SBI PPF Account and Interest Rate 2026

The Public Provident Fund (PPF) scheme was launched by the National Savings Organisation in 1968 in order to help individuals make huge savings over the long run by making small contributions.

- Interest rate of 7.1% p.a.

- Duration of scheme is 15 years

- Easy to open an account

- Nominees can be added

About SBI PPF Account

The scheme provides a high rate of interest and comes with tax benefits. Extension of account, withdrawal, and loan facilities are available for investors who contribute towards the scheme.

State Bank of India (SBI), which is the largest bank in the country, offers the PPF scheme with a good interest rate. SBI has over 15,000 branches in India, therefore, getting access to the scheme is easy. Opening the PPF account offered by SBI can also be done online. Therefore, opening a PPF account at SBI has become very easy.

For more information, Check out related articles: PPF Calculator, PPF Rules, PPF Investment & PPF Account Post Office

Steps to Open SBI PPF Account Online

The procedure to open a PPF account with SBI is very simple and can be done online with the help of internet banking or mobile banking. According to SBI, it is the first bank to offer instant account facility for a PPF account. However, the below-mentioned prerequisites are to be followed in order to open a PPF account with SBI:

- The individual must have a savings bank account with SBI.

- The Aadhaar number of the individual must be linked with the savings account.

- Net-banking or mobile banking facility must be enabled.

- The mobile number that is linked to the PPF account must be active. An OTP will be sent to the mobile number which is required for the opening of an account.

The procedure to open a PPF account online is mentioned below:

1.First, the individual must visit the SBI website (https://onlinesbi.sbi.bank.in/).

2.Next, the individual must log in to his/her account using the username and password.

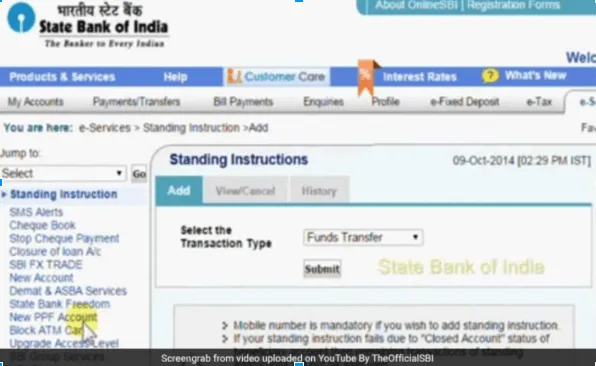

3.Once the login is complete, the individual must click on 'New PPF Account'.

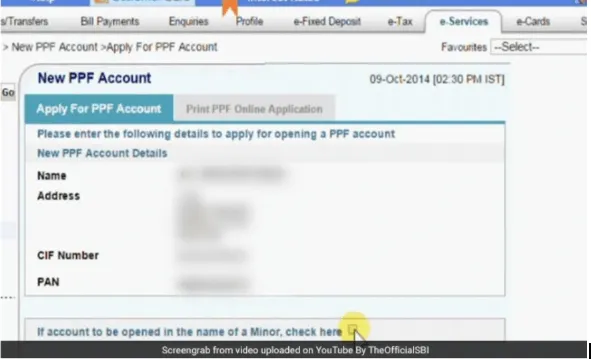

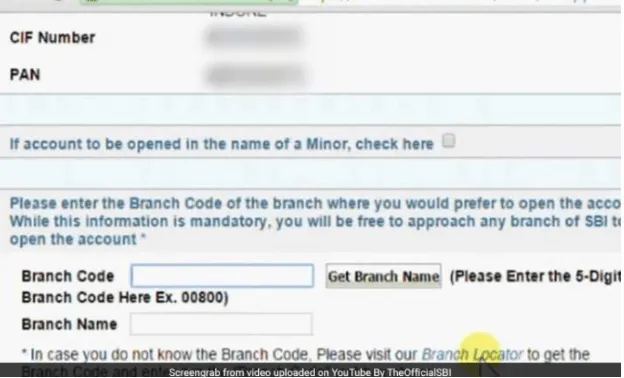

4.On the next page, the individual's name, address, CIF number, and PAN will be displayed.

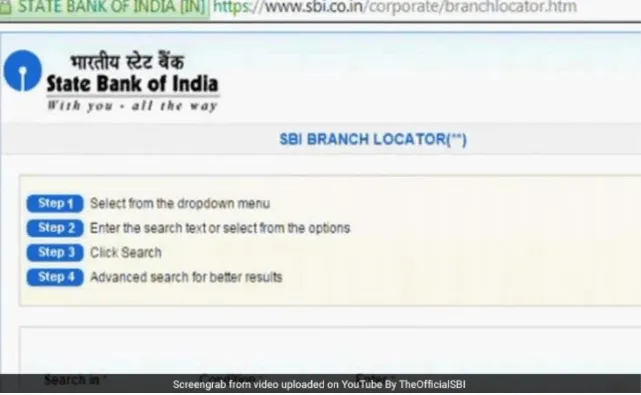

5.Next, the individual must enter the bank account from which contributions are made and his/her PAN number. The details of the bank branch must also be provided. By entering the branch code, individuals will get details of the branch.

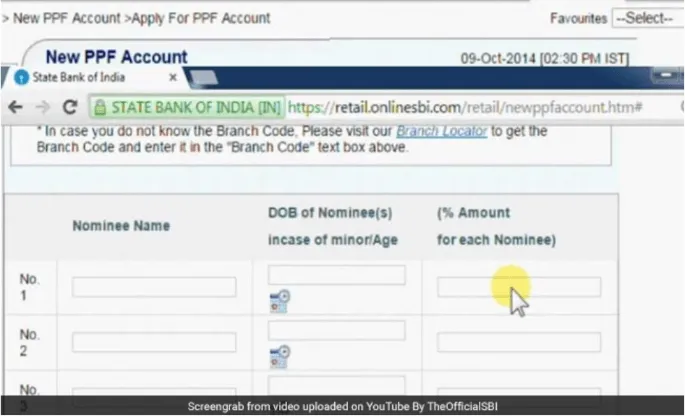

6.Next, your personal details must be verified. Once the details are verified, the individual must add nominee details. After checking the details, the individual must click on 'Proceed'.

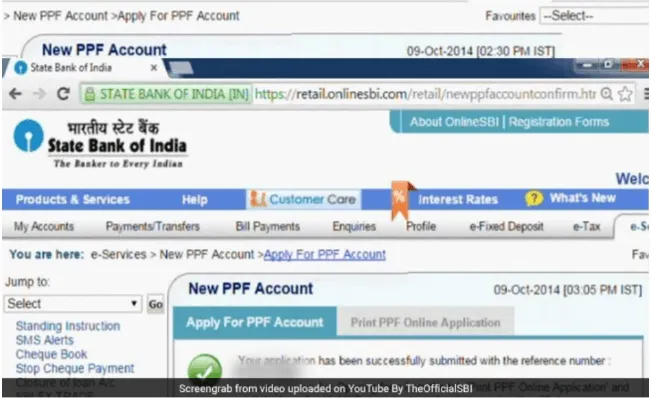

7.After completion of the above step, the PPF account of the individual will be created and the PPF number will be displayed on the screen. Using internet banking, the individual will be able to view the transaction statement and the annual statement.

8.Next, the account opening form must be taken, and the individual must submit the form at the SBI branch within 30 days from when the account was opened.

Steps to Open SBI PPF Account Offline

To open a PPF account with SBI offline, follow the steps mentioned below:

Step 1: Visit any SBI branch that is permitted to open PPF accounts.

Step 2: Fill out the PPF account opening form i.e., Form – 1.

Step 3: Submit the form along with the necessary KYC documents and photographs.

Step 4: Pay a minimum initial deposit of Rs.500 in cash or by cheque.

Steps to Access SBI PPF Passbook Online

You can check your account's credits and debits using the SBI PPF account passbook. Here is how you can access your SBI PPF account passbook online:

Step 1: Activate the internet banking facility for your account.

Step 2: Use your user ID and password for logging in to the SBI website.

Step 3: Click on the option that allows you to access your passbook.

Step 4: You can print and download the passbook.

Steps to Access SBI PPF Passbook Offline

The steps to access your SBI PPF account passbook offline are as follows:

Step 1: Visit the nearby SBI branch that is designated for PPF account opening.

Step 2: Update your PPF passbook to easily check all transactions.

Steps to Check SBI PPF Balance

SBI offers multiple online and offline methods to check the balance of your PPF account as well as all account debits and credits. Here are some essential tips to check your SBI PPF balance:

You must first link your SBI savings account or current account to your SBI PPF account and activate the internet/mobile banking facility. Following this, you can check the balance of your PPF account online by logging into your internet banking/mobile banking account. You just require updating your SBI PPF account passbook to be able to check your PPF account balance offline. The passbook comprises all credits and debits made to your account.

How to Download SBI PPF Account Statement

You can download your SBI PPF account e-statements online through SBI internet banking. Simply enter your login information to access net banking. All the debits and credits made to your SBI PPF account can be checked with these e-statements.

How to Deposit Money in SBI PPF Account?

In order to deposit money in your SBI PPF account, there are two ways that you may take. One if to do the transfer online and another is to visit any SBI bank branch and make the deposit.

- Online deposit of cash

SBI allows customers to deposit cash in their PPF accounts via online banking. You just need to login to your SBI online banking account and make a fund transfer similar to how you do for any other bank. You are required to enter your PPF number as the account number to which cash transfer needs to be made. The payee name should be exactly the same as that mentioned in the PPF account.

- Offline deposit of cash

Deposit to your SBI PPF account can be made offline too, by visiting any of the SBI bank branches. The offline fund transfer can be made either by filling in a pay-slip at the bank or by depositing an account payee cheque. However, the latter requires some extra time for the cheque to get cleared and for the deposit to show up in the PPF account.

SBI PPF Account Eligibility

The eligibility criteria to open a PPF account at SBI are mentioned below:

- The PPF account can be opened only by Indian citizens who live in the country and by individuals on behalf of a minor.

- Only one account can be opened by an individual in his/her name. However, an account can be opened on behalf of a minor.

- Only the mother or the father can open a PPF account on behalf of their minor child. However, the mother and the father can't open an account each on behalf of the child.

- Grandparents are not allowed to open an account on behalf of their minor grandchildren. However, in case the mother or father of the child passes away, the grandparents can open an account as guardians.

- Hindu Undivided Families (HUFs) will not be able to open an account.

Documents required to open a SBI PPF account

The documents required to open a PPF account at SBI is mentioned below:

- Form A or PPF account opening form

- Passport-size photograph

- Any address proof of the individual as per Know Your Customer (KYC) norms

- Nomination form

- Copy of the Permanent Account Number (PAN) must be submitted

SBI PPF Account Interest rate

The rate of interest is determined by the government on a quarterly basis. Currently, the rate of interest is 7.1% p.a. The calculation of interest is on the minimum balance that is present in the account from the 5th day to the end of the month and is paid on March 31 every year.

SBI PPF account Features

The main features of an SBI PPF account are mentioned in the table below:

Category | Features |

Limits of investment | The minimum and maximum amounts that are allowed to be deposited in a year are Rs.500 and Rs.1.5 lakh, respectively. Individuals who deposit more than Rs.1.5 lakh are not eligible for tax rebates. |

Payments towards the account | PPF account Payments can be made in a lump sum or in a maximum of 12 instalments. |

Withdrawals and loans | Withdrawals and loans against the account are determined on how old the account is and on the balance available in the account. |

Nominations | One or more nominees can be added to the account. The percentage that the nominees will receive will be decided by the subscriber. |

Scheme duration | The original duration of the scheme is 15 years. However, subscribers can extend the duration by 1 or more blocks of 5 years each. |

Tax benefits | Under Section 88 of the Income Tax Act, tax benefits are available for any contributions made towards the scheme. The interest that is generated from the contributions is also exempt from tax. The amount that is outstanding to the credit is also Wealth Tax exempted. |

Transfer of the PPF account | The PPF account can be transferred to another post office, bank, or branch and vice versa. There are no charges for the transfer of an account. |

Non-Resident Indians (NRIs) | NRIs can continue to operate the account in case they opened the account when they were residing in India. |

Are there any rules for premature withdrawal rules?

Only after the subscriber of the account or the minor account holder has completed five financial years of opening the account is premature withdrawal allowed. However, PPF premature withdrawal is allowed under the below-mentioned circumstances:

- In case the account holder, parents, children, or spouse require the money for the treatment of life-threatening diseases, premature withdrawal is allowed. However, the relevant documents stating the same from a competent medical authority must be submitted.

- In case the money is required for the higher education of the account holder or the minor account holder. However, documents such as proof of admission and fee bills from a recognised university must be submitted.

How to Withdraw SBI PPF Account

The process for withdrawing funds from PPF accounts at SBI includes the following key elements:

- After five years since the end of the year in which the first subscription was completed, SBI enables you to withdraw money from your PPF balance each year.

- You must complete the PPF Form-2 to withdraw money from your SBI PPF account. The PPF Form-2 is available online as well as at the selected SBI PPF branches.

- The maximum amount you are permitted to withdraw is the lesser of 50% of the balance in your SBI PPF account at the end of the fourth year immediately preceding the year of withdrawal or the balance in your PPF account at the end of the year before.

Extension of SBI PPF Account

You can extend your SBI PPF account after 15 years from the date the account was opened. Here are a few important points to take into account when extending the SBI PPF account:

- After the account matures, you may extend the SBI PPF account several times in blocks of five years.

- You have to submit PPF Form – 4 to the bank within a year of the account maturing.

- NRI PPF accountholders are not allowed to extend their accounts after maturity.

- Throughout the extension period, interest will keep accruing in your SBI PPF account at the current rate.

- During the extension period, you can stop contributing to your PPF account.

Things to Note While Opening SBI PPF Account

National Savings Organisation introduced the Public Provident Fund (PPF) in the year 1968 in an effort to mobilise small savings. This scheme offers investors the opportunity to invest in a scheme that offers decent returns as well as tax exemptions. The latter means that the PPF account holder can enjoy tax-free contribution of up to Rs.1.5 lakh (per financial year), interest earnings, and maturity proceeds from the scheme as per the Income Tax Act, 1961.

Under the Public Provident Fund (Amendment) Scheme, 2016, investors can open a PPF account in State Bank of India. SBI is considered to be the largest banking and financial services provider in the country.

Listed below are 10 important things to keep in mind when opening a PPF account in SBI:

- Anyone can open a PPF account for self or a minor as the legal guardian at one of the branches of SBI.

- The minimum and maximum investment limits of a PPF account are Rs.500 and Rs.1.5 lakh per year, respectively. If the investment limit exceeds Rs.1.5 lakh in a financial year then the excess sum will not be eligible for interest or tax exemption. The investment can be made in lump sum deposits or 12 installments in a financial year.

- The lock-in period of a PPF account is 15 years. After the completion of the said term, the account holder can choose to extend the tenure in blocks of 5 years.

- The government of India determines the interest rate of PPF. The interest is calculated on the available balance at the close of the 5th day of the month and the end of the month. Interest earnings are paid on the last date of March of every financial year.

- Account holders can take loans against their PPF accounts and are allowed to make partial withdrawals subject to certain terms and conditions. One withdrawal can be made every financial year after the 7th year and it should not exceed 50% of the account balance. Loans can be taken from the 3rd year to the end of the 5th financial year.

- Most investors prefer the PPF scheme for its tax exemptions on the contributions made, maturity proceeds, the interest earnings. The tax exemption on contributions made to a PPF account is limited to Rs.1.5 lakh per financial year.

- Investors can name one or more dependents as nominees at the time of opening a PPF account and the shares of the nominees can be determined by the investors.

- The PPF account can be transferred within a bank or post office (i.e. from one branch to another within SBI). Likewise, if a person has opened a PPF account in a bank and wants to transfer it to a post office, it is permitted, and vice versa. The transfer process is free of charge.

- Premature closure of a PPF account is permitted only if the account holder or dependents of the account holder require funds to treat serious ailments or pay for higher education. The premature payment is approved only if the account holder submits proof of the serious ailment or higher education in the form of supporting documents and bill payment receipts.

- Account holders can view their PPF account statements online in their SBI Net Banking Account. Furthermore, account holders can give standing instructions to SBI for periodically crediting their PPF accounts through netbanking.

If an investor had opened a PPF account as a Resident Indian and later became Non-Resident Indian, he or she can continue to have the account as per Govt OM no. F/01/10/2016-NS dated 23 February 2018. The National Savings Institute implements the PPF Amendment Scheme 2016 as well as other Small Savings schemes. Therefore, visit the official website to gather more information on the scheme.

How to Transfer SBI PPF Account

SBI offers the option of transferring our PPF account between SBI branches as well as to and from other banks and post offices. The process to transfer an SBI PPF account is mentioned below:

Step 1: Submit an account transfer form to your current SBI PPF account branch.

Step 2: The application must include your current PPF account number and branch as well as information about the bank or post office where you wish to transfer your account.

Step 3: Along with your application, you must include your SBI PPF account passbook.

Step 4: After the transfer has been approved, your documents will be sent to the new bank/branch.

Step 5: You must then carry your You must then carry your original KYC documents to the new bank/branch for verification.

Step 6: After the new account is active, the bank or post office will send you a new passbook with important account information, including credits, debits, and the account balance.

PPF Top Pages

- PPF

- PPF Online Payment

- Open PPF Account Online

- PPF Account Balance

- PPF Calculator

- PPF Account Opening Form

- PPF Interest rate

- PPF Loan

- PPF Withdrawal Rules

- Check PPF Account Statement Online

- Change Nominee Name in PPF

- Bank of Baroda PPF Account

- Central Bank of India PPF Account

- Bank of India PPF Account

- Canara Bank ppf account

- PPF Deduction

- PPF Closure Form

- PPF claim Status Online

FAQs on SBI PPF Account

- What documents are required to open a PPF account with State Bank of India (SBI)?

You will need a nomination form, PPF Form A, a copy of the PAN card, KYC documents, and passport size photographs to open an SBI PPF account.

- How can I close my SBI PPF account?

You can close your SBI PPF account by submitting a written application at the relevant branch. Include a valid reason in your application if you want to prematurely close your PPF account. You must also include other supporting documentation, such as a copy of your PPF passbook.

- Can an individual open more than one Public Provident Fund (PPF) account under his/her name?

An individual can open only one PPF account. However, the individual can open another account under his/her name for an individual below the age of 18.

- Is it possible to access the PPF account through SBI internet banking?

Yes, it is possible to access the PPF account by using SBI internet banking. Subscribers will also be able to view their PPF account statement and transfer funds to the PPF account with the help of internet banking.

- Are there any penalties if money is not deposited?

Rs.50 per year will be charged as fine if Rs.500 (minimum amount) is not deposited by the customer by the end of the year.

- Can a PPF account be transferred to SBI from another bank or post office?

Yes, according to the government's PPF scheme, subscribers are allowed to transfer the PPF account from a bank to a post office and vice versa.

- Can subscribers avail loan facilities using their PPF investment?

Subscribers can avail loan facilities against their PPF accounts between the third and sixth financial years from the date the account was started.

- Can non-resident Indians continue to maintain their PPF account if they had opened an account when they were Indian residents?

Earlier, as per a rule made by the Ministry of Finance, the PPF account would be deemed closed from the time resident Indians became NRIs. However, as per a new government rule dated on 23 February 2018, PPF accounts can be maintained by NRIs.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.