Professional Tax Slab in West Bengal for FY 2025-26

Salaried individuals in West Bengal need to pay a certain percentage of their salary as professional tax if their earnings are above a specified income level.

Professional tax slab rates differ from state to state in the country. As per the West Bengal Tax on Profession, Trade, Callings and Employment Act, 1979, the State Government of West Bengal can charge professional tax on income earned from various sources. The maximum amount is Rs.2,500 per year and in West Bengal, there are different slabs paid on a yearly basis by anyone with a salary that exceeds Rs.10,000 monthly.

What is Professional Tax in West Bengal?

Under the West Bengal State Tax on Profession, Trades, Callings, and Employment Act, 1979, individuals are required to pay professional tax with a monthly salary of more than Rs.10,000. This means that individuals are liable to pay professional tax in case the individuals’ salary is Rs.10,001 or more.

West Bengal Professional Tax Slab Rate in 2026

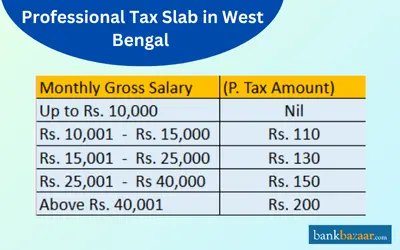

Each state government revises its professional slab tax rates at regular intervals, usually on yearly basis. Mentioned below is the revised rates of West Bengal Professional Tax:

Salary | Professional Tax (Monthly) |

Up to Rs.8,500 | Nil |

Between Rs.8,501 to Rs.10,000 | Nil |

Between Rs.10,001 to Rs.15,000 | Rs.110 |

Between Rs.15,001 to Rs.25,000 | Rs. 130 |

Between Rs.25,001 to Rs.40,000 | Rs. 150 |

Above Rs.40,001 | Rs.200 |

West Bengal Professional Tax Rule

The following are the details regarding the tax rule in West Bengal:

- As per Clause 2 of Article 276 of the Indian Constitution, the professional tax in West Bengal is levied under the West Bengal Tax on Profession, Trade, Callings, and Employment Act, 1979.

- There are two types of professional tax:

- Professional Tax Registration (PTRC): Applicable for salaried employees, where the employer deducts the professional tax amount from the salary of the employee and deposits the tax to the state government.

- Professional Tax Enrollment (PTEC): Applicable for self-employed individuals, and they must pay the tax themselves at WB professional tax offices.

- The maximum professional tax payable in West Bengal is Rs.2,500 per month.

How to Pay Professional Tax in West Bengal?

- For salaried employees, professional tax is deducted by employers and deposited with the Government.

- Self-employed individuals can pay it on their own by visiting local PT offices.

Who Pays Professional Tax in West Bengal?

The following are the individuals who are applicable to pay professional tax in West Bengal:

- Self-employed individuals are required to pay professional tax if earning if earning a specific amount.

- Professionals are eligible to pay professional tax involved in government and private organisations.

- Other categories of taxpayers involved in paying professional tax include occupiers for factories, licensed boat suppliers, management consultants, tax consultants, architects, etc.

The Profession Tax Schedule is available on the official website of West Bengal Professional Tax which is wbcomtax.nic.in. Professional tax is paid on yearly basis in West Bengal.

Listed below are some of the categories of professionals who need to pay professional tax in West Bengal:

- Legal practitioners.

- Medical practitioners.

- Architects

- Engineers

- Chartered accounts

- Management consultants

- Tax consultants

- Licensed shopkeepers

- Occupier for factories

- Licensed shipping brokers

- Licensed boat suppliers

Professional Tax E-payment in West Bengal

Professional tax can be paid online in West Bengal. To pay professional tax online in West Bengal, you need to visit the web portal called wbcomtax.nic.in where you need to click on “e-services” which will lead you to “e- payment” followed by “GRIPS”. If a person pays professional tax online and he possesses a valid PAN, he is eligible for receiving a Demat Certificate of Enrolment.

West Bengal Professional Tax Online Payment

Here are the steps of online professional tax payment in West Bengal:

- Visit the official website of the Profession Tax Directorate of Commercial Taxes, Government of West Bengal.

- under 'E-services' option, click on 'e-payment' option.

- Transaction can be completed ‘GRIPS’

- The following are the options given to complete the payment process:

- Enrollment number:

- Select the 'Enrolment Number' option.

- Provide the 12-digit PT Enrolment number.

- To get payment details, click on ‘Submit’.

- Select the payment amount, year of payment, and mode of payment.

- After following the given instructions, click on ‘Pay’ option .

- Government ID:

- Select the 'Government ID' option on the website

- Provide 12-digit government ID number

- Click on ‘Submit’

- Enter the payment mode, year of payment and payment amount

- After following the instruction given, click on ‘Pay’ option

- Registration Number

- Select 'Registration Number'

- Enter 12-digit registration number

- Click on ‘Submit’ to obtain the payment details

- Click on the 'Pay' option, after following the instructions given on the screen

- Application number:

- enter the 11-digit application number on the website

- To get payment details, select the ‘Submit’ option

- Select the ‘payment mode’

- Click on ‘Pay’ option after entering the required details

West Bengal Professional Tax Late Payment Penalty

The State Government of West Bengal charges professional tax penalty charges under the following conditions:

- If an individual fails to pay professional tax on time due for him/her.

- If a person fails to enroll within 90 days from the date he/she becomes eligible for professional tax payment.

What is the Due Date for West Bengal Professional Tax Payment?

Here are the details about the due date for professional tax payment in West Bengal:

- Online payment through website can be done for professional tax.

- Professional payment should be made by 31 July of each fiscal year by the enrolled individuals.

- Monthly payment should be made by the registered employers.

- Individuals or companies that fail to pay the due tax amount on time are required to pay a 1.00% penalty per month.

West Bengal Professional Tax Exemption

The details that you should know about the tax exemptions on West Bengal Professional Tax is given below:

- Tax exemptions to certain professionals are granted by the West Bengal state government has granted.

- This exemption applies to members of the auxiliary forces, Army, Air Force, or Navy.

- Individuals serving in any region of West Bengal are eligible for exemptions.

FAQs on Professional Tax Slab in West Bengal

- Who is exempt from professional tax in West Bengal?

Professional tax in West Bengal is exempted for members of the Indian Navy, Air Force and Army serving in any part of West Bengal.

- How much is the professional tax in West Bengal?

The professional tax rates vary based on the income of the individuals and the amount deducted is Rs.2,500 if the salary is more than Rs.10,000.

- Is professional tax compulsory in West Bengal?

Every individual is liable to pay professional tax in West Bengal if they are engaged in any trade, profession, or employment.

- How to pay professional tax in West Bengal?

The professional tax can be paid in West Bengal through an official website by providing the government ID, registration number, enrolment number, or application number of the new enrolment.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.