How to Pay Navi Mumbai Property Tax Online & Offline?

NMMC or the Navi Mumbai Municipal Corporation is a civic body responsible responsible for collecting property tax from the property owners to develop and maintain the infrastructure of the city.

The property owners can make online as well as offline payment for NMMC property taxes online. Here are the details that you must about the payment procedure and other related information.

What is NMMC Property Tax?

NMMC property tax is a key revenue source for the local government Navi Mumbai that supports the infrastructure through efficient waste management, road upkeep, and garbage collection. Annual payment of the property taxes must be down by the owners to aid community development, ensuring timely payments to avoid penalties and legal consequences.

Properties Applicable for NMMC Property Tax

Here is the list of properties on which NMMC property tax will be levied:

- Commercial properties

- Residential properties

- Industrial properties

- Vacant land

List of Zones under Navi Mumbai Property Tax

The NMMC's jurisdiction starts from Digha in the north and extends up to Belapur in the south. The total area under the jurisdiction of NMMC is 162.5 square kilometres which is divided into 9 zones. They are: CBD Belapur, Nerul, Vashi, Turbhe, Koparkhairane, Airoli, Ghansoli, Digha, and Dahisar

How to Pay NMMC Property Tax?

There are two ways to pay NMMC Property Tax: online and offline.

How to Pay NMMC Property Tax Online?

You can easily pay your property tax online by following the steps mentioned below:

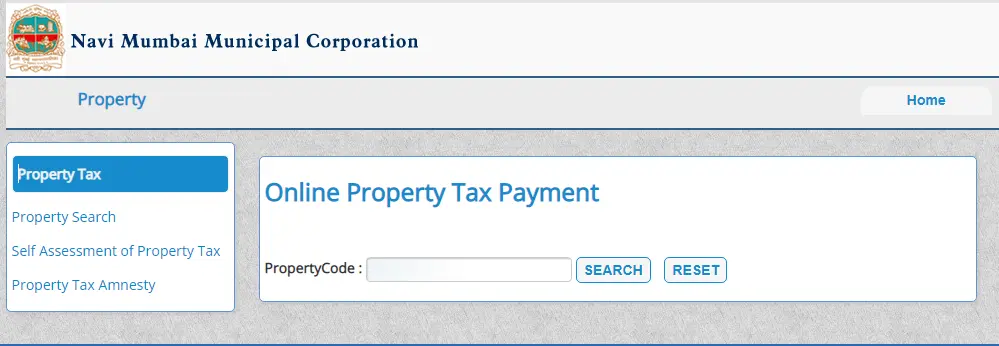

Step 1: Visit the official website of NMMC.

Step 2: Navigate to the 'Property' section and choose the 'Property Tax' option.

Step 3: Enter your 'Property Code' in the designated field and click on the 'Search' button.

Step 4: The screen will display the details of your property including the owner’s name, address, property ID etc.

Step 5: Check all the information thoroughly and make the payment of property tax through the preferred payment mode.

How to Pay NMMC Property Tax Offline?

If you prefer to make your NMMC property tax payment offline, follow these steps:

- Visit the Nearest NMMC Ward Office by locating the nearest NMMC ward office by the following steps:

- Visit the official NMMC website.

- Click on the "Departments" tab on the home page.

- Select "Property Tax Department" from the dropdown menu.

- To view a list of ward offices, click on the "Contact Us" tab.

- To access the contact details, address, and working hours of the nearest NMMC ward, choose your respective ward office.

2. Verify the following details of NMMC Property Tax Bill:

- Name and contact details of the property owner

- Address and description of the property

- Property Identification Number (PID)

- Payment instructions and options

- Confirmation of previous payments or receipt number

- Assessed value of the property

- Applicable tax rate

- Total property tax due

- Payment due date

- Penalties or interest for late payments, if any

3. Make the payment using demand draft, cheque, or cash at the ward office.

4. Collect and Save the Receipt for future reference.

Related Pages on Property Tax

NMMC Property Tax Payment Status

The Navi Mumbai Municipal Corporation allows the property owners to view the bill for tax payment by the following steps:

- Visit the official website of the Navi Mumbai Municipal Corporation.

- Navigate to the “Property Tax” section.

- Click on the “Property Tax” option.

- In the designated place enter the property code.

- Click on the “Search” button.

- Check all the information thoroughly that is displayed on the screen, such as name, address, property ID, etc., of the owner.

- To view the bill, click on the NMMC property tax bill section.

Property owners can also view their property tax bill by their name by the steps mentioned below:

- Visit the official website of the Navi Mumbai Municipal Corporation.

- Navigate to the “Search by Name” option.

- Select the ward number and other property details.

- Click on the “Search” option after checking all the details and the screen will display your NMMC property tax bill online.

Property Search for NMMC Property Code

If you want to find out the Property Code of a particular property under the jurisdiction of NMMC, you can follow the steps mentioned below:

Step 1: Visit the official website of NMMC at www.nmmc.gov.in.

Step 2: Navigate to the 'Property' section and choose the 'Property Search' option.

Step 3: Select the respective 'Ward', 'Sector', and 'Plot' from the drop-down box.

Step 4: Enter the 'Building Name' in the designated field.

Step 5: Enter the first name and last name of the owner in the designated fields.

Step 6: Click on the 'Search' button.

NMMC Property Tax Receipt

NMMC property tax receipt acts as proof of your timely tax payment that helps avoid penalties or legal complications. Here are the steps to download the NMMC property tax:

- Visit the official website of the Navi Mumbai Municipal Corporation.

- Go to the “Property Tax” section.

- Click on the “Property Tax” option.

- Enter the property code in the designated place.

- Click on the “Search” button.

- Check all the information displayed on the screen such as the property owner’s address, name, property ID, etc.

- Click on “View Ledger”

- All the details of your previous tax payments will be displayed.

- Click on the “Receipt” to download the receipt or click on the “Print” to get the hard copy of the receipt.

Exemption Of NMMC Tax Payment

The following is the list of properties exempted from NMMC tax payment:

- Central and State government-owned buildings

- Schools, colleges, and universities managed by the government are tax-exempt.

- Properties such as NGOs, hospitals, and orphanages

- Government-Sponsored Housing Schemes for economically weaker sections under government schemes

- Temples, churches, and places of worship

- Small flats under 500 sq. ft.

Due Date and Penalty Charge

Here are the details about the due date and penalty charged for non-payment of property tax:

- The property owners can check the date for Navi Mumbai zone as the State government sets the deadline for NMMC property tax payment each financial year.

- The property owners who miss the payment deadline are charged 2.00% penalty monthly on overdue amount which will continue until all dues are cleared.

NMMC Property Tax Rates

The NMMC property tax rates for various types of properties in Navi Mumbai are given in the table below:

Sl. No. | Tax Head | Residential Properties | Commercial Properties | Industrial Properties |

1. | General Tax (including 0.5% fire tax) | 23.50% | 32.50% | 40.50% |

2. | Water Benefit Tax | 1% | 4% | 0.00% |

3. | Sewerage Tax | 3% | 7% | 0.00% |

4. | Sewerage Benefit Tax | 1% | 2% | 0.00% |

5. | Municipal Education Tax | 1% | 4% | 4.00% |

6. | Street Tax | 2.67% | 3.33% | 8.33% |

7. | Tree Cess | 0.50% | 0.50% | 0.50% |

Total | 32.67% | 53.33% | 53.33% | |

Government Taxes | 6.00% | 15.00% | 15.00% | |

Total | 38.67% | 68.33% | 68.33% | |

NMMC Property Tax Payment - Checking the ledger

The ledger page can be especially useful if you need to dispute any charges or if you want to get a more accurate understanding of your tax payments. Once you reach the ledger page of your property, you will be able to see a more detailed breakdown of your NMMC property tax. This page will provide you with information such as your previous payments, current balance, interest charges, and other relevant details. You can download or print the ledger page if you need to keep a record of it for your records.

If you're looking for more detailed information about your NMMC property tax, you can visit your property ledger. Here's how you can do it:

Step 1: Visit the official NMMC property tax page.

Step 2: Look for the option to 'view current bill'.

Step 3: Click on 'view current bill'.

Step 4: Enter your property code and click on 'search'.

Step 5: The website will display the property details along with the outstanding tax amount.

Step 6: At the bottom of this page, you will see an option called 'View Ledger'.

Step 7: Click on 'View Ledger' to access the ledger page of your property.

Overall, accessing your property ledger is a great way to get more detailed information about your NMMC property tax. It's easy to do and can provide you with valuable information that can help you manage your taxes more effectively.

NMMC Property Tax Amnesty Scheme

Here are the details about the NMMC Property Tax scheme:

- The NMMC Property Tax Amnesty Scheme is also known as 'Abhay Yojana,' that encourages citizens to pay outstanding property taxes.

- The scheme was launched in response to the financial challenges during the COVID-19.

- With only 25% of penalty charges, the scheme offers an affordable option to pay pending taxes.

Benefits of NMMC Property Tax scheme are given below:

- The citizens are allowed to make payment of overdue taxes without high penalties.

- For the government, this scheme aids in revenue recovery and promotes tax compliance.

- Citizens can join the scheme by registering on the official website, where terms, payment options, and receipts are provided.

How To Calculate NMMC Property Tax?

The following are the steps to proceed with the NMMC property tax online calculation:

- Visit the official website of the Navi Mumbai Municipal Corporation.

- Navigate to the “Property Tax” section.

- Click on the “Self-Assessment of Property Tax” option.

- The screen will display an online calculator after clicking on the ‘Self-Assessment of property Tax’ option.

- Enter the details of your property in the given boxes.

Self-Assessment of Navi Mumbai Property Tax

In order to get the self-assessment of Navi Mumbai Property Tax done, you will be required to follow the steps mentioned below:

Step 1: Visit the official website of NMMC at www.nmmc.gov.in.

Step 2: Navigate to the 'Property' section and choose the 'Self Assessment of Property Tax' option. This will redirect you to the 'Property Tax Calculator'.

Step 3: On the 'Property Tax Calculator', enter the following information using the drop-down menu - Ward, Plot Type, Group Usage, Residential Usage Description, Commercial Usage Description, Industrial Usage Description, and Occupancy Status.

Step 4: Some of the information mentioned above are compulsory and has to be provided by the user.

Step 5: After filling up the necessary fields, you can click on the 'Compute Property Tax' button and the computed result will be displayed on your screen accordingly.

NMMC Property Tax Document- Name Change Procedure

To change the name on your NMMC property tax document, you will need to follow a few steps and provide some necessary documents. These documents include:

- Receipt of your last paid NMMC property tax bill: You will need to submit a copy of the receipt of the last paid NMMC property tax bill to the authority concerned. This will prove that you have cleared all your dues until the last payment.

- An attested copy of transaction details of the deed: You will need to provide an attested copy of the transaction details of the property deed, which shows the transfer of ownership from the previous owner to you. This could include a sale deed, gift deed, or inheritance certificate.

- No Objection Certificate or NOC from the housing authority: You will need to obtain a No Objection Certificate or NOC from the housing authority, stating that there are no dues or pending payments for the property. This certificate needs to be attested by the concerned authorities.

Once you have all the required documents, you can submit them to the NMMC office along with a request to change the name on your NMMC property tax document. After verification of the documents, the name on the document will be changed, and a new property tax bill will be issued in your name.

How to Resolve Property Tax Complaints at NMMC

Here are the step-by-step instructions to register a grievance concerning your NMMC property tax:

Step 1: Go to the official NMMC website.

Step 2: Look for a sidebar on the right-hand side of the homepage.

Step 3: Click on the 'Grievance' option in the sidebar. Wait for a new page to load.

Step 4: Login to the portal using your credentials. If you don't have an account, you can create one by clicking on the 'New User' option.

Step 5: Once you have logged in, you will see an option to 'Register Grievance' on the left-hand side of the page.

Step 6: Click on the 'Register Grievance' option.

Step 7: Fill in all the required details such as your name, contact information, property details, and a description of your grievance. Upload any supporting documents if required.

Step 8: Submit the form. You will receive a reference number that you can use to track your grievance status on the official NMMC website.

Keep checking the status of your grievance on the website until it is resolved.

How to Contact to NMMC Poperty Tax?

You can contact NMMC by visiting the registered office at the following address:

- Ground Floor, Sector-15 A,

- Palm Beach Junction, CBD Belapur,

- Navi Mumbai,

- Maharashtra-400614

Alternatively, you can also reach out to NMMC by sending an email to info@nmmconline.com.

FAQs on Navi Mumbai Property Tax

- What is the full form of NMMC?

The full form of NMMC is Navi Mumbai Municipal Corporation.

- What is NMMC property tax?

NMMC property tax is a tax levied by the Navi Mumbai Municipal Corporation (NMMC) on properties located within its jurisdiction. The tax is used to fund various civic amenities and services provided by the corporation.

- What is the official website to pay Navi Mumbai property tax?

The official website to pay Navi Mumbai property tax is www.nmmc.gov.in.

- Can NMMC property tax be calculated manually?

Yes, it is possible to calculate NMMC property tax manually. One needs to determine the rateable value of their property and use the applicable percentage (38.67% for residential and 68.33% for commercial) to compute the tax amount.

- How can one make payments for NMMC property tax?

To make payments for NMMC property tax, individuals can obtain their bill from the official website and pay it either online or offline.

- What additional services are offered on the NMMC property tax website?

In addition to paying property tax, the NMMC property tax website offers services such as registering for the Amnesty scheme, filing grievances, changing the name on NMMC records, calculating property tax for free, and registering for SMS alerts.

- What does the government do with the revenue from NMMC property tax?

The government uses the revenue generated from NMMC property tax to improve the infrastructure and carry out developmental work in the area.

- Who is liable to pay NMMC property tax?

The property owner is liable to pay NMMC property tax. In case of a rented property, the landlord is responsible for paying the tax, but it can be passed on to the tenant through the rental agreement.

- How is NMMC property tax calculated?

NMMC property tax is calculated based on the property's built-up area, location, age, type of property, and usage. The tax rate may also vary depending on whether the property is residential or commercial.

- Can I pay NMMC property tax online?

Yes, you can pay NMMC property tax online through the corporation's official website or mobile app. You can also make the payment through other modes such as cash, cheque, or demand draft.

- What is the due date for paying NMMC property tax?

The due date for paying NMMC property tax varies depending on the specific zone of the property.

- Is there any penalty for late payment of NMMC property tax?

Yes, if you fail to pay NMMC property tax before the due date, a penalty will be levied on the outstanding amount. The penalty rate may vary depending on the period of delay.

- What documents are required for paying NMMC property tax?

To pay NMMC property tax, you need to provide the property's unique identification number (UID), which can be found on the previous year's tax receipt or the property card. You may also need to provide other details such as the property's address and owner's name.

- Can I appeal against the NMMC property tax assessment?

Yes, if you disagree with the NMMC property tax assessment, you can file an appeal with the corporation's assessment and collection department within a specified period.

- What happens if I do not pay NMMC property tax?

If you do not pay NMMC property tax, the corporation may take legal action against you, including seizing your property or imposing a penalty on the outstanding amount. It is advisable to pay the tax on time to avoid any such consequences.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.