Kolkata Municipal Corporation (KMC) Property Tax

The tax that is levied on real estate properties by the respective government authorities is property tax. In order to simplify the process to collect tax, the Kolkata Municipal Corporation (Amendment) Bill 2016 was passed on 15 December 2016.

How to Pay KMC Property Tax Online?

Taxpayers who wish to pay the property tax can do it on the official website of KMC. The step-by-step procedure to pay the property tax online is mentioned below:

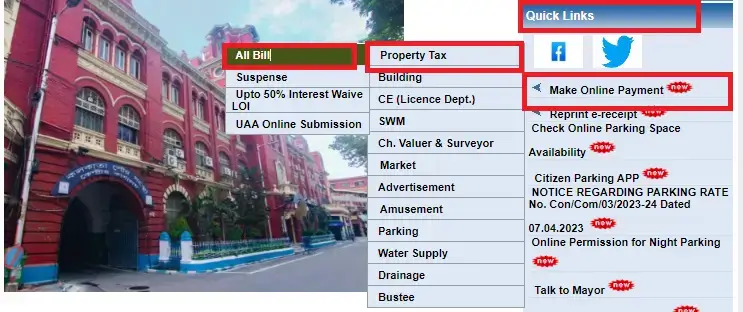

- Visit the KMC Official Portal

- In the right-hand column, click on 'Make Online Payment' under 'Quick Links' section.

- Now, select 'Property Tax' and click on 'All Bills' option.

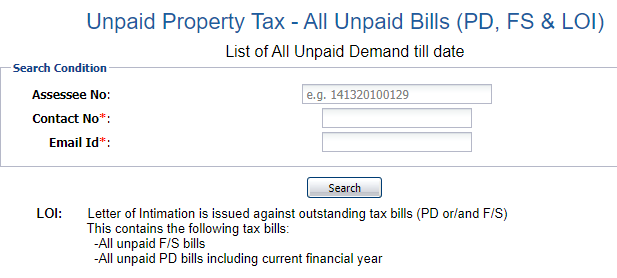

- Next, enter the assessee number, contact number, and email ID.

- Select ‘Search’.

- Next, the payment can be made via UPI, debit card, credit card, etc.

- The e-receipt can be downloaded.

How to Pay KMC Property Tax Offline?

The process that must be followed to pay the KMC Property Tax offline is mentioned below:

- Visit a KMC office.

- Request for an application form.

- Fill out the application form and submit it.

- Next, the property tax can be paid.

How to Check KMC Property Tax Payment Status Online?

The procedure that must be followed to check the KMC Property Tax payment status online is given below:

- Visit the official website of KMC.

- Select ‘Online Services’.

- Choose ‘Assessment Collection’.

- Select ‘Check Payment Status’.

- Next, the Assessee Number must be entered.

- Select ‘Search’. The payment status will be displayed.

What is the Process to Generate the Tax Receipt Offline?

You will need to visit the nearest KMC office and pay the property tax to receive the receipt.

What is the Process to Generate the Tax Receipt Online?

The process that must be followed to generate the tax receipt online is mentioned below:

- Visit the official website of KMC.

- Select ‘Online Services’.

- Choose ‘Assessment Collection’.

- Select ‘Reprint E-Receipt'.

- Choose the start and end date.

- Select ‘Search’ to download the receipt.

Calculation of KMC Property Tax - Online

The Unit Area Assessment (UAA) system was passed in March 2017 for the calculation of property tax. Under the system, the property tax can be calculated by the owners. The introduction of UAA has ensured the removal of ambiguity and subjectivity that was present in the previous system.

Unit Area Assessment - Important Points

- As per the UAA system, Kolkata has 293 blocks and categories from A to G. The division is based on the property's infrastructure, facilities, and market value.

- There are around 6 lakh taxpayers that are covered under the new system.

- A Base Unit Are Value (BUAV) will be assigned to every category. The BUAV will be the highest for category A and lowest for category G.

Calculation of Base Unit Area

Category | BUAV per square feet (Rs.) |

A | 74 |

B | 56 |

C | 42 |

D | 32 |

E | 24 |

F | 18 |

G | 13 |

Multiplicative Factors

Property Location (Road Width) | MF |

Up to 2.5m | 0.6 |

More than 2.5 m and up to 3.5 m | 0.8 |

More than 3.5 m and up to12 m | 1 |

More than 12 m | 1.2 |

Occupancy Status

Status of Occupancy | MF |

Tenant has occupied the property for up to 20 years for non-residential purposes | 4 |

Tenant has occupied the property for up to 20 years for non-residential purposes | 1.5 |

Tenant has occupied the property for more than 20 years and up to 50 years (no protected under West Bengal premises) | 1.2 |

Tenant has occupied the property for more than 20 years and up to 50 years (protected under West Bengal premises) | 1 |

Parking Space/ Garage/ Fee | 4 |

Occupation of the Family Owner | 1 |

Occupation of the Tennant (more than 50 years) | 1 |

Building Usage

Building Usage | MF |

Waterbody | 0.5 |

Residential use | 1 |

Bar, up to 3-start hotel, single-screen theatre, educational institution, health | 3 |

Ceremonial House, 3-star and 4-star hotels | 4 |

Restaurant, less than 250 sq.ft shop, Manufacturing/ Industrial | 2 |

Commercial Shops, Mall, Multiplex | 6 |

Hoarding, Tower, Offsite ATM, Night club | 7 |

5-star hotel, bank, office | 5 |

Vacant Land under the above-mentioned categories (up to 5 katha) | 2 |

Vacant land above 5 katha | 8 |

Building Structure

Building | MF |

Plot size above 10 katha, Residential Building | 1.5 |

Tenant’s occupation property for residential purposes for up to 20 years | 1.5 |

Pucca properties | 1 |

Apartments more than 2,000 sq.ft, Special projects by IG | 1.5 |

Open garages and parking spaces and covered garages and parking spaces | 0.8 |

Semi-pucca | 0.6 |

Kutcha | 0.5 |

Common area | 0.5 |

Property Type

Property Type | Tax Rate (%) |

Slums (Undeveloped) | 6 |

Slums (Developed) | 8 |

Government Properties as per KMC Act, 1980 | 10 |

Yearly value of Property Rs.30, 000 | 15 |

Others | 20 |

Calculation of Property Tax - Formula

The formula that is used to calculate the property tax under the UAA system is mentioned below:

Annual Tax = BUAV x Space that is covered/ Area of the land x Rate of tax (inclusive of HB tax) x Occupancy MF value x Structure MF value x Age MF value x Usage MF value x Location MF value

It is vital that all the records that are present in the UAA are up to date and no dues are pending. In the case of any errors, they should be corrected.

KMC Contact Details

- In the case of any queries and complaints, you can call from 033-2286 1305

- Toll Free Number: 18003453375

- WhatsApp Number: 8335988888

Note: You can contact the above number between 10 a.m. and 6 p.m. on working days and 10 a.m. to 5 p.m. on Saturdays.

FAQs on Kolkata Municipal Corporation Property Tax

- Can Kolkata property tax be paid online?

yes, the house Taxpayers of Kolkata Municipal Corporation able to pay property tax online.

- What does KMC in tax stand for?

KMC stands for Kolkata Municipal Corporation.

- what is the Official Website of Kolkata Municipal Corporation?

The official website address of the KMC government is https://www.kmcgov.in/

- What is meant by unit area assessment in property tax?

Unit area assessment (UAA) is a method that helps to standardize the property tax system based on area, location, uses of property, property age, nature of occupancy, and structure.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.