Personal Loan Interest Rates

Compare the lowest personal loan interest rate starting from 8.75% p.a. and apply for the best personal loan. There are various banks in India which offer personal loans to their customers and you can easily apply for it either online or offline.

Personal Loan Interest Rates (Feb 2026) - Check the Lowest Interest Rates

Bank Name | Interest Rate (p.a.) | Processing Fee |

10.05% to 15.05% p.a. | Up to 1.50% | |

9.99% p.a. to 24.00% p.a. | Rs. 6,500 + GST | |

10.45% p.a. to 16.50% p.a. | Up to 2% | |

9.99% p.a. to 22% p.a. | Up to 2% of loan amount | |

9.50% p.a. to 21.55% p.a. | Up to 5% | |

9.99% onwards | Up to 2% | |

10.49% onwards | Up to 3.5% onwards | |

10.85% to 21% p.a. | Up to 2.5% | |

10.65% p.a. onwards | Up to 2% | |

10.85% onwards | 1% of loan amount, subject to a minimum of Rs.2,500 up to Rs.15,000 | |

Floating: 10.25% p.a. to 15.80% p.a. Fixed: 11.25% p.a. to 16.80% p.a. | 0.35% of loan amount | |

11% to 15.50% p.a. | 1% | |

8.75% p.a. | Up to 1% |

Note: Interest rates mentioned above are updated in Feb 2026. Please note that additional GST will be charged on the applicable processing fee.

How to Get the Lowest Interest Rate on a Personal Loan?

If you are looking to apply for a personal loan, here are a few tips that will help you avail a cheapest rate of interest:

- Improve Your Credit Score: A high credit score indicates that you are creditworthy. Banks and financial institutions offer the lowest personal loan interest rates to applicants who have a high credit score. Thus, you should check your credit score before applying for a personal loan. If your credit score is less than 750, you should look for ways to improve it. There are more chances of you getting a personal loan at a low interest if your credit score is over 750.

- Avoid Missing Repayments: If you miss a loan or credit card repayment, your credit score may be adversely affected. Loan providers usually take your repayment history into account before deciding the personal loan interest rates. Those who have paid their past EMIs and credit card bills on time are likely to be charged a lower interest.

- Keep an Eye Out for Offers: Banks and financial institutions usually offer special interest rates for a limited period of time during festive occasions. If you apply for a loan while such an offer is running, you may be offered a lower rate of interest.

- Compare Interest Rates: Before applying to a particular bank for a personal loan, it is necessary to compare the personal loan interest rates charged by various NBFCs and banks. This will help you avail a personal loan at a competitive interest rate.

- Negotiate with the Lender: If you are an existing customer of a bank or have a good relationship with the loan provider, you can negotiate for the lowest interest rate. When doing this, it is advisable to submit a formal written request to the loan provider.

Factors that Affect Personal Loan Interest Rates

- Income: Loan providers take the applicant's income into account when deciding the interest rate. Individuals who have a high income pose a lower risk to the bank and, thus, might be offered a lower interest rate. On the other hand, those with lower annual incomes may have to pay a higher interest rate.

- Employer Details: If you work for a reputed organisation, the bank/financial institution is more likely to offer you a lower rate of interest.

- Nature of Employment: Loan providers may offer different interest rates to applicants based on whether they are self-employed or salaried.

- Age: The age of the applicant can also have an impact on the interest rate quoted by the loan provider. Individuals who are nearing retirement age may be charged a higher interest rate.

- Relationship with the Loan Provider: Existing customers of the bank/financial institution may be offered a lower rate of interest at the time of applying for a personal loan, provided they have a good relationship with the loan provider. This is, however, at the discretion of the bank and not all existing customers will be offered a preferential interest rate.

Fixed Interest Rates vs Floating Interest Rates: Which is better?

Feature | Fixed Rate | Floating Rate |

Interest Movement | Constant | Market-linked, may vary |

EMI Stability | Remains the same | Can increase or decrease |

Prepayment Charges | Usually applicable | Often waived |

MCLR Linkage | Not linked | Linked to MCLR |

The benefit of opting for a fixed interest rate is that you know exactly how much you will be charged during the loan tenure. Thus, those who wish to plan their finances in advance can opt for a fixed interest rate.

If you, however, don't mind a fluctuating interest rate, you can opt for a floating/variable interest rate. The benefit of opting for a variable interest rate is that your repayment amount will reduce when the interest rate is low.

How Reducing Balance Interest Rates Work in Personal Loans

When you avail a personal loan at a flat interest rate, the interest is calculated on the entire loan amount throughout the loan repayment period. In comparison, if you avail a loan at a reducing interest rate/reducing balance rate structure, the interest is only calculated on the outstanding loan amount. Thus, in this case, when you make a monthly repayment, the interest for the remainder of the loan tenure will be calculated on the outstanding loan balance.

Important Considerations Before Choosing a Personal Loan Interest Rate

While selecting a personal loan with a low interest rate, there are a few other things that you should consider:

- Processing Fee: Loan providers levy a one-time charge known as the processing fee, which can increase the cost of the loan. Even if you are charged a low interest, it is important to check and compare the processing fee charged by different lenders.

- Pre-Closure Charges: Certain banks may charge you a pre-closure fee if you repay the outstanding loan balance before the completion of the loan repayment tenure. Make sure to check if the bank/financial institution that you are applying to levies a pre-closure charge.

- Customer Service: In order to have good borrowing experience, it is necessary to apply to a lender that offers good customer service. Before submitting your loan application, you should check the customer care channels that are available and how prompt the lender is in providing you assistance when required.

- Eligibility Criteria: While the bank or financial institution may offer personal loans at low interest rates, you should make it a point to check if you meet the eligibility criteria specified by the lender. To this end, you should ensure that you check if your income meets the set limit and if you meet the age requirements specified.

- Loan Disbursal Time: If you are looking to take a personal loan due to an emergency, it is important to take the loan disbursal time into account. A number of leading banks and financial institutions disburse the loan amount within a matter of seconds.

- Other Charges: While the lender may charge you a slightly higher interest rate, you may be able to save on the overall cost of the loan if the processing fee, default charges, pre-payment fee, Loan Cancellation Charges, Check/EMI bounce charges, Instrument return charges, Stamp Duty Charges, Duplicate statement issuance charges, swap charges, Duplicate Amortization schedule issuance charges, etc., are low. Thus, make sure you compare the various charges levied by the lender before applying for a personal loan.

- Discounts: Although the bank/financial institution may have specified a high interest rate, you can try to negotiate with the bank for the lowest interest rate. Many times, lenders will give a discount to existing customers and to those who have maintained a healthy relationship with them.

- Special Offers: Certain lenders may charge you a lower interest rate during festive occasions.

*Some loan providers do charge a comparatively higher interest rate; however, you should take certain other factors into account before making a decision.

How to Calculate EMI on Your Personal Loan?

You can use the Personal Loan EMI calculator offered by BankBazaar to calculate the EMI you will have to pay. You will have to enter the loan amount, repayment tenure, interest rate, and the processing fee to know the EMI you will pay on a monthly basis.

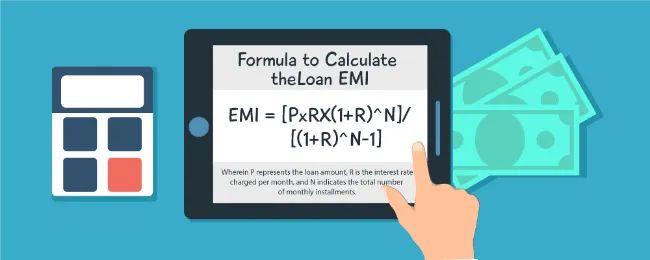

Formula to Calculate Personal Loan EMI

EMI = [PxRX(1+R)^N]/[(1+R)^N-1], wherein P represents the loan amount, R is the interest rate charged per month, and N indicates the total number of monthly installments.

Additional Charges You Should Know Before Taking a Personal Loan

Apart from your loan rate, there are a few other charges that form a part of your cost. These include the following:

- Processing charges - for processing your application

- Verification charges - for verifying your background and other parameters

- Government taxes - for example, GST

- Late payment fees - if you don't pay your EMIs on time

- Prepayment fees - if you want to prepay a part of your loan

- Foreclosure fees - if you want to close your loan ahead of schedule

How Lenders Calculate Prepayment Charges on Personal Loans

The prepayment fee is usually calculated in two ways:

- As a percentage of the amount you want to prepay, or

- As a percentage of the principal amount outstanding at the time of prepayment.

Some lenders may charge you a fixed fee for this facility.

FAQs on Personal Loan Interest Rates

- How does my income determine my interest rate?

Your income denotes your capacity to repay a loan. A higher income shows that you have a better financial bandwidth to repay the loan on time. This means that your risk level is low. Lenders prefer individuals with low-risk profiles and may hence offer you a lower interest rate.

- What is the average interest rate on personal loans?

Most banks charge personal loan interest rates between 8.75% to 24% p.a. The interest rate that you are charged will vary based on a number of factors such as your credit score, your income, the company that you are employed with, your age at the time of applying for the loan, etc. Thus, make sure to compare interest rates of different loan providers before applying for a personal loan.

- How does my credit score impact the cost of my loan?

A good credit score indicates that you are responsible in handling your finances. This keeps your risk rating low. If your credit score is 750 and above, most likely you will be offered preferential rates.

- How does my current debt level determine my interest rate?

When processing your loan application, lenders will look at how much debt you currently have. If you're spending most of your current income to repay existing loans, they may not grant you a personal loan. Even if they do, they will charge you a high rate of interest.

- How can I get a good interest rate?

If you have a credit score, preferably above 750 and are on good terms with the lender concerned, you might get preferential rates. Also, working in a well-known company and having a good credit profile may fetch you better rates.

- Can I get an interest rate lower than what is advertised by the lender?

Yes, you may be able to get an interest rate lower than what is advertised by the lender. This is where negotiation plays a vital role. If you're able to negotiate well with the lender, you may be able to get a good rate.

- Can I get a low rate of interest even if my credit score is bad?

Yes, you may be able to get a personal loan for low credit score. You can try and get a good rate by getting a co-applicant with good credit to apply along with you. Another way is to get a guarantor with good credit to back you up.

- If I offer collateral, will it help me get a good interest rate?

Offering collateral is another way to get an affordable rate of interest. Your rate is determined based on your risk level. Offering collateral reduces your risk level significantly as it serves as security against non-repayment. But do keep in mind that if you fail to repay the loan on time, the lender might take over your collateral.

- Will I get a lower rate of interest if I take a loan from my existing lender?

Having an existing relationship with a bank or lender is always beneficial. If you have a good relationship with your current banker, you're likely to get better loan terms. For example, you may get a rate of interest better than what most others get.

- Should I always choose the lowest available interest rate?

The interest on the loan denotes the cost of your borrowing. Hence, it is always better to opt for the lowest interest rate available in the market when you're applying for the loan. But keep an eye out for other charges levied by your lender.

- Should I prepay my loan even if I'm charged a prepayment fee?

This depends on whether you can make up for paying the fee. Prepaying your loan will help you save on interest costs. Prepayments reduce your outstanding principal, which in turn, reduces the interest cost. Compare and see if the prepayment charges are lower than the interest amount you save. If yes, then it makes sense to prepay and terminate your loan faster.

- Can banks change the interest rate during the loan tenure?

If you opt for a personal loan with a fixed interest rate, there will be no changes to the interest rate during the loan tenure. If you opt for a floating interest, the bank may change the interest rate when the MCLR changes.

- Are personal loan interest rates fixed or floating?

You can opt for a fixed interest rate or floating interest rate, based on the options that are provided by the lender.

- Should I take a loan from a loan provider that offers the lowest EMI?

While the EMI is an important factor to take into account, you should also consider other factors such as the processing fee, tenure of the loan, interest rate charged, repayment options, reliability of the loan provider, etc., when applying for a personal loan.

- How often does the variable or floating interest rate change?

Banks will change the variable/floating interest rate each time the Repo-linked Lending Rate (RLLR) changes, as and when decided by RBI.

- How do I benefit if the interest is calculated on a daily/monthly reducing balance?

In the case of monthly reducing loans, the principal amount gets reduced each time you pay an EMI, and the interest will only be calculated on the outstanding balance. In the case of daily reducing loans, the principal gets reduced on a daily basis and the interest is charged on whatever balance is outstanding. You, being the borrower, stand to benefit if you opt for a monthly/daily reducing personal loan since the overall interest that you will have to pay will be less.

- How does balance transfer help you get a lower interest rate?

Personal loan balance transfer is a process by which the borrower transfers their outstanding loan balance from their current loan provider to a new loan provider. The primary benefit of doing this is that you can transfer the outstanding loan amount to a bank/financial institution that offers a lower interest rate, thereby reducing the overall interest that you will have to pay during the loan tenure.

- Is there any relationship discount on interest rates?

If you currently have a good relationship with a loan provider, i.e. you are an existing customer of the bank/NBFC or you have availed a loan in the past for which all repayments were done as per schedule, you may be offered a preferential interest rate. However, this does not mean that all existing customers who apply for a personal loan will be offered a discounted interest rate.

Personal Loans by Bank

- SBI Personal Loan

- HDFC Personal Loan

- IDFC First Personal Loan

- Kotak Personal Loan

- Axis Personal Loan

- Yes Bank Personal Loan

- IDBI Personal Loan

- Indusind Personal Loan

- Standard Chartered Personal Loan

- Citibank Personal Loan

- RBL Personal Loan

- Indian Bank Personal Loan

- Canara Bank Personal Loan

- Bank of Baroda Personal Loan

- Bank of India Personal Loan

- Central Bank of India Personal Loan

- Punjab National Bank Personal Loan

- Union Bank Personal Loan

- IOB Personal Loan

- Bank of Maharashtra Personal loan

- UCO Bank Personal Loan

- Punjab and Sind Bank Personal Loan

- Jammu Kashmir Bank Personal Loan

- Indiabulls Dhani Personal Loan

- Shriram Finance Personal Loan

- Aditya Birla Finance Personal Loan

Personal Loan Eligibility by Banks

- SBI Personal Loan Eligibility

- HDFC Personal Loan Eligibility

- Kotak Personal Loan Eligibility

- Axis Bank Personal Loan Eligibility

- SCB Personal Loan Eligibility

- Tata Capital Personal Loan Eligibility

- IDBI Bank Personal Loan Eligibility

- Indusind Personal Loan Eligibility

- RBL Personal Loan Eligibility

- Yes Bank Personal Loan Eligibility

- Canara Bank Personal Loan Eligibility

- Bank of Baroda Personal Loan Eligibility

- PNB Personal Loan Eligibility

- IOB Personal Loan Eligibility

- Union Bank Personal Loan Eligibility

- Central Bank of India Personal Loan Eligibility

- UCO Bank Personal Loan Eligibility

- Bank of India Personal Loan Eligibility

- Bank of Maharashtra Personal Loan Eligibility

- City Union Bank Personal Loan Eligibility

- Corporation Bank Personal Loan Eligibility

- Dhanalakshmi Bank Personal Loan Eligibility

- Karnataka Bank Personal Loan Eligibility

- Karur Vysya Personal Loan Eligibility

Personal Loan Interest Rates by Bank

- HDFC Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates

- SCB Personal Loan Interest rates

- Tata Capital Personal Loan Interest rates

- RBL Bank Personal Loan Interest rates

- YES Bank Personal Loan Interest rates

- Canara Bank Personal Loan Interest Rates

- Bank of Baroda Personal Loan Interest Rates

- Punjab National Bank Personal Loan Interest rates

- Central Bank of India Personal Loan Interest rates

- Bank of India Personal Loan Interest rates

- UCO Bank Personal Loan Interest rates

- Corporation Bank Personal Loan Interest rates

- TMB Personal Loan Interest rates

Personal Loan EMI Calculator by Bank

- HDFC Personal Loan EMI Calculator

- AXIS Bank Personal Loan EMI Calculator

- Kotak Personal Loan EMI Calculator

- SCB Personal Loan EMI Calculator

- SBI Personal Loan EMI Calculator

- TATA Capital Personal Loan EMI Calculator

- YES Bank Personal Loan EMI Calculator

- PNB Personal Loan EMI Calculator

- Canara Bank Personal Loan EMI Calculator

- IOB Personal Loan EMI Calculator

- UCO Bank Personal Loan EMI Calculator

- KVB Personal Loan EMI Calculator

Personal Loan Customer Care by Bank

- SBI Personal Loan Customer Care

- HDFC Personal Loan Customer Care

- IDFC First Personal Loan Customer Care

- Kotak Personal Loan Customer Care

- Axis Bank Personal Loan Customer Care

- TATA Capital Personal Loan Customer Care

- Shriram Finance Personal Loan Customer Care

- Indusind Personal Loan Customer Care

- Indiabulls Personal Loan Customer Care

- BOB Personal Loan Customer Care

- IIFL Bank Personal Loan Customer Care

- Yes Bank Personal Loan Customer Care

- RBL Personal Loan Customer Care

- Punjab National Personal Loan Customer Care

- Canara Personal Loan Customer Care

- UCO Bank Personal Loan Customer Care

- Union Bank Personal Loan Customer Care

- Bank of India Personal Loan Customer Care

- Standard Chartered Personal Loan Customer Care

Personal Loan Status Track by Bank

- HDFC Bank Personal Loan Status

- IDFC First Personal Loan Status

- Yes Bank Personal Loan Status

- Tata Capital Personal Loan Status

- Axis Bank Personal Loan Status

- KOTAK Bank Personal Loan Status

- IndusInd Personal Loan Status

- SBI Bank Personal Loan Status

- PNB Bank Personal Loan Status

- Canara Bank Personal Loan Status

- Mahindra Finance Personal Loan Status

- Shriram Finance Personal Loan Status

- CITIBANK Bank Personal Loan Status

- IIFL Bank Personal Loan Status

- SCB Personal Loan Status

- RBL Personal Loan Status

- BOB Personal Loan Status

- Central Bank of India Personal Loan Status

- BOI Personal Loan Status

Personal Loan Articles

- Top Personal loan Finance Companies

- Personal Loan without Documents

- Personal Loan Verification Process

- Personal Loan Disbursal Process

- Personal Loan Preclosure Procedure

- Personal Loan for NRI

- Personal Loan Prepayment

- Pre Approved Personal Loan

- Personal Loan for Non Listed Companies

- Personal Loans by Private Sector Banks

- Microfinance Institutions

- Financial Inclusion Schemes in India

- Process of Bank Guarantee

- Promissory Notes

- Credit Appraisal

- Project Financing

- Statutory Liquidity Ratio

- Marginal Standing Facility

- Personal Loan Preclosure Calculator

- HDFC Bank Personal Loan Preclosure

Other Loans

- Mudra Loan

- Mortgage Loan

- MSME Loan

- Buy Now Pay Later

- Instant Loan

- SBI Mudra Loan

- NABARD

- SIDBI

- SKS Microfinance

- Agriculture Loan

- Business Start up Loan

- Marksheet Loan

- Loans For Unemployed

- Personal Loan for Low Salary

- Personal Loans by NBFCs

- Personal Loan for Govt Employees

- Personal Loan on Aadhar Card

- Personal Loan Insurance Plans

- Personal Loan Top Up

- Personal Loan for Salaried Employees

- Personal Loan for Self Employed

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.