Section 10 of Income Tax Act - Exemptions and Allowances

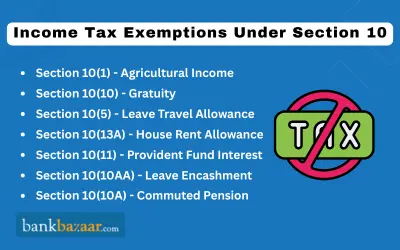

Section 10 of the Income-tax Act, 1961, provides exemptions to ease the income tax burden for salaried professionals. It outlines criteria for tax exemptions and focuses on income sources excluded from total income calculations.

Salaried employees benefit from various allowances under this section, such as Leave Travel Allowance, Uniform Allowance, Travelling Allowance, and House Rent Allowance.

However, some special allowances qualify for exemption under Section 10(14). These allowances, separate from regular salary, address specific employee needs.

While most allowances contribute to total income, specific exemptions under the Income Tax Act apply to certain allowances, often provided as recognition for services or compensation for exceptional work conditions.

Features of Section 10 of Income Tax Act

The following are the significant features of section 10 of Income Tax Act 1961:

- Under this Income Tax Act section, tax rebate is given to salaried professionals.

- Offers tax exemptions, such as tuition fee for children's education, travel allowance, rent allowance, gratuity, and many more to reduce the tax burden.

- Total amount of tax liability of salaried professionals is analysed for calculating total income.

Who can Claim Tax Exemptions under Section 10?

The criteria that must be met to claim tax exemptions under Section 10 are mentioned in the table below:

Age | Tax Exemption (Maximum) |

Under 60 years | Rs.2.5 lakh in a financial year |

Between 60 years and 80 years | Rs.3 lakh in a financial year |

More than 80 years | Rs.5 lakh in a financial year |

Individuals Receiving Allowances Exemption

Under section 10(14)(i) and section 10(14)(ii), special allowances are exempted for specific individuals, such as:

- UNO employees

- Government employees outside India, who are Indian citizen

- High Court Judges

- High court and Supreme Court judges entitled to receive the Sumptuary Allowance

Various Sub-parts of Section 10

The following are the sub-parts of Section 10 and the related details regarding exemptions:

1) Section 10 (1) - Exemption on Agricultural Income

The following is the list of exemptions on agricultural income under Section 10 (1):

- Sale of agricultural produce

- Agricultural operations such as sowing, cultivation, and tilling

- Agricultural land in India yielding rent or revenue

- Earning from farm building required for agricultural purposes

- For preservation and growth or product certain agricultural operations are exempted, such as weeding, pruning, cutting, etc.

Example:

Ms. Monica owns a farm where she grows vegetables. She spends a significant amount of time and money on agricultural operations such as sowing seeds, cultivating the plants, and tilling the soil. At the end of the season, she sells her produce at the local market and earns Rs.2,50,000 from these sales.

Exemptions Applied:

The Rs.2,50,000 earned from selling the vegetables is considered agricultural income.

Under Section 10 (1), this income from the sale of agricultural produce is exempt from tax.

The income Ms. Monica earns from her farming activities is exempt from tax because:

It comes from the direct sale of agricultural produce.

2) Section 10(2) - Exemption on the Income of a HUF

The following is the list of exemptions on income of HUF under Section 10 (2):

- Income must be paid out of family’s income, in case the income received by the individual

- The income must be paid out from the income received from estate belonging to the family in case of impartible estate

Example

Ms. Priya is a member of a HUF. She receives an income of Rs.1,00,000 from the HUF and Rs.15,000 as dividend income. The dividend income is considered her personal income. The Rs.1,00,000 received from the HUF is not taxable. However, the dividend income of Rs.15,000 is taxable.

3) Section 10(2A) - Exemption of Income from a Partnership Firm

The following is the list of exemptions on income from partnership of firm under Section 10 (2A):

- Profit earned by co-owner or partner is exempted from tax

- Income should be taxed as Partnership firm under the Income Tax Act 1961 and the partnership firm must be classified under the act

- The tax exempted is limited to a certain amount of the share of the profit earned by the partners of the Firm or LLP

Example

Ms. Suzy is a partner in a partnership firm named XYZ & Co. The firm has three partners, and it is classified as a partnership firm under the Income Tax Act, 1961. For the financial year, XYZ & Co. earns a total profit of Rs.9,00,000. According to the partnership deed, Ms. Suzy’s share of the profit is 30%.

Exemptions Applied:

Ms. Suzy's share of the profit from the firm is Rs.2,70,000 (30% of Rs. 9,00,000).

This profit share of Rs.2,70,000 is exempt from tax in Ms. Suzy's hands under Section 10(2A).

The profit share of Rs.2,70,000 received by Ms. Suzy is exempt from tax because it is her share of the profit from a partnership firm.

The partnership firm, XYZ & Co., is taxed separately as per the Income Tax Act, 1961.

Therefore, the income Ms. Suzy earns as her share of the firm’s profit is not taxable in her individual tax return.

4) Section 10(4) - Exemptions on the Income earned by an NRI from India

The following is the list of exemptions on the income earned by an NRI from India under Section 10 (4):

- Redemption of bonds yielding premium income

- Credited amount in a Non-Resident (External) Account yielding interest

- Exemption as specified by the government from the income earned in the form of interest from bonds or securities

- The credited amount in a Non-Resident (External) Account yielding interest earned by resident outside India.

Example

Ms. Deepika, an NRI residing in the UK, has invested in Indian government bonds and maintains an NRE account in an Indian bank. She earns Rs.50,000 from the redemption of these bonds and Rs.20,000 as interest credited to her NRE account.

Exemptions Applied:

The Rs.50,000 earned from the redemption of the bonds is exempt from tax.

The Rs.20,000 interest earned in her NRE account is also exempt from tax.

Ms. Deepika's income from the redemption of bonds is exempt because it is specified under Section 10(4) as premium income from bonds. The interest credited to her NRE account is exempt from tax, as specified under Section 10(4).

5) Section 10(5) - Exemption on Leave Travel Concession

The following is the list of exemptions on leave travel concession under Section 10 (5):

- Received from existing employer in a particular financial year for employee and their family

- Entitled for a specific amount from employer on the condition of travel concession across India while on leave

- Must be received in connection with future travel from previous or existing employer.

Example

Ms. Dolly, an employee of LMN Ltd., receives an LTC of Rs.50,000 from her employer for her family's travel expenses within India. This concession is provided for travel planned during her leave in the upcoming summer.

Exemptions Applied:

Ms. Dolly receives Rs. 50,000 from her current employer in the financial year for her family’s travel within India. This amount is exempt from tax under Section 10(5) because it is intended for travel while she is on leave. The exemption applies as the amount is for future travel, aligning with the conditions set by the employer.

The Rs. 50,000 LTC received by Ms. Dolly is exempt from tax as it is granted by her existing employer for the purpose of family travel within India. The exemption covers the specific amount provided by the employer, ensuring it meets the conditions of being used for travel while on leave. The exemption also applies because the concession is linked to future travel, fulfilling the criteria of Section 10(5).

6) Section 10(6) - Exemption to Indian Citizens Working Outside the Country on their Remuneration

The following is the list of exemptions to Indian citizens working outside the country on their remuneration under Section 10 (6):

- Employees must not stay in India for more than 90 days duration

- Remuneration is not entitled for deduation under this act

- Foreign company should not engage in any kind of trade or business in India under this act

Example

Ms. Shagufta, an Indian citizen, works for a foreign company based in the UAE. She earns a salary for her work there and visits India for a total of 85 days during the financial year.

Exemptions Applied:

Since Ms. Shagufta stays in India for only 85 days, she meets the condition of not exceeding 90 days. The remuneration she earns in the UAE is exempt from Indian income tax and is not subject to deductions under the Income Tax Act. The foreign company she works for does not engage in any trade or business in India, fulfilling the necessary condition.

Ms. Shagufta's salary from her employment in the UAE is exempt from Indian tax because she stays in India for less than 90 days in the financial year. The income she earns abroad is not eligible for deductions, ensuring clarity in the exemption. The foreign company's non-engagement in Indian trade or business validates the applicability of the exemption under Section 10(6).

7) Section 10(7) - Exemption on Allowances and Perquisites Paid by the Government

The following is the list of exemptions on allowances and perquisites paid by the government under Section 10 (7):

- Tax exempted under this section for all the allowances and perquisites paid by the government to the employees for their service outside India

- Can be availed by Indian citizens only who are government employees.

Example

Mr. Subir, an Indian citizen, is employed by the Indian government and is assigned to a diplomatic mission in the United States. As part of his employment, he receives various allowances and perquisites from the Indian government for his service abroad.

Exemptions Applied:

All allowances and perquisites received by Mr. Subir from the Indian government for his service outside India are exempt from tax under Section 10(7). This exemption applies specifically to Indian government employees like Mr. Subir who are engaged in service outside India.

8) Section 10(10CC) - Exemption on Tax on Perquisites Paid by the Employer

Under Section 10 (10CC) tax is exempted for non-monetary perquisites on behalf of the employees.

Example

Ms. Abhilasha is an employee of QRST Corporation. As part of her employment package, the company provides her with a company car for both official and personal use. Additionally, QRST Corporation also offers her accommodation in a company-owned apartment near the workplace.

Exemption Applied:

Tax Exemption: As per Section 10(10CC), the total value representing non-monetary perquisites provided by QRST Corporation to Ms. Abhilasha is exempt from taxation. Therefore, she does not need to pay tax on this amount, reducing her taxable income accordingly.

9) Section 10(10D) - Exemption on the Tax of Life Insurance Policy

The following is the list of exemptions on tax on the maturity value of Life Insurance policy under Section 10 (10D):

- Tax exempted for policies with premium paid not more than 20% of the sum assured and issued before 1 April 2012.

- Tax is exempted for policies, if the premium paid is not more than 10% of the sum assured and issued before 1 April 2012.

- Tax exempted on life insurance policies for persons with disability or diseases specified under Section 80U and 80DDB.

As per the Union Budget 2023, the tax exemption rules on life insurance policies issued after 1 April 2023 are:

- Premium paid up to Rs.5 lakh for other life insurance policies

- Total allowable premium paid up to Rs.2.5 lakh for ULIP policy

10) Section 10(11) - Exemption on Payment Made to Provident Fund and Sukanya Samriddhi Account

The following is the list of exemptions on contribution made to Provident Fund and Sukanya Samriddhi Account under Section 10 (11):

- On retirement or termination of service, the contribution made to the Provident Fund account is exempted from tax

- Tax exemption is also applicable for the contribution made to the Sukanya Samriddhi Account

11) Section 10(10BC) - Exemption on the Compensation Received for Natural Disaster

The tax exemptions are allowed on the compensation received for natural disaster under Section 10 (10BC) from the State Government, the Central Government, and local authority.

12) Section 10(13) - Exemptions on House Rent Allowance (HRA)

The following is the list of exemptions on House Rent Allowance (HRA) under Section 10 (1):

- Tax exempted if actual rent paid is 10% less than the salary

- The HRA would be exempted from tax if HRA on rented property in non-metro cities is 40% of the salary or 50% for metro cities

- If the employee receives actual HRA then tax is exempted

13) Section 10(14) - Exemption of Special Allowance

Under special allowance act of Section 10 (14), exemption is granted based on the amount utilised for a specific purpose by the employee. The exemption depends on the following points:

- Allowance amount.

- Actual amount used for the purpose for which the allowance has been granted.

1) Section 10 (14) (i)

Under Section 10 (14)(i), allowances are exempted to the extent of the amount received as allowance or amount spent on certain duties, whichever is the lower figure.

Allowances covered in this category are:

- Daily Allowance: It is given to employees to meet the daily charges incurred when on tour or for the duration of a transfer in the job. This type of allowance is granted when the employee is not in the usual place of duty.

- Travel Allowance: Travel allowance covers costs related to travel while on tour or on transfer while on duty. This allowance also includes travel costs incurred while getting transferred to another location, including packaging or transport of personal objects.

- Research/ Academic Allowance: Allowance granted for the purpose of encouraging academic and research related training, education or professional duties is termed as academic or research allowance.

- Conveyance Allowance: Allowance for conveyance is granted to employees in case of expenses incurred while travelling for duties of office. However, the employer does not pay for travel from home to work as it is not considered as a duty of the office. This allowance comes under a different section called as 'Transport allowance' and is not exempt from tax.

- Helper Allowance: Sometimes your employer allows you to appoint a helper for performing official duties of the office. In such cases, helper allowance is granted.

- Uniform Allowance: Allowance when given for the purchase or maintenance of uniform, required to be worn while on duty is referred to as uniform allowance. This allowance can be opted for only when an office duty prescribes a specific uniform.

Usually, it is not required to furnish details of the expenses incurred under this category of allowance unless the expense are disproportionate to the salary or unreasonable in reference to the duty performed by the employee. At most times, it is not required for you to keep a proof of documents and a simple declaration serves the purpose.

2) Section 10 (14) (ii)

Under this section, allowance granted to employees for working under certain set of conditions while on duty. The amount exempted is either the amount received as allowance or the limit mentioned, whichever is lesser.

The types of allowances in this category and exempt in allowances are listed below:

- Allowance for children education:

- Rs.100 pm for each child and a maximum of two children.

- Compensatory allowance for working in areas of high altitude or hilly areas, also known as climate allowance:

- Hilly areas of HP, UP, J&K and North East - Rs.800

- Siachen are of J&K - Rs.7000 per month

- Common places above 1000mtr or above - Rs.300

- Scheduled or tribal or agency areas allowance:

- Karnataka, West Bengal, MP, Assam, Orissa, Tamil Nadu, Bihar, UP and Tripura. - Rs. 200

- Allowance for duty in border area or remote area or any difficult/disturbed areas:

- Allowances ranging from Rs.200 to Rs.1300 pm are exempt under the Rule 2BB.

- Allowance for working in a transport system for personal expenses, while on duty:

- 70% of allowance up to Rs.10,000 pm.

- Field area allowance:

- Areas of Nagaland, J&K, HP, UP, AP, Sikkim and Manipur - Rs.2600 pm

- Allowance for employee's children's hostel expenses:

- Rs.300 pm for each child up to two children.

- Allowance granted to armed forces for cases of counter insurgency:

- Rs.3900 per month.

- Transport allowance to physically disabled employee on duty to travel to work:

- Rs.1600 per month.

- Transport allowance for commute between work and residence:

- Rs.1600 pm.

- Compensatory allowance for duty in modified field area:

- Specific areas of West Bengal, North East, Rajasthan, J&K, UP and HP - Rs.1000 pm.

- Island Duty allowance granted to armed forces in Andaman & Nicobar and Lakshadweep:

- Rs.3250 per month.

- Allowance for working in underground mines:

- Rs.800 per month.

- Special compensatory highly active field area allowance:

- Rs.4200 pm.

- Allowance for armed forces in a high altitude region:

- 9000 - 15,000ft - Rs.1060 pm

- Above 15,000 ft - Rs.1600 pm

14) Section 10(15)

The following are the exemptions under section 10(15):

- Section 10(15)(i): On redemption, interest, securities, bonds, premiums, deposits for all assesses

- Section 10(15)(iib): Bonds of Capital Investment yielding interest for all HUF or individual

- Section 10(15)(iic): Interest from relief bonds for HUFs or individuals

- Section 10(15)(iid): Declared bonds yielding interest that is bought in foreign exchange which is subject to certain limitations and is applicable for NRI individuals gifting.

- Section 10(15)(iii): Interest from securities and is issued by department under the Central Bank of Ceylon

- Section 10(15)(iiia): Interest earned on deposits from scheduled bank after approval from RBI and exempted to incorporated bank board

- Section 10(15)(iiib): Interest paid to Nordic Investment Bank and exempted to Nordic Investment Bank

- Section 10(15)(iiic): Interest is payable to the European Investment Bank and exempted to European Investment Bank

- Section 10(15)(iv)(a): Interest earned from the local authority or government on the money lent before 1 June 2001 and exempted to financial institutions of foreign nations

- Section 10(15)(iv)(b): Interest received from the industrial undertaking in India under agreement of loan before 1 June 2001 and exempted to financial institutions of foreign nations

- Section 10(15)(iv)(c): Interest earned from Industrial undertakings in a foreign nation for purchasing the raw materials, machinery, and capital plant within certain limitations and conditions before 1 June 2001 and exempted to all the assesses who participated in lending cash.

- Section 10(15)(iv)(d): Interest earned from lending money to financial institutions in Indian before 1 June 2001 and exempted to all assesses who participated in lending cash.

- Section 10(15)(iv)(e): Interest earned from the money lent outside India before 1 June 2001 by financial institutions in Indian under loan agreement and exempted to all assesses who participated in lending cash.

- Section 10(15)(iv)(h): Interest received from approved debentures or bonds of company and exempted to all assesses.

15) Section 10(26)

- Under Section 10(26) of the Income Tax Act, individuals belonging to Scheduled Tribes in Arunachal Pradesh, Manipur, Mizoram, Nagaland, and Tripura qualify for tax exemptions. These exemptions apply to income earned within the mentioned states or through dividends or interest on securities.

- Individuals from Sikkim are eligible for tax exemptions under Section 10(26AAA) of the Income Tax Act. This provision exempts income earned within Sikkim or from dividends or interest on securities.

16) Section 10(23 C)

- Under Section 10(23C) of the Income Tax Act, educational or medical institutions with total annual receipts not exceeding Rs.5 crore qualify for exemption.

17) Section 10(37)

Section 10(37) of the Income Tax Act offers exemptions for capital gains arising from the compulsory acquisition of urban agricultural land, subject to the following conditions:

- The land must have been used for agricultural purposes for at least two years preceding the sale date.

- The compulsory acquisition scheme must be approved by the central government or the Reserve Bank of India (RBI).

Section | Exemption | Details |

Section 10 (1) | Agricultural Income |

|

Section 10(2A) | Income from a Partnership Firm |

|

Section 10(5) | Leave Travel Concession |

|

Section 10 (10) | Gratuity |

|

Section 10 (10A) | Commuted Pension | Exempt for government employees |

Section 10 (10AA) | Leave Encashment | Exempt for government employees. |

Section 10 (10B) | Retrenchment Compensation | Exemption is provided either for:

Whichever is lower |

Section 10 (10C ) | Voluntary Retirement | Exemption is provided either for:

|

Section 10(10D) | Tax of Life Insurance Policy |

As per the Union Budget 2023, the tax exemption rules on life insurance policies issued after 1 April 2023 are:

|

Section 10(11) | Payment Made to Provident Fund and Sukanya Samriddhi Account |

|

Section 10(13A) | House Rent Allowance (HRA) |

|

Section 10(14) | Special Allowance |

|

Section (14) (ii) | Education and Disability Transport Allowance |

|

Section 10 (15) | Interest on Savings Certificates | Exempt on post offices and certain securities:

|

Section 10(26) | ST Income (NE States) |

|

Section 10(23 C) | Educational/ Medical Institutions | Under Section 10(23C) of the Income Tax Act, educational or medical institutions with total annual receipts not exceeding Rs.5 crore qualify for exemption. |

Section 10 (34) | Dividend Income | Exemption is provided for dividend up to Rs.10,000 that has been received until 31 March 2020 |

Section 10 (34A) | Buy-Back Shares | Exemption is provided for buy-back amount that has been received from domestic companies before 1 October 2024 |

Section 10 (35) | Mutual Fund Income | For certain mutual funds, income is exempted until 31 March 2020. |

Section 10(37) | Urban Agri Land Acquisition |

|

Section 10 (38) | LTCG on Equity | On listed mutual funds/ shares, LTCG is exempted if STT has been paid (until 31 March 2018) |

Section 10AA | SEZ Units |

|

Special Individuals Receiving Allowances Exempt

There are certain individuals who also receive allowances exempt under Section 10(11):

- Allowances granted to High Court Judges.

- Allowance given to a UNO employee.

- Sumptuary allowance received by Supreme Court and High Court Judge.

- Allowances granted to government employees who are Indian citizens, working abroad.

According to Section 10(11A) of the Income Tax Act, this is an income tax exemption for anyone working outside India and representing India in that country:

- Trade commissioners, High ranking Embassy officials, and other officers, are eligible for the benefits of this provision.

- For employees working in foreign enterprises provided their living tenure in India should not exceed 90 days, and the company does not have trade or business in India.

How to Claim Exemption under Section 10?

To claim an exemption under Section 10 on your taxes, you will need to follow the standard procedure for filing your income tax return.

- Collect all the necessary information related to your income and the specific exemptions you are eligible for under Section 10 of the Income Tax Act.

- Use either the physical forms provided by the Income Tax Department or opt for e-filing through the official website or authorized platforms.

- In your tax return, accurately disclose all sources of income, including those eligible for exemptions under Section 10. This may include income from dividends, capital gains, agricultural activities, etc.

- Clearly indicate the exemptions you are claiming under Section 10. Provide details of the specific subsections or clauses applicable to your situation.

- Depending on the exemption, you may need to provide supporting documents such as investment proof, certificates, or other relevant paperwork.

- Double-check all the information provided in your tax return to ensure accuracy and completeness. Once verified, submit your return either electronically or by post as per the prescribed procedure.

- Retain copies of your filed tax return and any supporting documents for future reference or in case of any queries or audits by the tax authorities.

FAQs on Special Allowances under Section 10 for Salaried Employees

- Is Section 10 exemption available under the new tax regime?

Yes, income tax is exempted up to Rs.1.5 lakh of maturity benefits of insurance policy and if total premium paid is less than or up to Rs.5 lakh other than ULIPs, under section 10.

- What are the eligibility criteria for Section 10(10D)?

You need to be an EPF member with the age of 58 years or 50 years for reduced pension to be eligible for the exemptions under section 10(10D).

- What does Section 10 (9) exempt?

under the Cooperative Technical Assistance Program, the income of the family members of the foreign employees is exempted under section 10(9).

- What is the tax benefit of Section 10 (10D)?

Under Section 10 (10D) an individual can avail themself of tax benefits on maturity of a Life Insurance policy.

- Is special allowance taxable for salaried employees?

Yes, special allowances are taxable for salaried employees and are paid on monthly basis, which are categorised into various forms, such as official allowance and personal allowance.

- What is the special allowance for salaried employees?

Special allowance is a certain sum of money paid to the salaried employees by their employers to meet certain needs. The amount is pre-determined, and the amount is a fixed sum of extra amount set for all business entities from sole proprietorships to corporates.

- Is special allowance considered for gratuity?

No, special allowance is not considered for gratuity, as the calculation of gratuity constitutes of only Basic salary and Dearness Allowance (DA) and no other components.

- What is the Income Tax Act's Section 10?

Section 10 of the Income Tax refers to income not used to calculate a person's total tax liability. This exempted income is not a part of the total income while calculating the tax liability of the individual.

- What are the exemptions that fall under Section 10?

Section 10 exempts Pension, LTA, gratuity, encashment of leave, voluntary retirement scheme, and HRA.

- How to compute taxable income after Section 10?

After deducting the allowances exempt under Section 10, the total taxable salary would be computed.

- What is the maximum amount you can claim under Section 10?

If you are under the age of 60 you can be exempted for Rs.2.50 lakh and if you are a senior citizen then your basic tax exemption limit is Rs.3 lakhs.

- Is Dearness allowance (DA) and special allowance the same?

No, DA is paid only to central government employees while special allowance is applicable for employees belonging to both private and public sector.

- Can my special allowance be higher than my basic pay?

Yes, only in rare cases. The general norm is that the basic pay is higher than the special allowance.

- Who is eligible for Special Allowance and why is it given?

According to section 17, clause (2), Employees are provided with any exceptional allowance benefit that is not a requirement to fully pay for certain expenses incurred while carrying out the responsibilities of a profitable office or job.

- What is the difference between Allowance and Perquisites?

While an allowance is money given to an employee for any reason, perquisites are a variety of services provided by their employers.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.