

- Is there any way I can get exemption from property tax?

You may get a property tax exemption based on your age (if you are a super senior citizen, for example), net income of the individual, type of property, location of property (if it is located in a famine zone or such affected regions), history of public service or value of the taxable property. If you have a vacant plot of land, you don't have to pay property tax on it. You need to check with your local administration for the details.

- Why is my property tax assessment higher than the value of my property?

Either you are not aware of the market value of your property, or your assessment is wrong. It is best to approach your local administration and clarify. The tax bill will also give you a clue on why the tax amount is high.

- Can I make property tax payments online?

This depends on your municipal authority. If they allow online payment of property tax, you can make use of that facility. Bengaluru, for example, has recently started allowing property tax payments online.

- Is property tax deductible from income tax?

If an individual is filling in for federal income tax return, then the taxpayer can avail tax deduction for the property tax paid throughout the year and earn refund, as applicable.

- Which system of property tax is followed in India?

Capital Value System of the property tax is followed in India, in which the market value of the property is determined by the government depending upon various factors including its location. This is published annually and revised on a yearly basis and is further used to calculate the tax amount.

- What will happen if I fail to pay property tax in India?

If you fail to pay the property taxes, then you will incur applicable penalty charges depending upon the state. In adverse cases, if the owner does not pay even after official notice, then it might lead to imprisonment or strict Government action.

- How much of house property is free from tax?

If a property is worth (Gross Annual Value) below Rs.2.5 lakh and the owner earn rental income from the property, then the owner is exempted from tax payment. In case, the rent is the main source of income for the individual, then the person may become liable to pay taxes.

- Who is exempt from paying real property tax?

Convents, mosques, charitable institutions, parsonages, churches, and all land, building, and other property used directly and exclusively for education, charitable and religious purposes are exempted from paying property taxes.

- Is there any exemption of property tax for women?

Government of India offers various monetary benefits to the women of the country for their empowerment. Women house owners can earn property tax rebates alongside various other benefits such as stamp duty concession, credit subsidy for house, low interest rates on house loans, and many others.

- How much is the property tax in India?

The percentage of property tax in India varies from state to state. In general, the percentage of property tax in India varies between 5.00% to 20%.

- Is local property tax to be paid every year?

Yes, local property tax has to be paid on a yearly basis. If you have residential property, then you are liable to pay Local Property Tax (LPT) on 1 November each year.

- Who is liable to pay property tax?

Owner, joint owner, or an individual physically residing in the property is liable to pay property tax. In the case of joint ownership, the main owner should nominate the joint owner as the designated liable person for property tax payment.

News About Property Tax

Payment of MCD property tax extended till 31 March

Property tax payments in Delhi now have an extended deadline until 31 March, without incurring any penalties, as announced by the Municipal Corporation of Delhi (MCD) amidst the ongoing pandemic situation.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.