EPF Withdrawal Forms - Types, Uses & Online Claim Process

Various forms are available under the Employees' Provident Fund (EPF) scheme. Depending on the purpose, the EPF Form would vary.

Funding a Life Insurance Corporation (LIC) policy, advances of EPF amount and withdrawal of EPF amounts are some of the purposes where different forms are needed.

Documents Required for PF Withdrawal Form

The most common documents required to withdraw your provident fund balance are listed below:

- Form 19

- Form 10C and Form 10D

- Form 31

- Two revenue stamps

- Bank account statement

- Identity proof

- Address proof

- A blank and cancelled cheque (IFSC code and account number should be visible). Also, you should ensure that the cheque provided by you is a single account holder cheque only.

Different EPF Forms

Given in the table below are the different EPF Forms that are available:

Form | Purpose |

Nomination for the EPF and Employees' Pension Scheme (EPS) | |

Registration form for new employees for EPS and EPF | |

Employees' Deposit Linked Insurance (EDLI) scheme claim form | |

Form 10C | EPS withdrawal |

To apply for a pension after retirement | |

Automatic transfer of EPF | |

Form 14 | LIC Policy |

Form 15G | To save Tax Deducted at Source (TDS) for any interest that is generated from EPF |

Form 19 | Settlement of EPF |

Form 20 | EPF settlement in case of employee's death |

Withdrawal of EPF |

Method to Fill EPF Form 19 Online

Given below is the list of steps that must be followed to fill the Form 19 online:

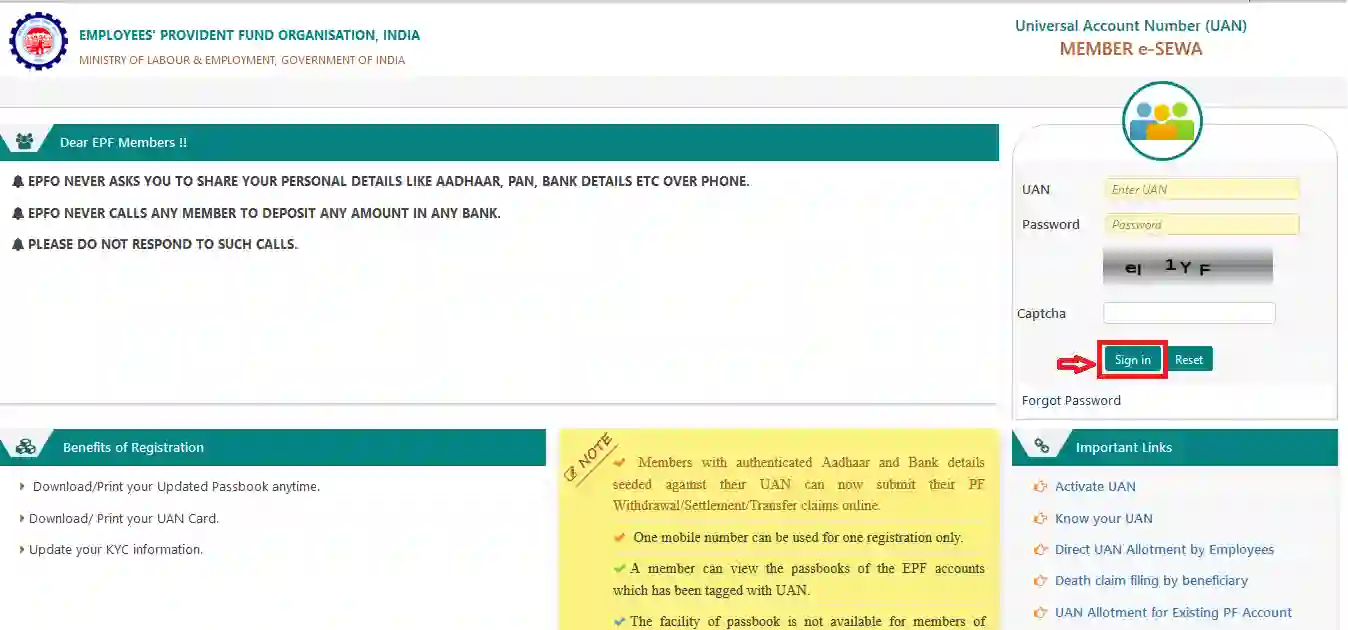

1.First, you must login to your Universal Account Number (UAN) portal by entering your UAN, password, and captcha details. This can be done on the Employees Provident Fund Organisation (EPFO) website (https://unifiedportal-mem.epfindia.gov.in/memberinterface/).

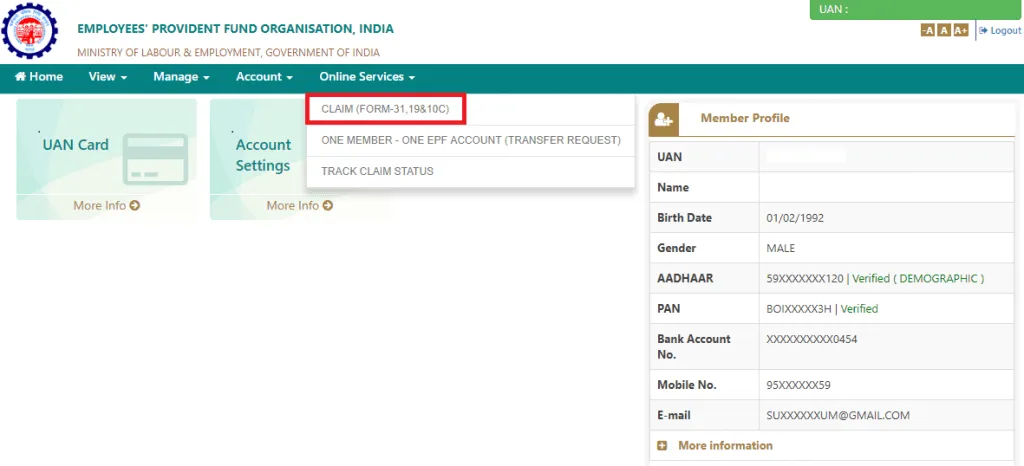

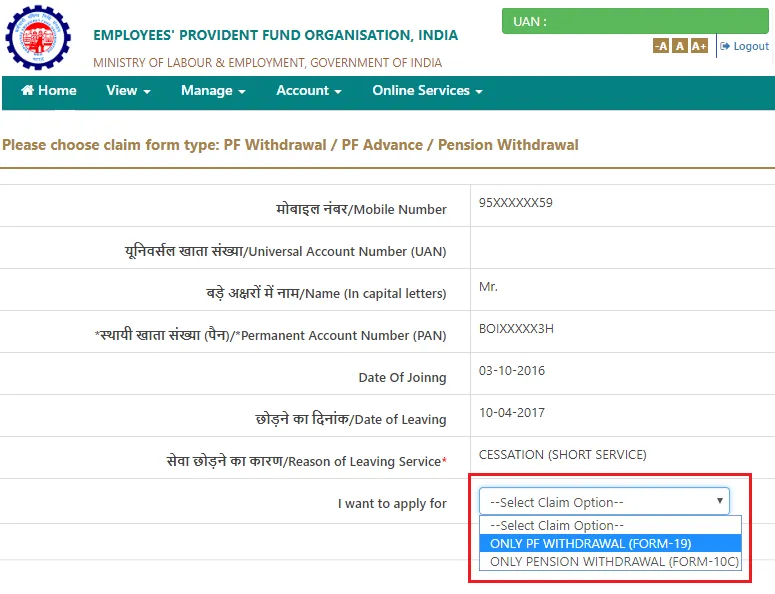

2.On the next page, you must click on 'Claim (Form - 31, 19 & 10C)' which can be found under the 'Online Services' tab.

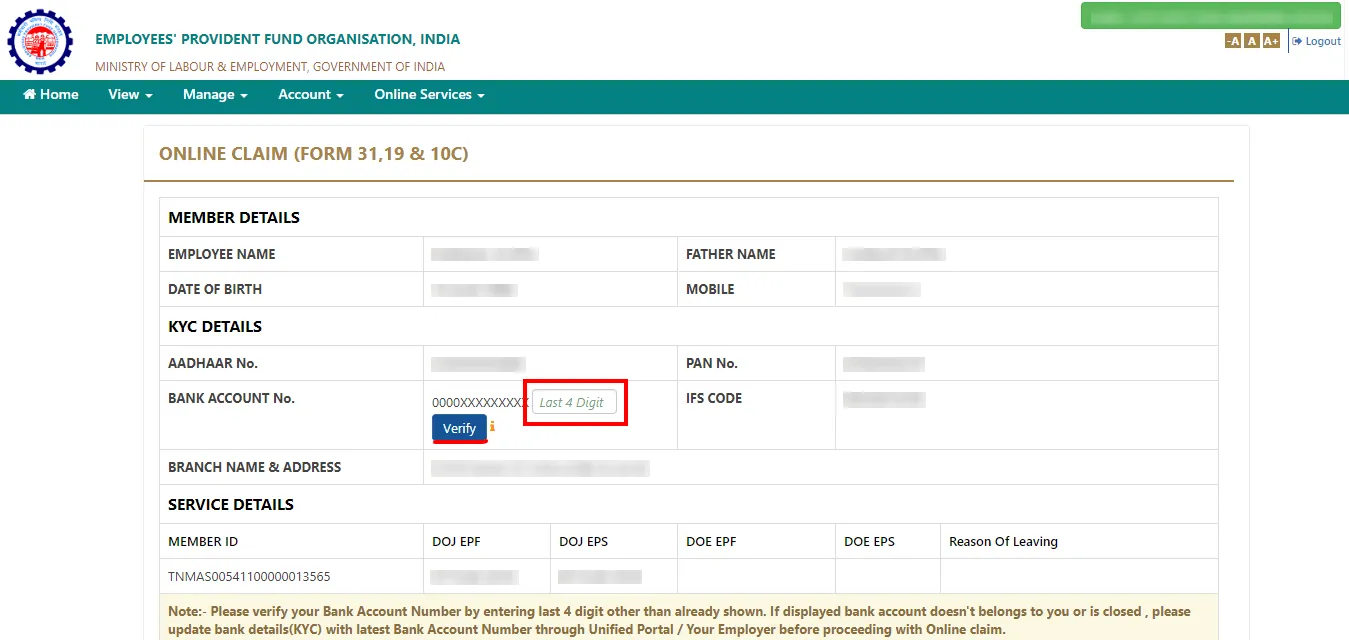

3.Next, you must enter the last four digits of your bank account number and click on 'Verify'.

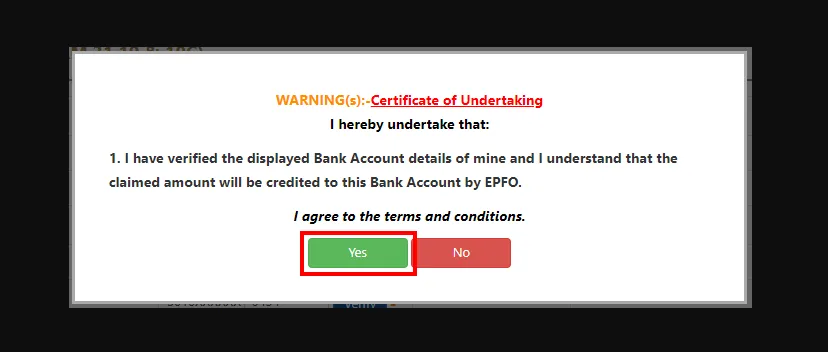

4.The 'Certificate of Undertaking' will pop up. You must click on 'Yes'.

5.In the 'I want to apply for' drop-down menu, you must select 'Only PF Withdrawal (Form-19)'.

6.On the next page, check the disclaimer and click on 'Get Aadhaar OTP'.

7.You will receive an OTP on your registered mobile number.

8.You will need to submit the application after entering the OTP details.

9.You will receive a reference number once the application is submitted.

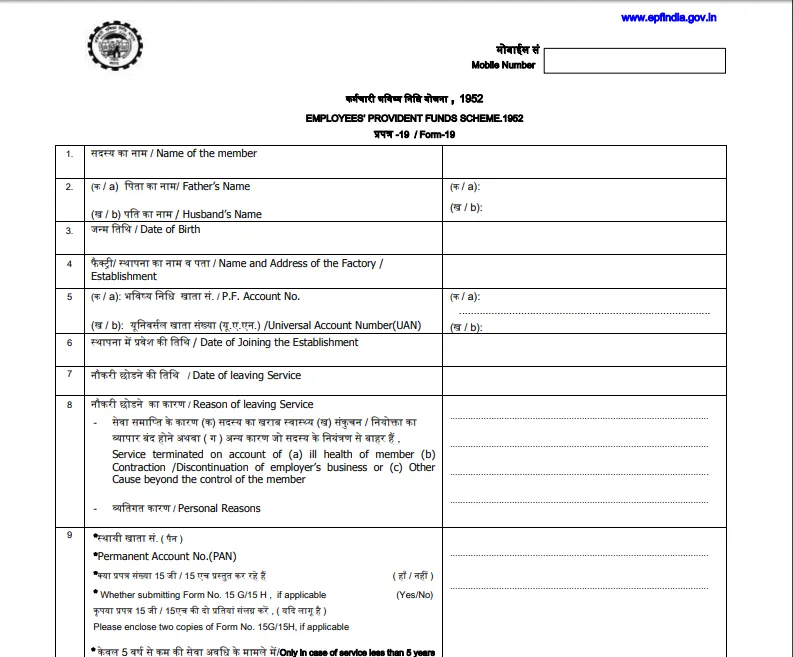

Form 19

This form allows you to withdraw your PF balance after quitting your job, superannuation, termination or at the time of retirement. Under no circumstances can any establishment or organisation can stop you from withdrawing from your provident fund balance.

The form requires you to fill in the following details:

- Your name as per your payslip

- Your father's name or husband's name (married women)

- Provident fund account number (pay slip)

- Reason for leaving the previous service

- Date of leaving the previous service

- Your permanent address

- Your preferred mode of remittance

- Name and address of your establishment

- Contribution for the current financial year

Employees can also file a claim for PF withdrawal using Form 19 on the EPFO website. A new form can be downloaded and filled out and submitted on the website.

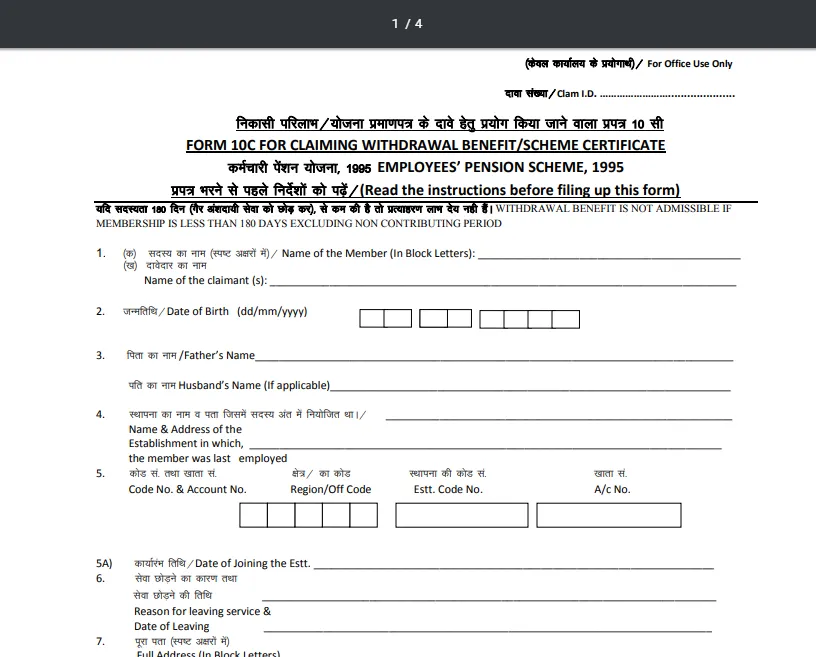

Form 10C

Form 10C is used for making claims of PF withdrawals. This form is to be submitted by employees who fall under the age bracket of 50 years, i.e., aged below 50 years. This form is usually submitted with F-19/20 for the following schemes:

- Settlement of withdrawal under old Family Pension Fund

- New Employees' Pension Scheme (EPS 95)

- Scheme certificate for membership retention (under 58 years)

The form requires you to fill in the following details:

- Name of the claimant

- Marital status

- Name and address of the establishment

- Code and account number

- Date of leaving

- Reason for leaving service

- Are you willing to accept scheme certificate in lieu of withdrawal benefits?

Advance Report

This is given when you opt for payment of withdrawal benefit by cheque.

In 2017, the EPFO launched new EPF Withdrawal Forms that do not require the employer's signature. The forms are Form 10C UAN, Form 19 UAN and Form 31 UAN. The eligibility criteria for using these forms include having a UAN that has been activated and the individual's PAN, Aadhaar, and bank details should be seeded with the UAN. Additionally, the employer has to verify the employee's KYC with a digital signature.

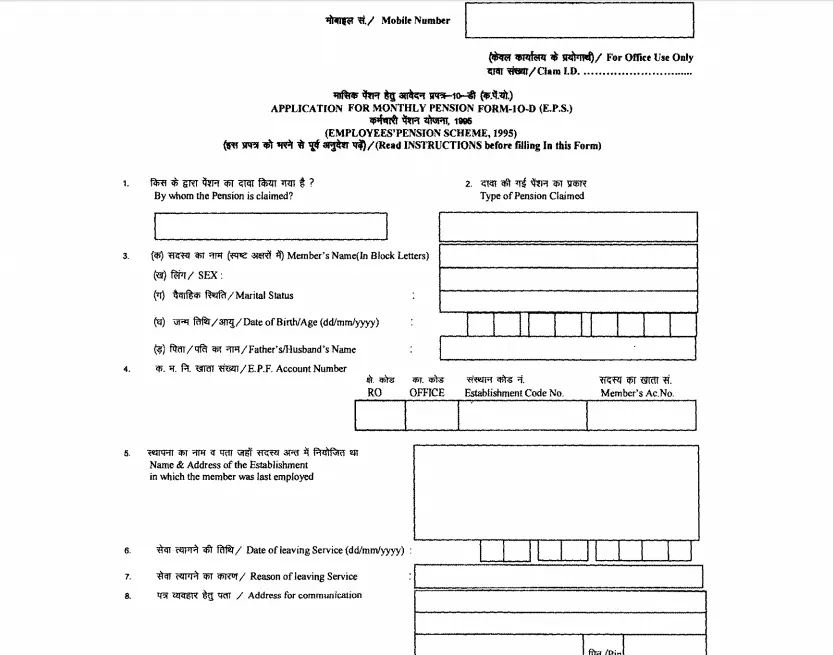

Form 10D

Form 10D is used for making Monthly Pension claims. This form is also submitted along with the F-19/20. If the employee is aged more than 50 years but less than 58 years, he/she will be required to submit Form 10D.

The form requires the following details to be filled up:

- Name of the claimant

- Permanent Address

- Marital Status

- Name and address of the last organisation

- Date of leaving the last organisation

- Reason for leaving the last organisation

- Advance Report and so on

Form 19 UAN

This form is applicable when an employee resigns due to physical disabilities, permanent relocation to a different country and on retirement. Filling the form is fairly simple. The employee has to provide all the details such as UAN, PAN and date of exit from the job. If the tenure at the job were less than five years, the employee would also have to submit Form 15G or Form 15H. However, these additional forms can only be submitted if the annual income of the employee is less than Rs.2.5 lakh.

The employee would also have to submit a cancelled cheque with the required bank details for the transfer. Once the form is filled and the required documents are attached, the same should be signed and submitted at the EPFO office.

Form 10C UAN

Form 10C UAN is submitted along with Form 19 when an employee also claims the amount accumulated under the Employee Pension Scheme (EPS). This form is applicable when the employee resigns before completing ten years at their job. This can also be used in cases where the employee resigns before completing ten years of service. All the details of the form such as PAN, UAN, date of joining and date of leaving should be duly filled out and submitted at the EPFO office.

Form 31 UAN

This form is used when an employee wishes to withdraw their EPF or require an advance. All the details of the form such as PAN, UAN, date of joining and date of leaving should be duly filled out and submitted at the EPFO office.

Form 20

Final settlement of the EPF account of the deceased member can be claimed by the legal heir using this form.

Form 15G

This form is required if an individual wishes to withdraw EPF before completing five years of service in the company. If the total income including the EPF amount is below the minimum tax slab, then there will be no tax liability. The individual needs to provide the employer with form 15G (or 15H in case of senior citizen) so that no TDS gets deducted.

Form 11

This form consists of all the vital details of the employee, such as EPS and EPF account number, bank account number, and other details. This form declaration of their EPFO membership and can be provided to the employer in case of any change in employment, which will help in transfer of balance amount from previous EPF and EPS account to the new one.

Form 14

When the member’s LIC policy premium is paid from the EPF account, this form can be furnished to the EPF commissioner after attestation by the employer to apply for financing facility.

Form 2

This form is the nomination certificate or the declaration that provides the details of the nominee. After death of the employee’s death, this form authorises the nominee as the first claimant.

Form 5

This form is typically for the employer who is registered under the Employees’ Provident Fund Scheme. Submission of this form by the employer is mandatory in case any new employee of the company has been enrolled under EPFO scheme. The form should be submitted by 15th of every month and should have all the required details of the new employee. If no new employee has joined, then the employer must notify mentioning ‘Nil’ in the form.

Form 5(IF)

This form is applicable for claiming insurance benefit under Employees’ Deposit Linked Insurance (EDLI), in case of sudden demise of the employee while still in service. Withdrawal can be made by the legal heir or nominee after attestation of the form by the gazetted officer.

Eligibility for PF Withdrawal

The following are the eligible conditions for EPF withdrawals are:

- Beneficiaries must provide the following details:

- Aadhar and PAN details must be provided

- UAN should be in an active status

- UAN and bank details should be linked together

- Complete sum of EPF can be withdrawn post-retirement

- Before one year of retirement, 90% of the total amount can be withdrawn as permitted by EPFO

- Permission from the employer is not required by the employee for withdrawal

- Partial withdrawal is permitted in case of medical emergencies, higher education, or home acquisition

- EPF corpus can be withdrawn in case the employee has job due to retrenchment

- After one year of unemployment, 75% of the EPF corpus can be withdrawn

Note:

- Early retirement is considered after an age of 55 years by the EPFO

- Withdrawal permission can be obtained online by attaching

- Remaining amount after withdrawal will be transferred to new EPF account after acquiring employment

How to Apply for Online PF Withdrawal?

The following are the steps to apply for online PF withdrawal:

- Visit the UAN portal

- Enter the un number and password

- Enter the captcha code

- Select the ‘Manage’ option and click on the ‘KYC’

- Validate your KYC details such as bank details, PAN, and Aadhar

- Click on ‘Online Services’ option

- Select the applicable ‘Claim Form’

- The page displays the KYC information, member's information, and other details

- Click on ‘Verify’ option after entering the bank details

- Sign the undertaking certificate by clicking on ‘Yes’

- Click on ‘Proceed for Online Claim’ to complete the process

- Select the claim type either full, partial, or pension withdrawal, by clicking on the ‘I Want to Apply for’

- Select ‘PF Advance’ by entering the purpose, amount, and address

- Click on the certificate for submitting the application

- Upload the scanned documents as required

The choice will not be displayed on the screen for ineligible members for the respective services opted for. After approval from the employer, the withdrawal request will be processed, and the fund will be credited within 15 to 20 days.

How to Check EPF Claim Status?

The following is the process to check the EPF claim status online:

- Visit the UAN member portal

- Activate the UAN

- Log in to the portal by entering the credentials

- Click on ‘Online Services’ section

- Click on ‘Track Claim Status’

This portal is also applicable for other online services, such as transferring funds from old to new accounts, updation of contact details, e-KYC and many more.

What is the Limit for PF Withdrawal?

The limit of PF withdrawal depends on the following purposes:

- Post-matriculation education and marriage: Three

- Purchasing or constructing a house: Once

- Medical emergencies or treatment of critical illness: No limit

FAQs on PF Withdrawal Form

- What is the eligibility to withdraw EPF for repayment of home loan?

The member must have completed three years of continuous employment in order to be eligible to withdraw PF for repayment of home loan. However, the maximum amount that can be withdrawn is 90% of the corpus.

- Can EPF be claimed offline?

Yes, individuals can use the offline withdrawal form for claiming EPF.

- For withdrawal of EPF, is PAN mandatory?

Individuals will need to update PAN details if they do not want an additional tax to be reduced from their EPF account. There can a be high tax deducted at source (TDS) of up to 34.6% if PAN details are not updated if one withdraws an amount higher than Rs.50,000.

- What is the process to withdraw the previous employer's PF if the current employer is also a member of the EPFO?

An individual will not be able to his/her previous PF if the current employer is also a member of the EPFO. The individual must transfer the PF amount from the previous organisation to the current one. This can be done on the EPFO portal by using the UAN details.

- Is it mandatory to submit Form 15G/H for EPF withdrawal?

If individuals withdraw their EPF after 5 years of employment, they are exempted from paying tax. However, to be exempted from paying tax for withdrawing EPF before the 5-year period, Form 15G/H must be submitted.

- Is there any tax that must be paid for withdrawing PF before 5 years of service?

Depending on the individual's slab rate, the PF amount withdrawn before completing 5 years of employment is taxable. There is no TDS deduction if the amount is less than Rs.50,000. If the amount is more than Rs.50,000, the TDS will be charged at an interest rate of 10%. If the amount that is withdrawn and the PAN is not updated, TDS will be charged with an interest rate of 34.608%.

- Is there any limit to the number of times PF can be withdrawn?

- Depending on the reason for withdrawal, PF can be claimed various times

- PF can be withdrawn a maximum of three time for marriage and post-matriculation education.

- PF can be claimed only once in case of purchasing or constructing a house.

- Before retirement, there is no limit to the number of times, PF can be claimed for medical emergencies and treatment of a critical illness.

- What happens if no contribution is made to the PF account?

After leaving the company, if no contribution is received from the company after three years, then no interest will be earned for the PF amount.

Annie Jangam is a financial writer with a unique background in biotechnology and eight years of genomics research experience, culminating in 6 international publications. Her three-year experience in SEO-based content writing spans diverse topics. She combines her analytical skills with a talent for clear communication to simplify complex financial concepts. She delivers informative, engaging content with scientific precision and creative flair in the fintech industry. She covers various financial products such as banking, insurance, credit cards, tax, commodities, and more. Her research background demonstrates her dedication, attention to detail, and problem-solving skills, making her a valuable asset in the data-centric world of fintech. |

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.