Indian Bank Balance Enquiry Number (Toll-free)

Keeping a track of your bank balance is an amazing practice for your financial health. It helps you monitor your spending and ensure you have sufficient funds for upcoming expenses. It helps you manage your budget effectively.

Additionally, this practice helps you detect any unauthorized transactions or errors immediately, protecting your money. Indian Bank customers have several options to check their account balance. You can check your balance through SMS, missed call, Net-banking, ATM, Mobile Banking, e-mail, WhatsApp and toll-free number as well. Read on to learn more on how to check your balance through each method.

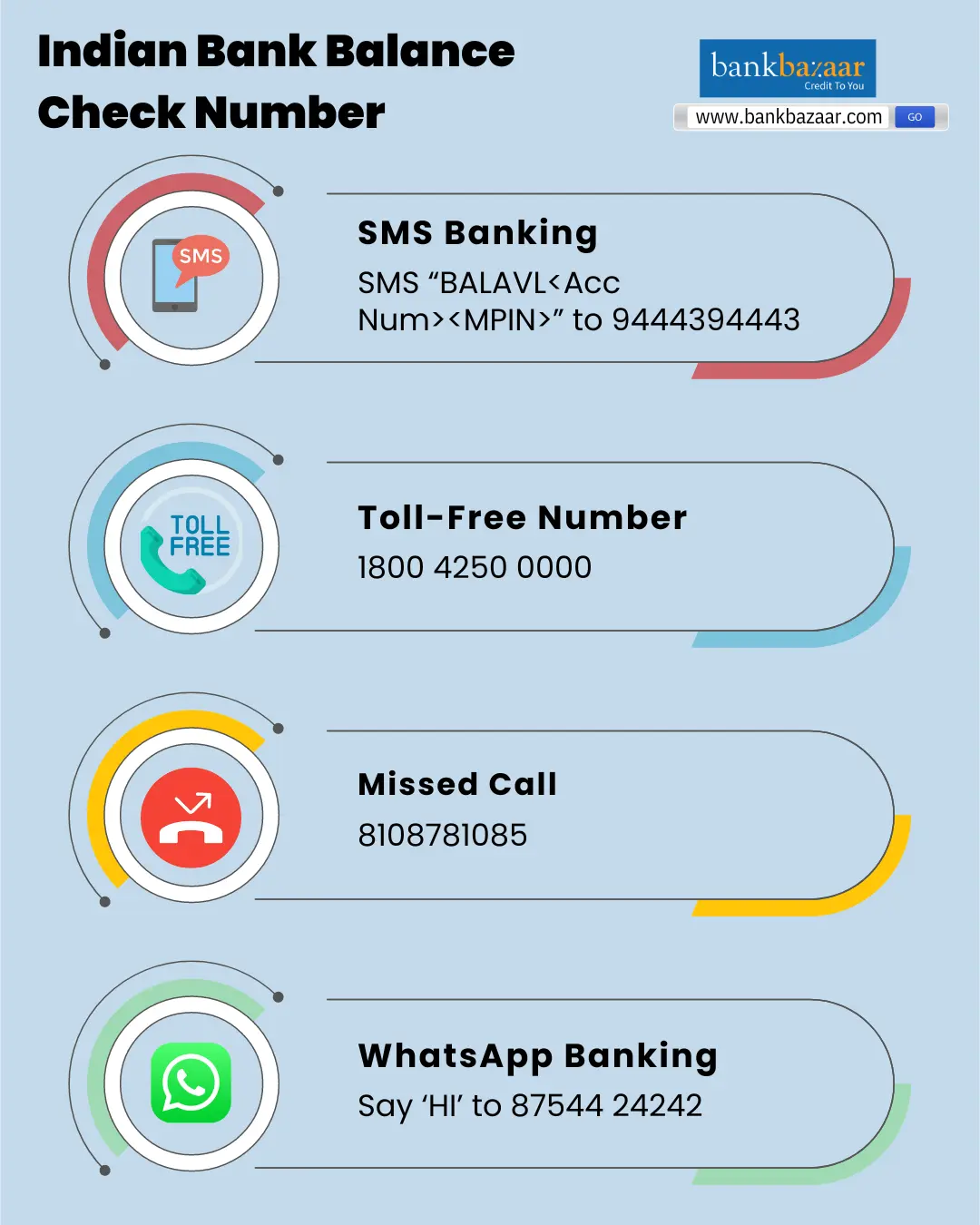

The following are the toll-free numbers for Indian Bank to check your account balance:

Indian Bank National Helpline Number | 1800 1700 |

Indian Bank NR Customer Support Number | +91 22 4444 2888 |

Indian Bank Balance Check Number via WhatsApp | Say ‘Hi’ to 87544 24242 |

Additionally, they can either login to their internet banking account or the IndPay mobile app or they can make use of the phone banking facilities (via the missed call and SMS service) to check their account balance.

1. Indian Bank Account Balance Check via Toll-Free Number

The easiest method to check your bank balance is via toll- free number. Follow the steps given below:

Step 1: Give a Call to 1800 1700 from your registered mobile number.

Step 2: Choose the language of your choice from the options available.

Step 3: You will then be connected to a customer care executive, who will provide your account balance.

2. Indian Bank Account Balance Check via the Missed Call Service

If the customer has registered their mobile number with their Indian Bank savings account, they can use the missed call service to check their balance. To utilize this service, follow the steps below:

Step 1: Ensure that your mobile number is registered with Indian Bank.

Step 2: Following the registration, the customer has to call Indian Bank at: 9677633000

Step 3: The call will automatically disconnect after 1–2 rings, and you will receive an SMS with your account balance details.

Note: Indian Bank Customers doesn't charge any fees for balance enquiry via Missed call.

3. Indian Bank Account Balance Check through SMS Service

For customers who do not have an internet connection or online accounts with Indian Bank, they can check their account balance using the SMS facility. To use this service, the customer must first register their mobile number at their home branch by submitting the SMS banking application form.

Once the customer receives their MPIN and confirmation that their number has been registered, they can proceed with the SMS facility.

You can also keep track of your account balance by getting automated messages on your registered mobile number whenever you proceed to make any transaction.

4. Indian Bank Account Balance Check through Net Banking

For customers that have an internet banking account with Indian Bank, they can follow the steps mentioned below to check their account balance.

Step 1: Visit the Indian Bank online banking portal

Step 2: Click on 'Login for Net Banking'

Step 3: Now, enter 'User Id', 'Captcha' and the click on 'Proceed'.

Step 4: Once you have logged in, click on the 'Accounts' tab.

Step 5: As soon as you do that, the page will display the balance in your account.

Step 6: Click on ‘Statement’ 'detailed statement' to check your recent transactions.

5. Indian Bank Balance Check through IndOASIS MobileApp

Indian Bank customers can also make use of the mobile app to check their account balance by following the steps mentioned below.

First, the customer will be required to download the IndPay mobile app and register before he/she can carry out any banking procedure.

Step 1: Go to Play store or Apple store Store and Install the 'IndOASIS' app.

Step 2: Log in or Register to your IndOASIS mobile banking app using your username and password.

Step 3: Now, click on 'Accounts'. button.

Step 4: Display the balance in your account under the 'Savings' menu along with other details.

Step 5: You can also choose to go through the detailed statement of your account.

6. Indian Bank Account Balance Check at an ATM

Indian Bank customers can also check their account balance at an ATM of their choice. Customers need to follow the steps mentioned below to do so.

Step 1: Visit an ATM closest to you.

Step 2: At the ATM, insert your Indian Bank debit card

Step 3: Enter the 4-digit Indian Bank ATM PIN

Step 4: Click on 'Balance Enquiry'.

Step 5: The ATM will then display the balance in your account.

7. How to Check Indian Bank Account Balance via a UPI App

Given below are the steps to know Indian Bank account balance via a UPI app:

Step 1: Open any UPI app on your smartphone.

Step 2: Enter the code to unlock the app.

Step 3: Now, select the Account from which you need to check the balance

Step 4: Then, Click on 'Fetch Balance'

Step 5: Enter your 'UPI PIN' to fetch your account balance.

Do note that you can use UPI apps like Freecharge, Amazon Pay, Google Pay, PhonePe, CRED

9. How to Check Indian Bank Account Balance via Whatsapp?

Given below are the steps to know Indian Bank account balance via Whatsapp:

Step 1: Save the number 8754424242 on your smartphone.

Step 2: Send a “Hi” on this number through your registered mobile number.

Step 3: A message containing the list of services being offered with each number assigned will be sent to you.

Step 4: Reply with the assigned number, usually “1”.

Step 5: You will immediately be notified about your account balance.

10. How to Check Indian Bank Account Balance via Bank?

In case you are not comfortable with any of the online methods, you can also check your bank balance by visiting the bank branch. You can avail any one of the two methods:

- Ask for balance information at the counter: The official at the counter will need your account number and verified ID and inform you about your balance and other transaction details.

- Update your passbook: Visit the Passbook Vending Machine. Insert your passbook and begin printing. Once completed, you will be able to view your balance on your passbook.

FAQs on To Check Indian Bank Account Balance

- Will I be charged to check Indian Bank account balance?

No, you will not be charged to check Indian Bank account balance.

- Can I check my account balance at any ATM?

Yes, you can check your balance at any bank’s ATM using your debit card, subject to free transaction limits.

- Is it safe to check account balance through UPI?

Yes, it is safe to check account balance through UPI. However, do note that you should not share your UPI password with anyone.

- Can I visit the bank and check my account balance?

Yes, you can visit the bank and check your account balance.

- How many times can I check my account balance?

You can check your account balance any number of times.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.