Gratuity - Meaning, Eligibility Criteria & How to Calculate it

What is Gratuity?

Gratuity is a lump sum amount paid to an employee by an employer as a reward for long-term service, after one year, based on tenure and last drawn salary, with exceptions for disability.

One can consider it to be a financial ‘Thank you’ gift from the employer to an employee as a reward for long-term service, typically after five years, under the Payment of Gratuity Act, 1972. It may be paid earlier in cases of disability, based on tenure and salary.

Gratuity Calculation Formula with Examples

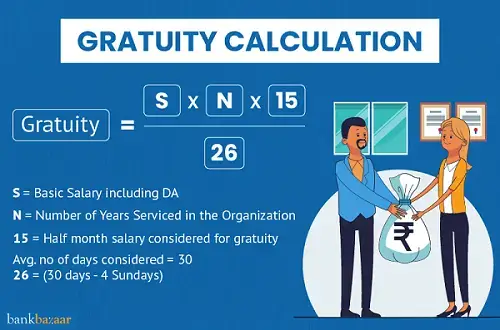

Gratuity Formula - Listed below are the components that go into the calculation of the gratuity amount. The amount is also dependent upon the number of years served in the company and the last salary drawn.

For Employers Covered Under the Gratuity Act:

Gratuity = (N*B*15)/26

where,

N = Number of Years Serviced in the Organization

B = Basic Salary including DA

What is 15/26? - 15 defines half-month compensation of 15 days and 26 represents the number of working days in a month (excluding Sundays)

- Example:

- 15 years of service, last drawn salary = Rs.55,000

- Gratuity = (15 × 55,000 × 15) / 26 = Rs.4,75,962

Important Notes:

- Gratuity amount is capped at Rs.20 lakh for private sector employees; excess is treated as ex-gratia. While the amount is capped at Rs.25 lakh for central government employees.

- If service in the final year exceeds 6 months, round up to the next full year (e.g., 18 years 7 months = 19 years).

For Employers Not Covered Under the Gratuity Act:

- Formula: Gratuity = (15 × last drawn salary × years of service) / 30

- Example 1:

- 8 years of service, last drawn salary = Rs.65,000

- Gratuity = (15 × 65,000 × 8) / 30 = Rs.78 lakh

- Example 2:

- Amit has worked with a company for 20 years and had Rs.25,000 as his last drawn basic plus DA amount, then,

- Gratuity Amount for Amit = 20*25,000*15/26 = Rs.2,88,461.54

However, an employer can choose to pay more gratuity to an employee. Also, for the number of months in the last year of employment, anything above six months is rounded off to the next number while anything below six months in the last year of employment is rounded off to the previous lower number.

Eligibility Criteria for Payment of Gratuity

Following are the few instances when you will be eligible to receive gratuity:

- Must be a permanent or fixed-term employee (not an apprentice).

- Service requirement of, minimum of one year of continuous service with the same employer.

- Gratuity is paid on resignation, retirement, or voluntary exit after five years.

- Applies to companies with 10 or more employees in the past 12 months.

- All such employees (except apprentices) are eligible, even if temporary

Calculation of Gratuity in Case of Death of an Employee

If an employee dies, the gratuity amount is still payable, subject to certain conditions as outlined in the Payment of Gratuity Act, 1972:

- Minimum Service Requirement: Gratuity is payable if the employee had completed at least one year of continuous service before death.

- Recipient of Gratuity: Paid to the nominated person; if no nominee exists, it goes to the legal heirs.

- Gratuity Calculation:

- Based on completed years of service up to the date of death.

- Any service exceeding six months is rounded up to the next full year.

- Formula Used:

- Gratuity = (Last drawn salary × 15 × completed years of service) / 26

- Tax Implications: Gratuity received by nominee/legal heir is tax-exempt up to a specified government limit; excess may be taxable.

- Payment Timeline: Employers must pay the gratuity within 30 days from the date it becomes due (date of death).

In case of the death of an employee, the gratuity benefits are calculated based on the tenure of service of the employee. The amount is, however, subject to a maximum of Rs.20 lakh for private sector employees. The following table shows the rates at which the gratuity will be payable in case of death of an employee:

Tenure of service | Amount payable towards gratuity |

Less than a year | 2 * basis salary |

1 year or more but less than 5 years | 6 * basic salary |

5 years or more but less than 11 years | 12 * basic salary |

11 years or more but less than 20 years | 20 * basic salary |

20 years or more | Half of the basic salary for each completed six-monthly period. However, it is subject to a maximum of 33 times of the basic salary. |

Advantages of Gratuity

The benefits of gratuity are outlined below:

- Boosts Employee Confidence: Enhances employee confidence by providing a sense of financial security for the future.

- Employee Loyalty: Demonstrates that employers value their employee's contributions and long-term financial well-being, fostering loyalty and a positive work environment.

- Ensures Fair Compensation: Ensures employees are fairly compensated for their years of service, especially in cases of termination, death, or disability.

- Financial Security: Provides crucial financial support after retirement, helping employees cover expenses like healthcare, travel, and other post-retirement needs.

- Helps in Retirement Planning: Forms an essential part of retirement planning, providing a lump sum payment that supplements pension or personal savings.

- Improves Employer-Employee Relationship: Builds trust and mutual respect, as offering gratuity shows the employer’s commitment to supporting their workforce.

- Legal Protection: The Payment of Gratuity Act, 1972, ensures employees’ right to gratuity, guaranteeing payment and preventing denial or delay by employers.

- Tax Benefits: Gratuity is tax-free up to a certain limit, offering employees tax savings and reducing their overall tax liability.

Taxation Rules for Gratuity

The taxation process for gratuity depends upon the employee who is receiving the gratuity amount. Two standard cases arise for the calculation of tax on gratuity:

- Government Employee Receiving Gratuity Amount: In case any employee under the state government, central government or local authority receives gratuity amount than the amount is fully exempt from Income Tax.

- Any Other Salaried Individual Receiving Gratuity Amount from an Employer who is Covered by Payment of Gratuity Act:

- In such a case the least of the following three amounts is exempt from tax.

- Rs.20 lakh

- Gratuity actually received by employee

- The gratuity amount eligible to be received

- Any Other Salaried Individual Receiving Gratuity Amount from an Employer who is not Covered by Payment of Gratuity Act: In such a case the least of the following three amounts is exempt from tax

- Rs.10 lakh

- (Average salary of last 10 months x 15/30) x number service year completed

- Actual amount of gratuity received

Tax Exemptions on Gratuity

Based on the policy changes made during the 2016 budget, here's what gratuity laws looks like:

- Gratuity received by government employees upon retirement, termination, or superannuation is fully tax-exempt and applies to central and state government staff, defence personnel, civil service members, and employees of local authorities.

- Tax exemption on gratuity for private sector employees:

- (*15/26) X Last drawn salary** X completed year of service or part thereof in excess of 6 months.

- Rs.10 lakh.

- Gratuity amount that is actually received.

* 7 days in case an individual is an employee of a seasonal establishment.

** Salary amounts to the total salary received by an employee including Dearness Allowance and excluding any other benefits like bonus, HRA, commission, and any other such perquisites.

- Tax exemption on gratuity for private sector employees who are not covered under the Act:

- Average salary of last 10 months (basic + DA) x number of employment years.

- Rs.20 lakh as per the amendment.

*Average salary = Average Salary of last 10 months immediately preceding the month of retirement ** Salary = Basic Pay + Dearness Allowance (to the extent it forms part of retirement benefits) + turnover based commission.

New Gratuity Rule – Key Highlights (Updated on November 2025)

The key highlights of the new gratuity rule are mentioned below:

- Gratuity will be given after 1 year of continuous service for fixed-term employees. Earlier, it was five years.

- Increasing gratuity payouts and additional components have been added to the definition of wages.

- To benefit employees, calculation of gratuity is done on a higher basis.

- The gratuity must be paid by employers within 30 days. An interest of 10% will be imposed annually if gratuity is not paid within 30 days.

- Under the new rule, excessive contractualisation is reduced, direct hiring is promoted, and formal employment is encouraged.

- Human resource policies and payroll must be updated as the definition of wages has been expanded.

- Like regular employees, social security measures, medical benefits, leave facilities, and salary structure must be provided to FTEs.

Key Highlights of the 2025 CCS Gratuity Amendment Rules

The highlights of Central Civil Services (Payment of Gratuity under National Pension System) Amendment Rules, 2025 signifying notable changes of gratuity rules under the National Pension System (NPS) are mentioned below:

Broader Definition of Gratuity

- Gratuity now includes: Retirement, Death, and Residuary Gratuity.

- New Rule 4A restricts gratuity benefits for employees re-employed post-retirement.

Recognition of Service in State/Autonomous Bodies

- Service in State Governments or Autonomous Bodies counts toward gratuity if:

- Transition occurred with due approval.

- No previous gratuity claim was made.

- The Central Government will bear the gratuity cost without seeking reimbursement from States.

Gratuity for Missing Employees

- Defined process for granting gratuity to families of missing government servants.

- Death Gratuity allowed after 7 years or sooner if death is confirmed.

- Requires FIR and confirmation from the police.

Rules for Withholding or Recovery of Gratuity

- Gratuity can be withheld/recovered if the retiree is found guilty of:

- Corruption

- Misconduct

- Negligence leading to financial loss

- UPSC consultation needed before the President issues final orders.

Notional Pay Included in Gratuity Calculation

- Retrospective promotions or revised pay post-retirement will now factor into gratuity and emoluments.

Interest on Late Gratuity Payments

- Delay due to administrative reasons will attract interest.

- Officials responsible for the delay will be held accountable.

Extraordinary Leave Treatment

- Medical leave taken as extraordinary leave will count as qualifying service.

- Specific guidelines issued for counting non-medical extraordinary leave.

Gratuity in Case of Death During Penalty Periods

- Gratuity will be based on original pay, disregarding penalties in effect at the time of death.

Employment Types Affected by New Gratuity Rules

The type of employees who will be impacted by the new gratuity rules are:

- Seasonal and temporary workers

- Workers in startups

- Terminated employees due to misconduct

- Fixed-term contract employees with less than one year of service

- Gig economy workers, such as share-ride drivers, freelancers

- Newly hired employees or employees on probation

Gratuity Rules

The regulations concerning gratuity are established within the framework of the Payment of Gratuity Act of 1972.

- Gratuity Applies to Companies with more than 10 Employees:

- Organizations with at least 10 employees on any single day in the last 12 months must pay gratuity.

- The obligation continues even if the employee count later drops below 10.

- Minimum 5 Years of Continuous Service Required:

- Employees must complete 5 years of uninterrupted years to qualify, except in cases of death or disablement.

- A year is considered as 240 working days (or 190 for underground workers).

- Service continuity includes periods, such as strikes, leave, layoffs, and non-fault termination.

- Gratuity Is Not Limited to Retirement: It is also payable on resignation, death, disablement, or termination (under eligible conditions).

- Gratuity Calculation Depends on Salary & Tenure:

- For employees covered under the Gratuity Act:

- Formula: (15 × Last Drawn Salary × Completed Years of Service) / 26

- For example: 15 × Rs.87,000 x 14 years = Rs.7,02,692.31

- For employees not covered under the Act:

- Formula: (15 × Average Last 10 Months’ Salary × Years of Service) / 30

- For example: 15 years × Rs.72,550 x 13 years = Rs.4,71,575

- For employees covered under the Gratuity Act:

- Gratuity Can Be Forfeited in Certain Cases: Employers may deny gratuity if the employee is terminated for misconduct, fraud, or damaging the employer’s property.

- Bankruptcy Does Not Nullify Gratuity Liability: Even if a company declares bankruptcy, it must still pay in gratuity, and courts cannot overrule this.

- Tax Exemption Up to Rs.20 Lakh:

- Gratuity up to Rs.20 lakh is tax-free for employees of organisations covered under the Gratuity Act (excluding government departments and local bodies).

- The exemption limit was previously Rs.10 lakh.

- Tax Rules Vary Based on Employment Type: Different tax treatments apply to employees covered and not covered under the Gratuity Act.

- Rs.20 Lakh Exemption Is Cumulative:

- Tax-free limit applies to the total gratuity received from all employers combined.

- Example: If total received is Rs.23 lakh, tax applies to Rs.3 lakh.

- Gratuity to Legal Heirs Is Fully Tax-Exempt:

- Gratuity paid to a deceased employee’s widow or legal heir is not taxable.

- Additional compensation for injury or death is also tax-free.

Forfeiture of Gratuity

The Payment of Gratuity Act of 1972 states that an employer has the authority to withhold all or part of an employee's gratuity payment, even if the employee has completed five or more years of service. This only functions when the employee has been fired for disorderly behaviour, which includes attempting to physically injure others while on the job.

Even if eligibility criteria are met, gratuity may be denied under following circumstances:

- Gratuity can be forfeited to cover damage or loss caused by the employee’s willful act, omission, or negligence, gratuity can be forfeited as per Section 4 (6) of Payment of Gratuity Act 1972.

- Gratuity may be fully or partially forfeited if employment is terminated due to riotous, disorderly behavior, or any act of violence and due to an offense involving moral turpitude committed during the course of employment.

Timeline for Gratuity payment

There are three steps involved regarding gratuity payment. These include:

- Initiation: An individual or an authorized person must send in an application to an employer regarding the gratuity he/she is owed by a company.

- Acknowledgement and calculation: The organization that owes gratuity will compute the amount as soon as the application is received and will also send a notice of the same to the person and the governing authority with the amount stated.

- Disbursal: The employer, having sent the acknowledgement, has a time period of 30 days to pay the gratuity amount to the individual.

Nomination Procedure for Gratuity

Once an employee completes one year of service, they are required to submit a nomination within 30 days. This nomination should be in favour of one of their family members. For employees with at least one year of service when these rules begin, the process should normally be completed within 90 days from that date of commencement of the rules.

Any nomination made in favour of a person outside the family will be deemed invalid. If the nominee passes away before the employee, the interest in the nomination reverts back to the employee. In such instances, the employee must create a new nomination for that interest using Form F.

Gratuity Application Form

There are multiple gratuity application form which are mentioned below:

- Form A: Notice of opening: Within 30 days of the rules becoming applicable to the establishment, the employer must submit the prescribed notice to the controlling authority.

- Form B: Notice of Change: Within 30 days of any change in name, address, employer, or nature of business the employer must submit the prescribed notice to the controlling authority.

- Form C: Notice of Closure: At least 60 days before the intended business closure The employer must notify the controlling authority in the prescribed format.

- Form F: Nomination: The employee must submit the nomination in the prescribed format, in duplicate, either in person (with receipt) or via registered post with acknowledgment. It should be submitted within 90 days if already employed for a year when the rules start, or within 30 days after completing one year of service.

- Form G: Fresh Nomination: Within 90 days of acquiring nomination an employee without a family must submit a fresh nomination. All nominations or modifications must be signed (or thumb-impressed if illiterate) in front of two witnesses, who must also sign a declaration.

- Form H: Modification: A notice to modify a nomination, including if a nominee dies before the employee, must be submitted in duplicate in the prescribed format. It must be signed (or thumb-impressed if illiterate) in front of two witnesses, who must also sign a declaration.

- Form I: Application for gratuity by an employee: An eligible employee, or a person authorized by them, should apply for gratuity in the prescribed format within 30 days from when it becomes payable. If the retirement date is known, the application can be submitted up to 30 days in advance.

- Form J: Application of gratuity by a nominee: A nominee eligible for gratuity should apply to the employer in the prescribed format within 30 days from the date it becomes payable.

- Form K: Application of gratuity by a legal heir: Within one year from the date gratuity becomes payable, a legal heir eligible for gratuity should apply to the employer in the prescribed format.

- Form L: Notice for payment of gratuity: Within 30 days of receiving the application, the employer must notify the applicant of the payable gratuity amount and payment date only if the claim is valid. A copy of this notice must also be sent to the controlling authority.

- Form M: Notice for rejecting claim for payment of gratuity: If the gratuity claim is not admissible, the employer must issue a notice within the due date, stating the reasons for rejection. A copy of the notice must also be sent to the controlling authority.

- Form N: Application for direction before the Controlling Authority: The claimant can apply to the controlling authority within 90 days using the prescribed format, along with copies for each opposite party, if the employer rejects a nomination, pays less, or fails to issue Form M or N on time.

- Form T: Application for recovery of gratuity: If the employer fails to pay gratuity as directed, the employee, nominee, or legal heir may apply in duplicate to the controlling authority using the prescribed format for recovery.

Investment Options for Gratuity Amount

When investing in gratuity funds, it's essential to consider financial goals, risk tolerance, and investment duration. Here are some options:

- Fixed Deposits (FDs): This is a low-risk option giving secure returns with capital preservation.

- Public Provident Fund (PPF): This is a tax-efficient option with long-term savings with a 15-year lock-in.

- Employee Provident Fund (EPF): Secure retirement savings with tax benefits.

- National Pension System (NPS): Mix of equity and debt for long-term growth.

- Mutual Funds (Equity & Debt): Equity for higher returns, debt for stability.

- Sovereign Gold Bonds (SGBs): Paperless gold investment with tax perks.

- Real Estate & REITs: Direct property or market-based real estate exposure.

- Stock Market: Direct investment in high-risk, high-reward opportunities.

- Recurring Deposits (RDs): Systematic, monthly savings with fixed returns.

Key Differences Between Gratuity and Pension

The differences between Gratuity and Pension scheme are mentioned in the table below:

Gratuity | Pension |

One-time lump sum payment | Monthly payment |

Paid by employer | Paid by employer |

Eligible after minimum five years of service | Depends on scheme and service period |

Tax-free for up to Rs.20 lakh | Depending on the source, it is partially taxable |

Nomination can be done via Form F | Nomination applicable for part of the pension enrollment |

FAQs on Gratuity in Salary

- Is there a cap on gratuity payments?

Yes, gratuity is capped at Rs.25 lakh as per the amendment for central government employees, irrespective of the number of years worked.

- What is Gratuity?

Gratuity is a financial component offered by an employer to an employee in recognition of his/her service rendered to an organisation.

- Will a contract employee receive gratuity after 5 years of service?

If the employee is on the company's payroll, they are eligible for gratuity. If they work for a contractor, the contractor is responsible for paying it.

- Will I still receive gratuity if my employer goes bankrupt?

Yes, gratuity is payable even if the employer files for bankruptcy, and no court order can withhold it.

- Are employees not covered under the Gratuity Act eligible for gratuity?

Yes, employees not covered by the Gratuity Act may still receive gratuity, calculated using: Gratuity = Average salary (basic + DA) x ½ x Number of years of service.

- How much gratuity will I receive after five years of service?

The gratuity amount depends on your last drawn salary and the number of years worked.

- How do I nominate someone to receive my gratuity in case of death?

You can nominate heirs for your gratuity by filling out Form F when joining the company.

- Is it compulsory to complete one year of continuous service to apply for gratuity?

Yes, it is compulsory to complete one year of continuous service to apply for gratuity.

- What does 15/26 represent in the gratuity calculation?

The term 15/26 in gratuity calculation refers to the formula used in the Gratuity Calculator. Gratuity calculations assume the number of working days in a month to be 26 days, and the wages are computed at the rate of 15 days.

- What is the difference between a Provident Fund and Gratuity?

PF involves contributions from both the employer and the employee, while gratuity is a one-time payment made by the employer as a gesture of appreciation.

- What kind of employees does the Gratuity Act, 1972 cover?

The Gratuity Act applies to employees in factories, mines, oilfields, plantations, ports, railway companies, and other establishments, including government jobs, across India (except Jammu & Kashmir).

- How many days will it take for the employer to remit the gratuity amount?

Usually, gratuity is released along with or just before/after your full and final settlement is done. The government mandates employers to pay the amount within 30 days.

- Is there any upper limit to the gratuity that an employee receives?

Yes, there is an upper limit to the gratuity that an employee can receive. The company cannot pay an employee more than Rs.20 lakh, regardless of the number of years the employee has been in service as per Section 4(3) of The Payment of Gratuity Act, even if the employee is eligible for an amount more than Rs.20 lakh.

- When is an individual paid gratuity?

Individuals are paid gratuity under these circumstance - Termination or resignation, Layoff or retrenchment, Death due to an accident or illness, Voluntary Retirement Scheme (VRS) & Retirement.

- Will a person who works under contract receive a gratuity after five years of service?

A person is an employee of a corporation if they are listed on their payroll. According to the guidelines, they will be given a tip. However, the contractor that they work for must pay the gratuity if the latter is an independent contractor.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.