EPF Claim Status 2026

To check your EPF claim status, use the UMANG app, log in to the EPFO portal with your UAN, or send an SMS in the format ‘EPFOHO UAN ENG’ to 7738299899.You can also give a missed call to 9966044425 or call the 24x7 EPFO helpline at 1800 118 005 for updates.

What is EPF Claim Status?

EPF Claim Status refers to the current progress or stage of your request to withdraw, transfer, or settle your Employees' Provident Fund (EPF). It shows whether your claim is under process, approved, rejected, or settled. You can check it online using your UAN or PF account number

However, employees must activate their UANs in order to claim the EPF amount online. On the EPFO portal, the activation procedure can be completed.

In order for employees to check the status of their claim, the below-mentioned details must be available with them:

- Company details

- Extension code if it needs to be provided

- Employer's EPF Regional Office

- Universal Account Number

For more information, Check out related articles: UAN registration, UAN Login, PF Balance Check & PF Passbook

How to Claim EPF Offline

To apply for EPF claim offline, you have to download the new composite form (Aadhaar/non-Aadhaar) and submit it.

- Composite Form - If your UAN is activated and you have seeded your Aadhaar and bank details on the UAN portal, use the Composite Claim Form (Aadhaar). Fill up the form and deliver it to the appropriate jurisdictional EPFO office without the employer's signature.

- Non-composite Form - In the event that the Aadhaar and bank details are not seeded on the UAN portal, you may use the Composite Claim Form (Non-Aadhaar). Fill out the form and deliver it to the appropriate jurisdictional EPFO office together with the employer's attestation.

Various methods to check claim status

Employees will be able to check the status of the claims by following one of the below-mentioned methods:

Checking the claim status online

Employees must follow the below-mentioned procedure in case they want to check PF status online:

Step 1: Initially, employees must visit the official website of the EPFO.

Step 2: The next step would be to click on ‘For Employees‘. Check the ‘Our Services’ menu to locate this.

Step 3: On the next page, employees must click on ‘Know Your Claim Status‘. The link is provided under ‘Services‘.

Step 4: On the next page, the employee must enter his/her UAN and captcha details. After entering the details, the employee clicks on ‘Search’.

Step 5: On the next page, the employee must enter the PF number, establishment code, the PF office (under the drop-down menu), and the state where the PF office is present.

Step 6: After entering the above details, the employer clicks on ‘Submit’, and the system displays the claim status on the screen.

To keep employees informed about their PF withdrawal application, the EPFO sends SMS updates to their registered mobile numbers. The system sends an SMS to the employee in the following circumstances:

- After receiving the claim application.

- After the employee’s bank account receives the funds.

Employees can also check the status of their claim by logging in to their UAN portal. Follow the procedure below to log in to the EPFO portal:

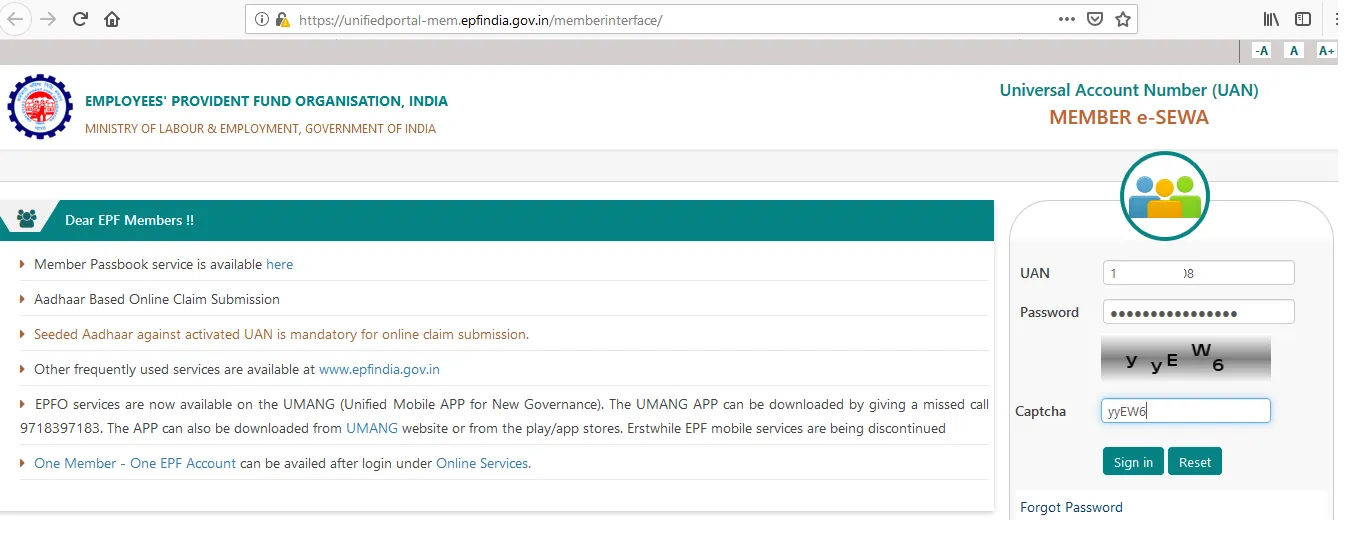

- First, employees must visit the EPFO portal where they can log in to the UAN portal (https://unifiedportal-mem.epfindia.gov.in/memberinterface/). The employee must enter his/her UAN, password, and captcha details. After entering the details, the employee clicks on ‘Sign in’.

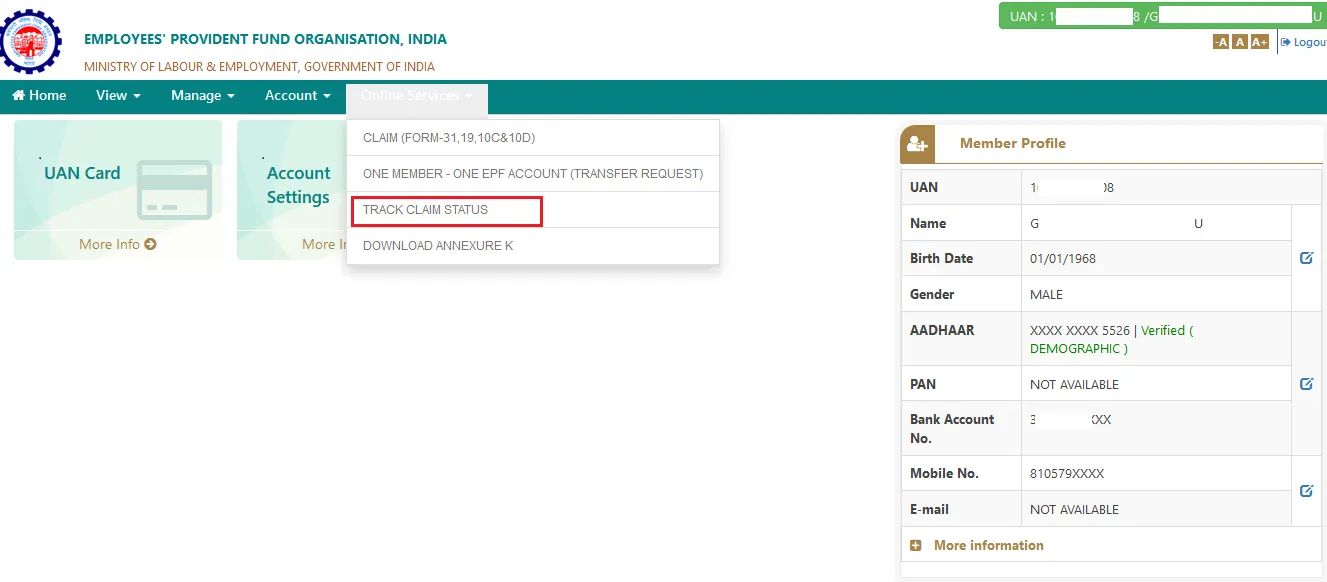

- Once the employee has logged in to the UAN portal, he/she must click on 'Track Claim Status' which can be found under 'Online Services'.

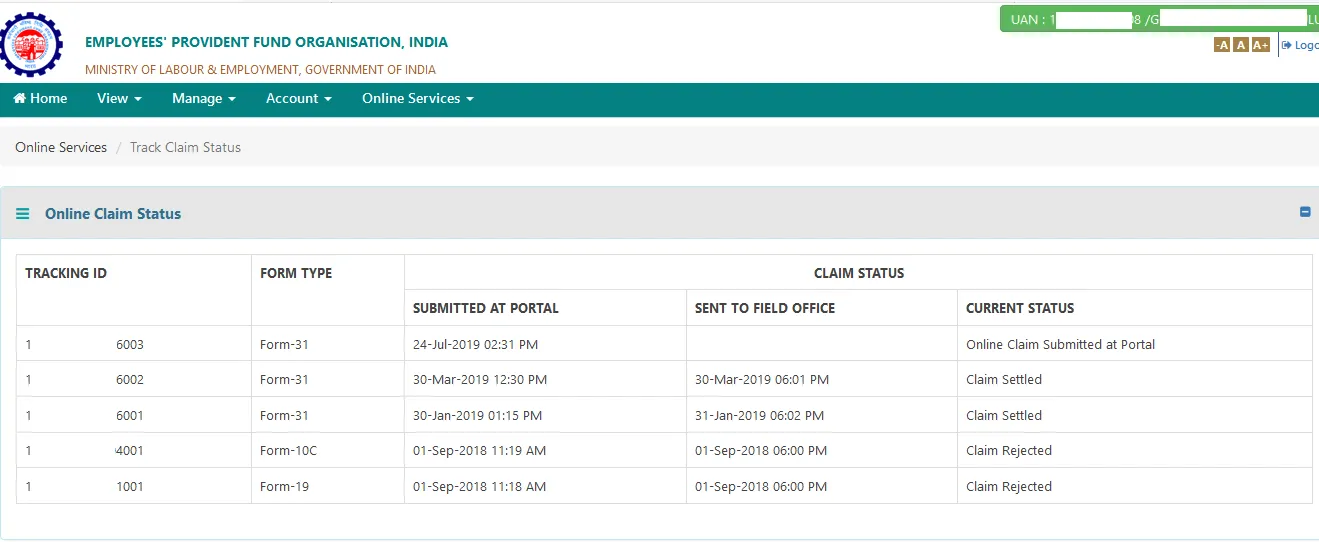

- The next page displays the details of the ‘Online Claim Status’ on the screen.

- Scroll down to view the ‘Transfer Claim Status’ details on the screen.

By giving a missed call

By placing a missed call from their registered cellphone number to 9966044425, employees can find out the status of their claim. The employee must nevertheless connect the cellphone number to their UAN. The employee must also update his or her bank account information, PAN, and Aadhaar information on the UAN portal. Due to the call terminating after two rings, the employee is not charged. The claim's specifics will be sent to the registered mobile number via SMS.

By sending an SMS

Employees can send an SMS to inquire about the status of their claim. The SMS must be sent from the employee's mobile device, which must be connected to the UAN portal. The SMS must be sent to 7738299899 in the format "EPFOHO UAN LAN". The format specifies the language in which the employee would want to receive the information as 'LAN'. The table listing the various languages and codes that the SMS service is accessible in is below:

Language | Code |

English | ENG |

Punjabi | PUN |

Marathi | MAR |

Telugu | TEL |

Malayalam | MAL |

Hindi | HIN |

Gujarati | GUJ |

Kannada | KAN |

Tamil | TAM |

Bengali | BEN |

By using the UMANG app

Employees can also check various details regarding their PF such as balance available, claim status, etc., by using the Unified Mobile Application for New-age Governance (UMANG) app. The UMANG app must be downloaded and is available in both iOS and Android platforms.

Here is a step-by-step procedure to track your PF claim on the UMANG App:

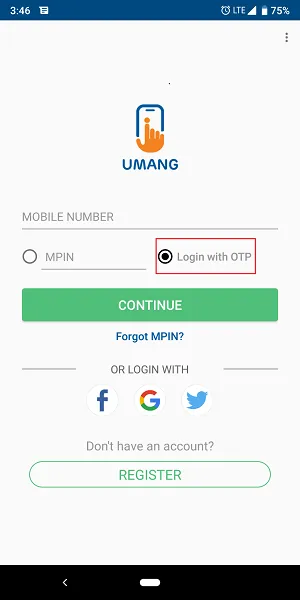

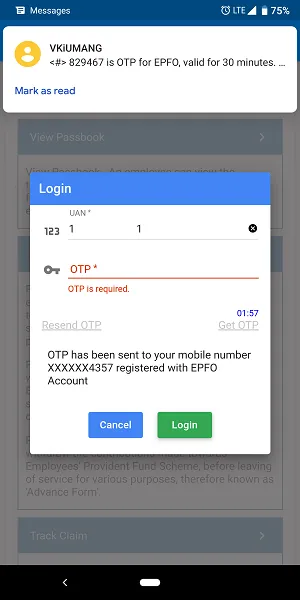

- Download and install the UMANG app from the Play Store or App Store. Next, log in to your EPFO account, you will have two options, viz. 'MPIN' and 'Login with OTP'. Enter your mobile number and choose your preferred option.

- If you choose 'Login with OTP', you will have receive an OTP on your registered mobile number. Enter it in the provided space to log in to your account.

- After you have entered your OTP, click on 'Login'.

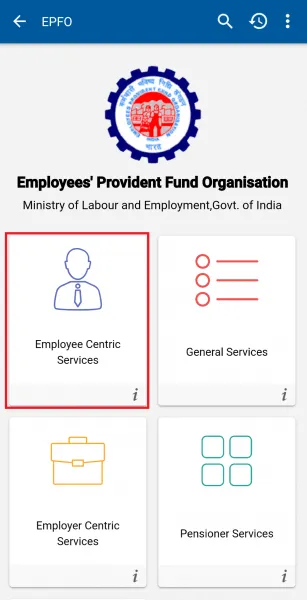

- After logging in, the system redirects you to the main page of the EPFO portal. Here, you will have to select ‘Employee Centric Services‘.

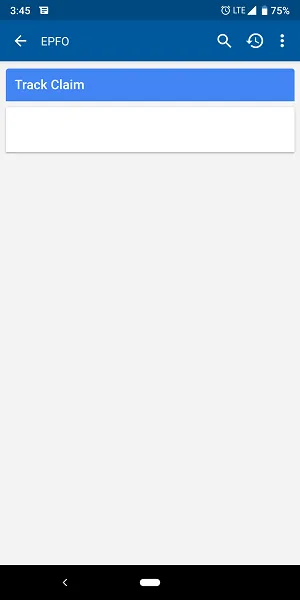

- Next, select 'Track Claim' and you will be redirected to the page where you can track your claim status.

- This page shows your claim status. In case you have no claims, the screen will appear as below. But if you do have claims, the screen will show the details of the claim status.

The UMANG app offers several services, including:

- View your passbook.

- Raise claims.

- Check the status of your claims.

- Access PF claim details.

- Search for establishments.

- Locate EPFO offices.

- Check the status of your Temporary Return Reference Number (TRRN).

Types of EPF Claim Status

The different types of EPF claim status are mentioned below -

- Payment under process

- Settled

- Rejected

- Not available

FAQs on PF Claim Status

- What is the eligibility to claim EPF?

After retiring from their current employer, EPF members over the age of 58 are able to claim their EPF benefits. For members who have completed 10 years of service with the specific organization, they are eligible to receive 90% of the EPF amount as a monthly pension.

- What are the methods to submit the claim form?

PF claim forms can be submitted both online and offline. PF non-refundable advances, pension withdrawal benefits, and the Composite Claim Form can be submitted online. However, the member's bank details, Permanent Account Number (PAN), and Aadhaar number must be linked with the UAN. All types of claims forms can be filed offline.

- What is the procedure for members to raise their grievances?

Members will be able to raise their grievances on the Employees Provident Fund Organisation (EPFO) portal (http://epfigms.gov.in/). They can also raise their grievances by approaching the Regional PF Commissioner.

- What to do if the PF claim is pending?

You have to wait until the PF office verifies your claim request and transfers the amount to your bank account. You can even contact your previous employer to approve your PF claim request, in case it is pending from your previous employer’s end.

- Why is my PF claim status still under process?

If your PF claim is under review at the PF office, then the PF status will be under process and the amount will be credited to your bank account after processing your claim request.

- What are Form 10C and Form 19?

Form 10C is for pension withdrawal and for Provident Fund withdrawal, it is Form 19.

- How long does it take for the claim to be settled?

According to the EPF scheme, the claim must be settled by 20 days.

- Is it possible for PF members to apply for a settlement of claims without the employer's attestation?

Form 31, Form 10C, and Form 19 are the three types of claims PF members can apply for with the employer's attestation. However, the Universal Account Number (UAN) of the member must be activated. The bank account and Aadhaar number of the member must also be linked to the UAN and the employer must approve both details using a Digital Certificate Signature.

- Can an employer reduce their share of contribution towards the EPF?

No, employers cannot reduce their share of contribution towards EPF. It is against the law for employers to reduce their contribution.

- Can employees continue to make contributions towards the EPF even after their resignation?

No, employees cannot make contributions towards the EPF after their resignation. The contribution of the employer and employee must match, and since there is no contribution made by the employer, the employee cannot make any contribution as well.

- Is it possible for the widow and children of a pensioner to withdraw the pension at a different place or bank?

No, the widow and children of a pensioner can withdraw the pension only at the same bank and place.

- How do I know whether my PF withdrawal has been approved or not?

You can track the approval status of your PF withdrawal through online mode. On receiving EPF claim application or transfer of funds to claimant’s bank account, EPFO will send SMS alert to your registered mobile number confirming the status of the PF withdrawal status.

- How much time will it take to settle the EPF payment sent via NEFT?

EPF payment sent visa NEFT will take up to three days at EPF and bank level each, to complete the process of settlement. In general, it takes around 20 days to settle all the PF claim requests.

- Can I withdraw an amount from my EPF account, if I am jobless?

No, you cannot withdraw the EPF amount from your account if you are jobless. You can withdraw the amount if your unemployment period exceeds three months.

- Do I need Aadhaar for filing an online EPF claim?

Yes, Aadhar is required to submit an online EPF claim. Your Aadhar should be required to seed the UAN. If Aadhar is linked to your PF account, this also makes it easier for the employer to deposit money into your EPF account and file Employee-cum-Return (ECR) challans.

- Can I withdraw my EPF amount if I have completed five months in my current organisation?

No, the EPF amount cannot be withdrawn unless you are unemployed from your current organisation. If you are unemployed for one month you can withdraw 75%, while the remaining 25% can be withdrawn after two months.

- Is the employer’s approval needed to file claims?

No, the employer’s approval is not required to file EPF claims, as per the new EPF rules or the lates amendments.

- Will EPFO continue to pay interest on your EPF Account after you leave the company?

EPF account becomes inoperative if you resign from your service before attaining 58 years of age and you do not apply for EPF withdrawal with 36 months from the date of eligibility. Individuals will stop receiving interest on the EPF amount, as soon as the EPF account becomes inoperative.

News on EPF Claim Status

EPFO Raises Auto-Settlement Limit for PF Withdrawals to ₹5 Lakh

The EPFO has increased the automatic settlement limit for PF withdrawal claims to ₹5 lakh. This means claims up to this amount will be processed faster without manual checks. The change aims to reduce delays and make it easier for employees to access their funds.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.