How Is Your CIBIL Score Calculated?

Loading your search...

CIBIL score is calculated by analyzing factors such as payment history, credit utilization, credit length, credit mix and recent credit inquiries. These elements are assigned specific weights, and their collective assessment determines an individual's creditworthiness.

Maintaining a positive payment record and responsible credit management are crucial for a good Credit score.

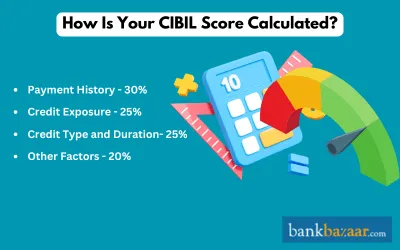

Your CIBIL score is made up of four factors and each of them have a weightage:

Payment History | 30% |

Credit Exposure | 25% |

Credit Type and Duration/ | 25% |

Other Factors | 20% |

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness, calculated using data from your credit report. Lenders and other companies use the data to evaluate your creditworthiness to repay loans on time.

How is CIBIL Score Calculated?

Though they may report slightly different information, your credit score is generally based on the same key factors.

Key factors that influence the calculation of CIBIL score are mentioned below:

Payment History (35%)

- Tracks whether bill payments are done on time.

- Counts the number of late payments and how late they were.

Amounts Owed (30%)

- Refers to your credit utilization compared to your available limit.

- High utilization can negatively impact your score.

Length of Credit History (15%)

- A longer credit history gives lenders more information about your borrowing behavior.

Credit Mix (10%)

- Having different types of credit (e.g., credit cards, car loans, mortgages) shows you are capable of managing varied credit responsibilities.

New Credit (10%)

- Frequent applications for new credit can lower your credit score, thereby signifying financial stress.

- Lenders may view this as a risk factor.

What is the Ideal CIBIL Score you Should Have?

The details of range of CIBIL score and their meaning are given in the table below:

CIBIL Score Range | Meaning |

750 - 900 |

|

700 - 750 |

|

550 - 700 |

|

300 - 550 |

|

Ideal CIBIL Score Rating For Different Types of Loans

The CIBIL score rating for different types of loans are listed in the table below:

Loan | Ideal CIBIL Score |

Personal loan | Above 700 |

Home Loan | Above 650 |

Loan against Property | Above 650 |

Car Loan | Above 700 |

Business Loan | Above 700 |

Gold Loan | Not Required |

How to Check CIBIL Score Online?

Here are the steps to check the CIBIL Score online:

Step 1: Visit the official CIBIL website

Step 2: Select ‘Get Your Credit Score’. You can also click on ‘Check my CIBIL score’.

Step 3: Enter the required details, such as email address, password, first name, last name, ID type, ID number, Pincode, and mobile number.

Step 4: Click on ‘Accept and Continue’.

Step 5: Type in your identity proof details

Step 6: Select ‘Proceed to Payment’.

Step 7: Make payment for the same

Step 8: Your CIBIL report and your score will be sent to your email.

Improving Your CIBIL Score

The following are the points that should be remembered to improve your Credit score:

- Pay on Time

- Always make timely bill payments.

- Credit score and lender perception are negatively impacted by late or missed payments.

- Keep Credit Utilization Low

- Utilise only a small portion of your available credit.

- Credit score gets reduced if credit utilisation is high.

- Maintain a Balanced Credit Mix

- Aim for a healthy mix of secured loans (e.g., home or auto loans) and unsecured loans (e.g., credit cards or personal loans).

- Relying heavily on unsecured credit may be seen as a risk by lenders.

- Apply for Credit Moderately

- Limit the number of new credit applications.

- Credit score gets lowered in case of frequent applications as it indicates financial distress or excessive dependency on credit.

- Monitor Joint and Co-signed Accounts

- Stay updated on co-signed, guaranteed, or joint accounts, as you are equally responsible for any missed payments.

- A partner's negligence in these accounts can damage your credit profile.

- Check Your Credit Report Regularly

- To catch errors or unauthorized activity, review your CIBIL Score and Report throughout the year.

- Raise a dispute on the CIBIL website in case of inaccuracies.

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply BankBazaar's partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.

CIBIL Related Articles

- CIBIL

- Hidden facts about CIBIL Score

- CIBIL Myths

- How Credit Information is important

- CIBIL Redressal Process

- Credit Report for Business Loans

- CIBIL Dispute and Its Resolution

Know More About CIBIL

TransUnion CIBIL is one of the leading credit information companies in India. The company maintains one of the largest collections of consumer credit information in the world. CIBIL Score plays a key role in the lives of consumers. Banks and other lenders check the CIBIL Score of the applicants before approving their loan or credit card application. Consumers can visit the official website of CIBIL to check their CIBIL Score and Report. CHECK YOUR CIBIL SCORE now.

FAQs on CIBIL Score Calculation

- Is my credit score and my CIBIL score one and the same thing?

Yes, your credit score and your CIBIL score are the same. The Credit Information Bureau (India) Limited was the very first credit bureau in the country and so, CIBIL score was a term that was used synonymously with the term, credit score.

- How can I check my CIBIL score online at no cost?

If you want to check your CIBIL score with paying any money, you can search for cibil website on the internet. You should then fill in all details and once you submit this, you will be able to see your credit score.

- Will a loan rejection affect my CIBIL score?

Yes, a loan rejection will lower your CIBIL score.

- Which one is a good score, 650 or 772?

A credit score of 772 is considered good, while 650 is average, according to TransUnion CIBIL. Those with a score of 772 are more likely to get loans or cards at better rates, while a 650 score may limit access to pre-approved offers, depending on the lender.

- How frequently does your CIBIL score get calculated monthly or yearly?

A credit score is calculated periodically and not daily. Credit Information Companies update it every 30 to 45 days based on data provided by banks and NBFCs

- Can I check my CIBIL score myself without impacting my score?

Yes, you can check your CIBIL score without impacting your score. Checking your score is considered as a soft enquiry that does not impact your CIBIL score negatively.

- How to calculate the CIBIL score for a personal loan?

Calculating CIBIL score for easy approval of home loan is simple and effortless. Ensure that you have a CIBIL score ranging between 720 to 750, as any score lower than the minimum limit will lead to extra payout of interest to lenders as compensation for the risk borne by them.

- How to calculate the CIBIL score for a personal loan?

Calculating CIBIL score for easy approval of home loan is simple and effortless. Ensure that you have a CIBIL score ranging between 720 to 750, as any score lower than the minimum limit will lead to extra payout of interest to lenders as compensation for the risk borne by them.

- How to calculate the CIBIL score for a home loan?

CIBIL considers various factors depending on which the CIBIL score is given which helps deciding whether the loan will be approved or not. For easy approval of home loan, CIBIL score of 750 and above is required.

CIBIL Score Requirements for Loans

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.