PPF Account for NRIs in India

Non-resident Indians are not permitted to open or operate a PPF account in India. It is However, if a person opens a PPF account as an Indian citizen and later becomes an NRI then the account will remain active.

The PPF scheme is a highly beneficial tax saving cum investment instrument that offers incredible interest rates and compounding benefits in its 15-year maturity period.

While this option has been widely utilized by many Indian residents, there exists the confusion on whether NRIs are allowed to operate these PPF accounts.

Sadly, non-resident Indians are not allowed to open, operate, or run PPF accounts.

Investment in Existing PPF Account After Becoming an NRI

The Public Provident Fund (PPF) is a popular long-term savings and investment scheme offered by the government of India. It allows individuals to build a substantial corpus while enjoying tax benefits.

However, there are specific rules and regulations regarding NRIs' eligibility to invest in the PPF scheme.

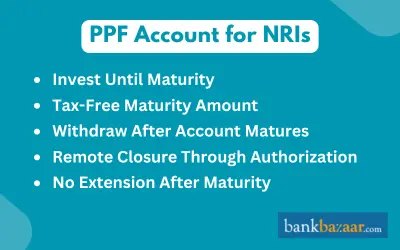

- Investment till Maturity: If an individual opened a PPF account while they were a resident of India and later becomes a Non-Resident Indian (NRI), they are allowed to continue investing in the same PPF account until its maturity. This means that even after becoming an NRI, they can keep contributing to the existing PPF account, and the account will continue to earn interest until its maturity date.

- No Fresh Contributions after Maturity: Once the PPF account reaches its maturity period, NRIs are not permitted to make any fresh contributions to the account. The maturity period of a PPF account is 15 years from the end of the year in which the account was opened. Therefore, after the completion of this maturity period, no further deposits can be made by the account holder, whether they are a resident or an NRI.

- Non-Repatriation Basis: NRIs can continue subscribing to the PPF account until its maturity on a Non-Repatriation Basis. This means that while they can contribute to the account until maturity, the funds in the account cannot be repatriated or transferred back to the NRI's country of residence or converted to any foreign currency. The money remains in the account and continues to earn interest as per the prevailing PPF rates.

- Notification of Change in Residential Status: It is essential for PPF account holders who become NRIs to inform their account-holding bank or post office (whichever is applicable) about the change in residential status within one month of becoming an NRI. This notification is required to ensure compliance with the regulations and to facilitate the continuation of contributions till the maturity of the account.

PPF Withdrawal or Account Closure by NRI

As an NRI, the procedure for PPF withdrawal is the same as that for residents; there are no relaxations or limitations specific to NRIs. The process and forms for withdrawal remain unchanged.

The PPF corpus can be transferred to your NRO (Non-Resident Ordinary) account in India, and there is no tax on this amount in India. However, it's important to note that your country of residence may impose taxes on the PPF withdrawal, so it's advisable to check the tax regulations in your country before proceeding with the withdrawal.

How to withdraw the PPF corpus

To withdraw the PPF corpus after maturity, follow these steps:

Step 1: Visit the Base Branch - You need to visit the base branch of your PPF account, which is the branch where you initially opened the account.

Step 2: Submit PPF Withdrawal Form - Fill out the PPF withdrawal form and submit it along with your PPF passbook.

Step 3: Provide NRO Account Details - While submitting the withdrawal form, provide the account number of your NRO account where you want the money to be credited.

Step 4: Tax Implications - There is no tax on the PPF withdrawal amount in India, but tax regulations in your country of residence may vary.

PPF Account Limitations for NRIs

The PPF account rules differ for Non-Resident Indians (NRIs), and there are certain limitations they need to be aware of:

- No New Contributions after Maturity: Unlike common Indian residents who can extend their PPF accounts with new contributions after maturity, NRIs cannot continue investing in their PPF accounts once they reach maturity. They can keep the account open but cannot make any fresh contributions.

- Contribution Channels: NRIs can contribute to their PPF accounts through the NRE (Non-Resident External), NRO (Non-Resident Ordinary), or FCNR (Foreign Currency Non-Resident) accounts.

- Partial Withdrawals: Similar to ordinary Indian residents, NRIs can make partial withdrawals from their PPF accounts. However, the withdrawn amount cannot be repatriated abroad; it must be utilized within India.

- Nevertheless, the NRI can repatriate the maturity proceeds through the NRO account, as permitted by the Reserve Bank of India (RBI) under the Liberalized Remittance Scheme (LRS).

- This scheme allows NRIs to transfer a certain amount of funds overseas for various purposes.

Steps to Close PPF Account for NRIs:

Closing a PPF account as an NRI involves specific steps, whether the individual visits India or appoints a representative. Here's a detailed guide on how to close the PPF account for NRIs:

If the NRI is visiting India:

Step 1: Visit the Bank Branch-The NRI must personally visit the bank branch in India where the PPF account is held.

Step 2: Submit Documents- At the branch, submit the PPF withdrawal form, a copy of ID proof, a passbook, and a cancelled cheque from the NRO (Non-Resident Ordinary) account where the money will be credited.

Step 3: Complete Formalities- Complete the necessary formalities at the bank to process the PPF account closure.

Step 4: Funds Transfer- Upon closure, the PPF funds will be transferred to the individual's NRO account.

If the NRI cannot visit India:

Step 1: Download the PPF Withdrawal Form- Download the PPF withdrawal form from the bank's website or obtain it from the bank where the PPF account is held.

Step 2: Provide Necessary Documents- Attach copies of ID proof, address proof, and a cancelled cheque of the NRO account.

Step 3: Authorization Letter- Write an authorization letter stating that the representative (appointed individual) will visit the bank on your behalf for PPF account closure, as you are unable to be physically present.

Step 4: Send Documents to Representative- Send all the required documents, including the filled withdrawal form and authorization letter, to your appointed representative in India.

Step 5: Representative Visits the Bank- The representative visits the bank branch where the NRO account is held and gets the necessary documents attested by the bank manager.

Step 6: Submit Documents for PPF Withdrawal- The representative submits all the documents, including the withdrawal form and authorization letter, to the bank branch for PPF account closure.

Step 7: Processing and Funds Transfer- The bank processes the application, and upon closure, the PPF funds are credited to the individual's NRO account.

PPF Top Pages

- PPF

- PPF Balance

- PPF Online Payment

- PPF Deposit Limit

- PPF Calculator

- PPF Rules

- How to Open PPF Account Online

- PPF Interest Rate

- PPF Account Opening Form

- Change Nominee Name in PPF

- PPF Withdrawal Rules

- Axis Bank PPF Account

- Bank of Baroda PPF Account

- Central Bank of India PPF Account

- Union Bank ppf account

- PPF Claim Status

- PPF Tax Benefits

- Check PPF Account Statement

FAQs on PPF Account for NRIs in India

- Will my PPF account continue to earn returns if it remains inactive?

No, an inactive PPF account will not accrue any interest during the period of inactivity. Once the account is revived, interest will be calculated based on the balance at the time of reactivation.

- Can I withdraw my PPF balance after 5 years?

Yes, the Government has introduced positive changes to the PPF scheme, allowing individuals to withdraw the entire balance and close their PPF accounts after completing 5 years of account tenure.

- Can I contribute to my existing PPF account after becoming an NRI?

Yes, you can make contributions to your existing PPF account even after becoming an NRI, using your NRE (Non-Resident External) or NRO (Non-Resident Ordinary) account. However, contributions can only be made until the maturity of the PPF account.

- Is it possible for a non-resident Indian to open a PPF account?

No, individuals with non-resident Indian (NRI) status are not eligible to open a PPF account. The NRI status disqualifies them from initiating, operating, or managing a PPF account.

- What are the consequences of an NRI opening a PPF account?

While it is technically possible for an NRI to open a PPF account, doing so may lead to legal repercussions. To avoid any issues, it is advisable for NRIs with existing PPF accounts to contact the relevant authorities and close the account.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.