Kotak Mahindra Personal Loan Status

Kotak Mahindra offers personal loans to interested individuals for any expenditure, from educational to wedding needs. The loan can be availed at attractive interest rates and flexible repayment tenures.

What's more, one can apply for a personal loan online in the comfort of one's home. Kotak Mahindra also offers a special top-up/balance transfer feature too. The bank typically approves the loan at the earliest. Read on to learn how to check if your application has been approved.

What are the Details Required to Check Kotak Personal Loan Status?

You will need to provide any of the following to know the loan application status:

- Application form number

- Lead number

- Mobile number

- Prospect number

- CRN Number

- First Name and DOB

- PAN and DOB

- Last Name and DOB

How to Check Kotak Personal Loan Status through Application Form

- Search for "Kotak Mahindra Personal Loan Status" on google and click on the first link, "Track Application Status - Kotak Mahindra".

- Alternatively, you can scroll down to the bottom of the Kotak Mahindra official website home page and click on the link "Track Application Status"

- On the redirected page, select the name of the product from the drop-down menu. In this case, click on "Salaried Loan".

- Once you select the product, you will have to select one of the identifiers which can be used to track your application. Click on "Application Form Number".

- Type in the application number and click on "Submit"to learn the status of your loan application.

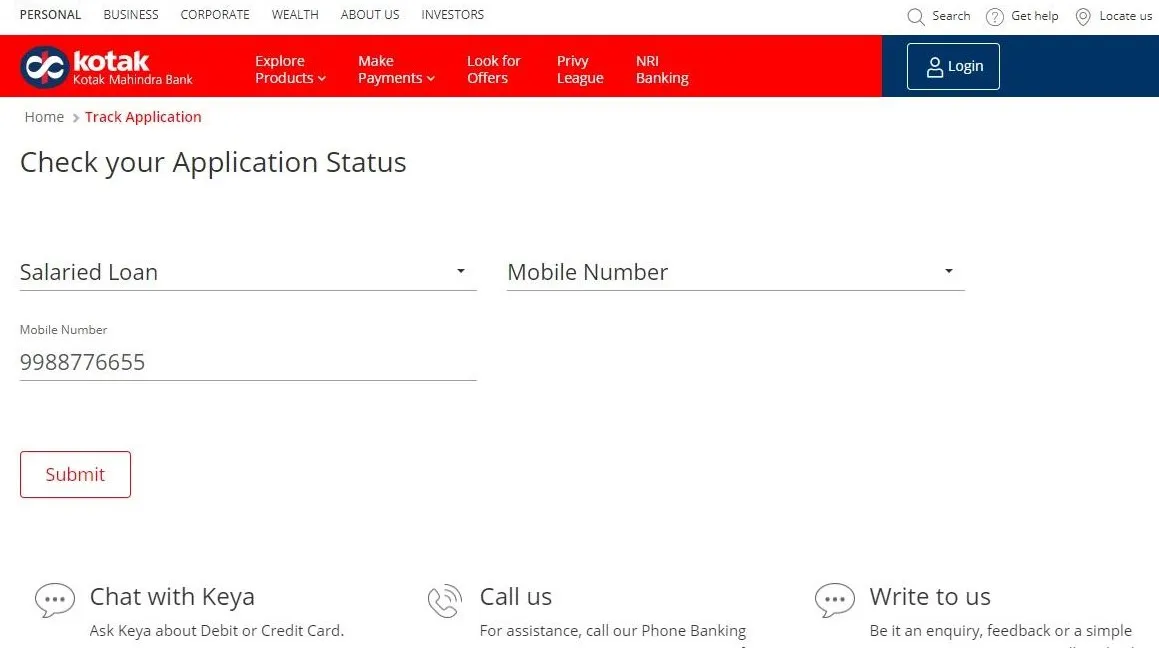

How to Check Kotak Personal Loan through Mobile Number

- Similar to the previous process, you can either google "Kotak Mahindra Personal Loan Status " or visit the official website of Kotak Mahindra and click on the "Track Application Status" link.

- Select "Salaried Loan" from the drop-down menu visible.

- Next, select the identifier from the list provided in the drop-down menu. In this case, click on "Mobile number".

- Type your mobile number and then click on "Submit".

How to Check Kotak Personal Loan Status Offline

If you prefer checking your loan application status offline, you can make use of the below-mentioned options:

- Call the helpline number: You can call Kotak Mahindra's helpline number - 1860 266 2666 to learn the status of your loan application.

- Visit a branch: You can visit the nearest Kotak Mahindra branch to know what your loan application status is.

- Ask the virtual robot: You can also use Kotak's virtual robot called Keya and find the link to track your application status.

Check your Personal Loan Application Status

Kotak Mahindra makes it easy for loan applicants to check the application status by offering different modes as explained below.

- Online channels:One can check the loan application status online through the official website or through the mobile application by following a few simple steps.

- Offline channels: Individuals can also conveniently visit the bank branch or enquire with the customer care cell to get an update on the loan application status.

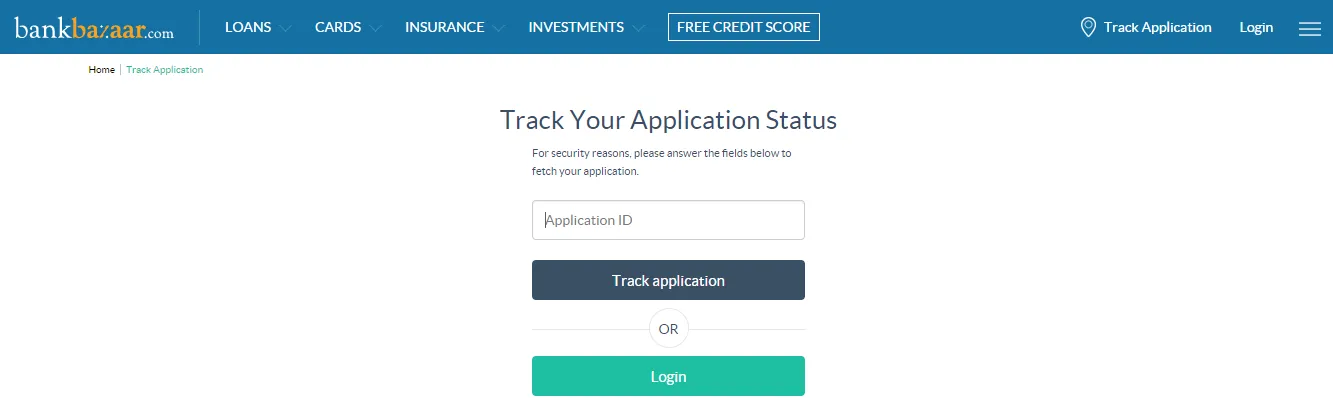

How to Check Kotak Personal Loan Status on BankBazaar

- Visit and click on "Track Application" visible on the right-hand corner of the page.

- On the redirected page, enter your application ID and mobile number and click on "Track Application".

- You will then be able to view the status of your loan application.

Alternatively, you can login to BankBazaar to find out your loan application status.

FAQs on Kotak Personal Loan Status

- What is the maximum loan amount limit offered by Kotak Mahindra?

Any individual looking to get a personal loan from Kotak Mahindra can apply for any amount between Rs.50,000 to Rs.15 lakh.

- Has the bank set any minimum salary requirement?

Yes, the loan applicant should have a minimum net salary of Rs.20,000 per month to get a personal loan from Kotak Mahindra.

- What is the interest rate charged for Kotak Mahindra Personal Loan?

The personal loan offered by Kotak has interests ranging from 10.99% to 24%.

- Does the lender levy any processing charges for the personal loan?

Up to 2.5% of the sanctioned loan amount can be charged as loan processing fees. GST and any other statutory levies

- What are the documents to be submitted to get a personal loan?

Here is a list of documents you need to apply for a personal loan by Kotak Mahindra:

Identity proof, Residence proof, Bank statement for the previous three months, Salary slip for the previous three months and 2-3 passport-sized photographs.

- How to contact Kotak Bank personal loan customer care?

You can contact Kotak Bank personal loan customer care through the following ways:

Call phone banking at 1860 266 2666 (this is a 24x7 helpline number for which standard call charges apply). If you are an 811 customer, you can call the number 1860 266 0811.

Personal Loans by Bank

- SBI Personal Loan

- HDFC Personal Loan

- IDFC First Personal Loan

- Kotak Personal Loan

- Axis Personal Loan

- Yes Bank Personal Loan

- IDBI Personal Loan

- Indusind Personal Loan

- Standard Chartered Personal Loan

- Citibank Personal Loan

- RBL Personal Loan

- Indian Bank Personal Loan

- Canara Bank Personal Loan

- Bank of Baroda Personal Loan

- Bank of India Personal Loan

- Central Bank of India Personal Loan

- Punjab National Bank Personal Loan

- Union Bank Personal Loan

- IOB Personal Loan

- Bank of Maharashtra Personal loan

- UCO Bank Personal Loan

- Punjab and Sind Bank Personal Loan

- Jammu Kashmir Bank Personal Loan

- Indiabulls Dhani Personal Loan

- Shriram Finance Personal Loan

- Aditya Birla Finance Personal Loan

Personal Loan Eligibility by Banks

- SBI Personal Loan Eligibility

- HDFC Personal Loan Eligibility

- Kotak Personal Loan Eligibility

- Axis Bank Personal Loan Eligibility

- SCB Personal Loan Eligibility

- Tata Capital Personal Loan Eligibility

- IDBI Bank Personal Loan Eligibility

- Indusind Personal Loan Eligibility

- RBL Personal Loan Eligibility

- Yes Bank Personal Loan Eligibility

- Canara Bank Personal Loan Eligibility

- Bank of Baroda Personal Loan Eligibility

- PNB Personal Loan Eligibility

- IOB Personal Loan Eligibility

- Union Bank Personal Loan Eligibility

- Central Bank of India Personal Loan Eligibility

- UCO Bank Personal Loan Eligibility

- Bank of India Personal Loan Eligibility

- Bank of Maharashtra Personal Loan Eligibility

- City Union Bank Personal Loan Eligibility

- Corporation Bank Personal Loan Eligibility

- Dhanalakshmi Bank Personal Loan Eligibility

- Karnataka Bank Personal Loan Eligibility

- Karur Vysya Personal Loan Eligibility

Personal Loan Interest Rates by Bank

- HDFC Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates

- SCB Personal Loan Interest rates

- Tata Capital Personal Loan Interest rates

- RBL Bank Personal Loan Interest rates

- YES Bank Personal Loan Interest rates

- Canara Bank Personal Loan Interest Rates

- Bank of Baroda Personal Loan Interest Rates

- Punjab National Bank Personal Loan Interest rates

- Central Bank of India Personal Loan Interest rates

- Bank of India Personal Loan Interest rates

- UCO Bank Personal Loan Interest rates

- Corporation Bank Personal Loan Interest rates

- TMB Personal Loan Interest rates

Personal Loan EMI Calculator by Bank

- HDFC Personal Loan EMI Calculator

- AXIS Bank Personal Loan EMI Calculator

- Kotak Personal Loan EMI Calculator

- SCB Personal Loan EMI Calculator

- SBI Personal Loan EMI Calculator

- TATA Capital Personal Loan EMI Calculator

- YES Bank Personal Loan EMI Calculator

- PNB Personal Loan EMI Calculator

- Canara Bank Personal Loan EMI Calculator

- IOB Personal Loan EMI Calculator

- UCO Bank Personal Loan EMI Calculator

- KVB Personal Loan EMI Calculator

Personal Loan Customer Care by Bank

- SBI Personal Loan Customer Care

- HDFC Personal Loan Customer Care

- IDFC First Personal Loan Customer Care

- Kotak Personal Loan Customer Care

- Axis Bank Personal Loan Customer Care

- TATA Capital Personal Loan Customer Care

- Shriram Finance Personal Loan Customer Care

- Indusind Personal Loan Customer Care

- Indiabulls Personal Loan Customer Care

- BOB Personal Loan Customer Care

- IIFL Bank Personal Loan Customer Care

- Yes Bank Personal Loan Customer Care

- RBL Personal Loan Customer Care

- Punjab National Personal Loan Customer Care

- Canara Personal Loan Customer Care

- UCO Bank Personal Loan Customer Care

- Union Bank Personal Loan Customer Care

- Bank of India Personal Loan Customer Care

- Standard Chartered Personal Loan Customer Care

Personal Loan Status Track by Bank

- HDFC Bank Personal Loan Status

- IDFC First Personal Loan Status

- Yes Bank Personal Loan Status

- Tata Capital Personal Loan Status

- Axis Bank Personal Loan Status

- KOTAK Bank Personal Loan Status

- IndusInd Personal Loan Status

- SBI Bank Personal Loan Status

- PNB Bank Personal Loan Status

- Canara Bank Personal Loan Status

- Mahindra Finance Personal Loan Status

- Shriram Finance Personal Loan Status

- CITIBANK Bank Personal Loan Status

- IIFL Bank Personal Loan Status

- SCB Personal Loan Status

- RBL Personal Loan Status

- BOB Personal Loan Status

- Central Bank of India Personal Loan Status

- BOI Personal Loan Status

Personal Loan Articles

- Top Personal loan Finance Companies

- Personal Loan without Documents

- Personal Loan Verification Process

- Personal Loan Disbursal Process

- Personal Loan Preclosure Procedure

- Personal Loan for NRI

- Personal Loan Prepayment

- Pre Approved Personal Loan

- Personal Loan for Non Listed Companies

- Personal Loans by Private Sector Banks

- Microfinance Institutions

- Financial Inclusion Schemes in India

- Process of Bank Guarantee

- Promissory Notes

- Credit Appraisal

- Project Financing

- Statutory Liquidity Ratio

- Marginal Standing Facility

- Personal Loan Preclosure Calculator

- HDFC Bank Personal Loan Preclosure

Other Loans

- Mudra Loan

- Mortgage Loan

- MSME Loan

- Buy Now Pay Later

- Instant Loan

- SBI Mudra Loan

- NABARD

- SIDBI

- SKS Microfinance

- Agriculture Loan

- Business Start up Loan

- Marksheet Loan

- Loans For Unemployed

- Personal Loan for Low Salary

- Personal Loans by NBFCs

- Personal Loan for Govt Employees

- Personal Loan on Aadhar Card

- Personal Loan Insurance Plans

- Personal Loan Top Up

- Personal Loan for Salaried Employees

- Personal Loan for Self Employed

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.