SBI Personal Loan Status

You can avail a personal loan scheme from State Bank of India (SBI) to meet various needs of yours at attractive interest rates and flexible repayment tenure. Once you have applied for a personal loan, you can check the status of your personal loan both online and offline.

What are the Details Required to Check SBI Personal Loan Status?

Once you have applied for an SBI Personal Loan, you can check the status of your personal loan either online or offline. After you have applied for a personal loan you will be given a reference number. You will have to use the reference number and your registered mobile number to check the status of your personal loan.

How to Check SBI Personal Loan Status Online via Loan Account

Given below are the steps that you will have to follow in order to check the status of your SBI Personal loan:

- Visit the personal loan section on the SBI website.

- Click on 'Apply Online'.

- You will be directed to a separate page. On the top right-hand side of the page, click on 'Application Tracker'.

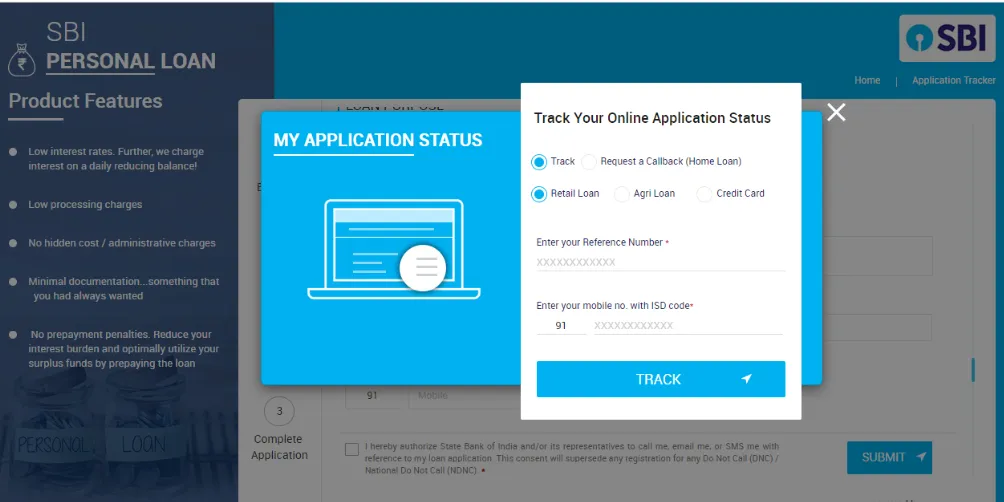

- A pop-up will appear where you will have to select 'Track' and 'Retail Loan'.

- The next step will require you to enter your reference number followed by your registered mobile number. Click on 'Track'. You will be able to see the status of your personal loan.

How to track Loan Status through Reference Number?

Given below are the steps that you will have to follow to check the status of your policy. The screenshots for the same are given below:

- On the official website of SBI, visit the personal loan section.

- Click on 'Apply Online'.

- You will be directed to a separate page where you can apply for a personal loan. On the top right-hand side of the page, you will locate 'Track Application'. Click on it.

- A new pop-up will open where you will have to select 'track' and 'retail loan'. You will have to enter your reference number followed by your registered mobile number and click on 'Track'.

- You can then check the status of your personal loan.

How to Track Loan Status Through the Mobile App

Given below are the steps that you will have to follow if you wish to track the status of your policy from the SBI mobile app.

- Download the SBI Loans app on your mobile phone. If you are an Android user, you can download it from the Play Store app, or from the App Store if you are an iPhone user.

- Open the app and click on 'Personal Loan'.

- Select the Personal Loan scheme availed by you and click on 'Next'.

- On the top left-hand side of the app, click on 'Menu'. A drop-down bar will appear where you will have to click on 'Track Application'.

- Enter your application reference number followed by your mobile number registered with the bank.

- You can then check the status of your personal loan.

Different Ways to Check SBI Personal Loan Status

There are two modes through which you can check the status of your personal loan:

- Online: You can check the status of your personal loan online by visiting the SBI website. You will be required to enter details such as your unique reference number and your registered mobile number to check the status of your personal loan. You can follow the same process by downloading the bank's mobile app.

- Offline: You can check your personal loan status by visiting the nearest SBI branch. You must carry the relevant documents with you and know your reference number and mobile number to check the status of your personal loan. You can also contact the customer care service to check the personal loan status. You must also know your reference number so that it becomes easier for the bank representative to help you know the status of the personal loan.

How to Check SBI Personal Loan Status Offline?

The process to check the status of your SBI personal loan offline is very easy. All you have to do is visit the nearest SBI branch and ask an SBI official to help you check the status of your personal loan. You must ensure that you carry all the relevant documents with you so that you can track your personal loan status in a seamless and hassle-free manner. You must also know your reference number so that the SBI official can help you check your SBI personal loan status.

Toll-Free Numbers for SBI Personal Loan Assistance

You can check the status of your SBI personal loan by calling on their toll-free numbers:

How to Check SBI Personal Loan Status via BankBazaar

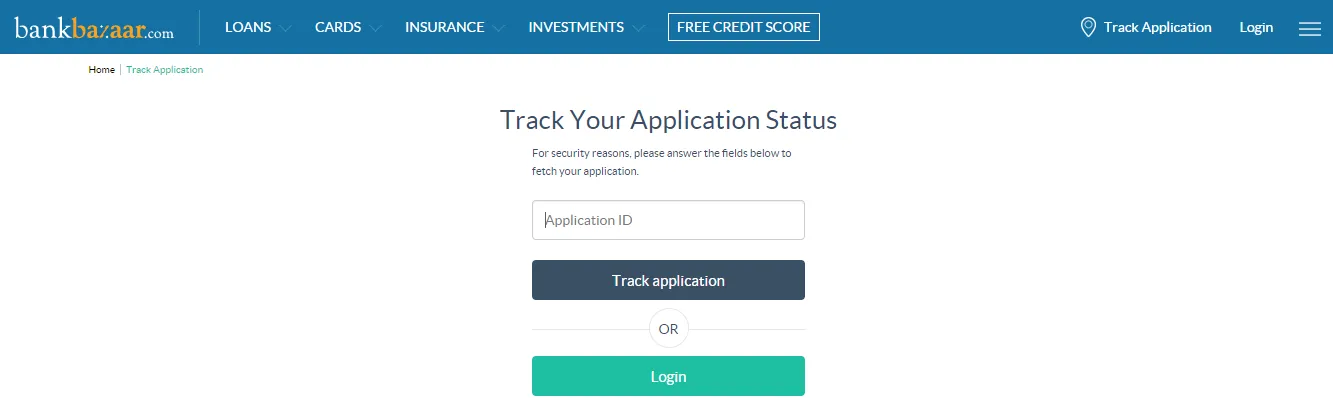

You can visit the BankBazaar official website to check the status of your personal loan. Given below are the steps that you will have to follow to check the status of your personal loan on the BankBazaar website.

- Click on the following link Track Application

- Enter your Application ID and your mobile number. You can also login to the BankBazaar portal using your Facebook or Google account.

- You can then login to the portal and check the status of your personal loan.

FAQs on SBI Personal Loan Status

- How can I check my personal loan status?

Using their application reference number and registered mobile number or date of birth, SBI personal loan applicants can check the status of their personal loan online. In addition, customers can also check the status of their personal loan application by calling the toll-free numbers - 1800 112 211 and 1800 425 3800.

- What are the interest rates of the SBI personal loan?

Depending on the personal loan chosen by the customer, the interest rates will be set anywhere between 11.90% p.a. and 15.30% p.a.

- What are the other modes through which I can check the status of my SBI personal loan?

You can check the status of your SBI personal loan by calling on their toll-free numbers 1800-112-211 and 1800-425-3800 which are accessible from all the landline and mobile phones. You can also call on the number 080 26599990.

- Is it possible to check the status of some other types of loan products availed by me?

Yes, you can check the status of other types of loan products that you have availed. You can visit the SBI website or download the SBI loan app, and under the specific loan product availed by you check the status of your loan product. You will have to enter your reference number and the mobile number registered with the bank to check the status of the loan that you have availed.

- What should I do if my personal loan application loan status is not reflecting online?

If you are unable to check the status of your personal loan either on the SBI website or on the mobile app, then you must immediately call the customer care service number and enquire about the status of your personal loan. You can also visit the nearest SBI branch and check the status of your personal loan.

- Do I need to pay any fee to check the status of my personal loan?

No, you will not be required to pay any fee to check the status of your personal loan. This facility is free of cost and the bank does not charge any fee for it.

- Is there any advantage of checking the status of my personal loan online?

There is no specific advantage of checking the status of your personal loan online except that the whole process is hassle free in nature and saves a lot of time. You can check the status of your personal loan from the comfort of your home provided that you have a smartphone/laptop and a secured internet connection.

Personal Loans by Bank

- SBI Personal Loan

- HDFC Personal Loan

- IDFC First Personal Loan

- Kotak Personal Loan

- Axis Personal Loan

- Yes Bank Personal Loan

- IDBI Personal Loan

- Indusind Personal Loan

- Standard Chartered Personal Loan

- Citibank Personal Loan

- RBL Personal Loan

- Indian Bank Personal Loan

- Canara Bank Personal Loan

- Bank of Baroda Personal Loan

- Bank of India Personal Loan

- Central Bank of India Personal Loan

- Punjab National Bank Personal Loan

- Union Bank Personal Loan

- IOB Personal Loan

- Bank of Maharashtra Personal loan

- UCO Bank Personal Loan

- Punjab and Sind Bank Personal Loan

- Jammu Kashmir Bank Personal Loan

- Indiabulls Dhani Personal Loan

- Shriram Finance Personal Loan

- Aditya Birla Finance Personal Loan

Personal Loan Eligibility by Banks

- SBI Personal Loan Eligibility

- HDFC Personal Loan Eligibility

- Kotak Personal Loan Eligibility

- Axis Bank Personal Loan Eligibility

- SCB Personal Loan Eligibility

- Tata Capital Personal Loan Eligibility

- IDBI Bank Personal Loan Eligibility

- Indusind Personal Loan Eligibility

- RBL Personal Loan Eligibility

- Yes Bank Personal Loan Eligibility

- Canara Bank Personal Loan Eligibility

- Bank of Baroda Personal Loan Eligibility

- PNB Personal Loan Eligibility

- IOB Personal Loan Eligibility

- Union Bank Personal Loan Eligibility

- Central Bank of India Personal Loan Eligibility

- UCO Bank Personal Loan Eligibility

- Bank of India Personal Loan Eligibility

- Bank of Maharashtra Personal Loan Eligibility

- City Union Bank Personal Loan Eligibility

- Corporation Bank Personal Loan Eligibility

- Dhanalakshmi Bank Personal Loan Eligibility

- Karnataka Bank Personal Loan Eligibility

- Karur Vysya Personal Loan Eligibility

Personal Loan Interest Rates by Bank

- HDFC Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates

- SCB Personal Loan Interest rates

- Tata Capital Personal Loan Interest rates

- RBL Bank Personal Loan Interest rates

- YES Bank Personal Loan Interest rates

- Canara Bank Personal Loan Interest Rates

- Bank of Baroda Personal Loan Interest Rates

- Punjab National Bank Personal Loan Interest rates

- Central Bank of India Personal Loan Interest rates

- Bank of India Personal Loan Interest rates

- UCO Bank Personal Loan Interest rates

- Corporation Bank Personal Loan Interest rates

- TMB Personal Loan Interest rates

Personal Loan EMI Calculator by Bank

- HDFC Personal Loan EMI Calculator

- AXIS Bank Personal Loan EMI Calculator

- Kotak Personal Loan EMI Calculator

- SCB Personal Loan EMI Calculator

- SBI Personal Loan EMI Calculator

- TATA Capital Personal Loan EMI Calculator

- YES Bank Personal Loan EMI Calculator

- PNB Personal Loan EMI Calculator

- Canara Bank Personal Loan EMI Calculator

- IOB Personal Loan EMI Calculator

- UCO Bank Personal Loan EMI Calculator

- KVB Personal Loan EMI Calculator

Personal Loan Customer Care by Bank

- SBI Personal Loan Customer Care

- HDFC Personal Loan Customer Care

- IDFC First Personal Loan Customer Care

- Kotak Personal Loan Customer Care

- Axis Bank Personal Loan Customer Care

- TATA Capital Personal Loan Customer Care

- Shriram Finance Personal Loan Customer Care

- Indusind Personal Loan Customer Care

- Indiabulls Personal Loan Customer Care

- BOB Personal Loan Customer Care

- IIFL Bank Personal Loan Customer Care

- Yes Bank Personal Loan Customer Care

- RBL Personal Loan Customer Care

- Punjab National Personal Loan Customer Care

- Canara Personal Loan Customer Care

- UCO Bank Personal Loan Customer Care

- Union Bank Personal Loan Customer Care

- Bank of India Personal Loan Customer Care

- Standard Chartered Personal Loan Customer Care

Personal Loan Status Track by Bank

- HDFC Bank Personal Loan Status

- IDFC First Personal Loan Status

- Yes Bank Personal Loan Status

- Tata Capital Personal Loan Status

- Axis Bank Personal Loan Status

- KOTAK Bank Personal Loan Status

- IndusInd Personal Loan Status

- SBI Bank Personal Loan Status

- PNB Bank Personal Loan Status

- Canara Bank Personal Loan Status

- Mahindra Finance Personal Loan Status

- Shriram Finance Personal Loan Status

- CITIBANK Bank Personal Loan Status

- IIFL Bank Personal Loan Status

- SCB Personal Loan Status

- RBL Personal Loan Status

- BOB Personal Loan Status

- Central Bank of India Personal Loan Status

- BOI Personal Loan Status

Personal Loan Articles

- Top Personal loan Finance Companies

- Personal Loan without Documents

- Personal Loan Verification Process

- Personal Loan Disbursal Process

- Personal Loan Preclosure Procedure

- Personal Loan for NRI

- Personal Loan Prepayment

- Pre Approved Personal Loan

- Personal Loan for Non Listed Companies

- Personal Loans by Private Sector Banks

- Microfinance Institutions

- Financial Inclusion Schemes in India

- Process of Bank Guarantee

- Promissory Notes

- Credit Appraisal

- Project Financing

- Statutory Liquidity Ratio

- Marginal Standing Facility

- Personal Loan Preclosure Calculator

- HDFC Bank Personal Loan Preclosure

Other Loans

- Mudra Loan

- Mortgage Loan

- MSME Loan

- Buy Now Pay Later

- Instant Loan

- SBI Mudra Loan

- NABARD

- SIDBI

- SKS Microfinance

- Agriculture Loan

- Business Start up Loan

- Marksheet Loan

- Loans For Unemployed

- Personal Loan for Low Salary

- Personal Loans by NBFCs

- Personal Loan for Govt Employees

- Personal Loan on Aadhar Card

- Personal Loan Insurance Plans

- Personal Loan Top Up

- Personal Loan for Salaried Employees

- Personal Loan for Self Employed

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.