Cheque - Complete Information

What is a Cheque?

A cheque is a financial document that directs a bank to pay a specified amount to the named recipient. It guarantees payment upon presentation and is governed by the Negotiable Instruments Act of 1881. Cheques remain essential for secure banking transactions.

A cheque is a financial document instructing a bank to pay a specified amount to the person named on it, with the amount written in both words and numbers. Also known as a negotiable instrument, a cheque guarantees payment to the bearer either upon presentation to the bank or by a specified date. The three main parties involved are the payee (the person receiving the payment), the drawee (the bank responsible for making the payment), and the drawer (the person who writes the cheque).

Cheques remain a crucial negotiable instrument in the banking sector. Each cheque is marked with a unique cheque number, IFSC code, and MICR code.

Essentially, a cheque is a type of bill of exchange that authorises a bank to transfer funds from one party’s account to another’s. It is governed by the Negotiable Instruments Act of 1881.

Types of Cheques

Cheques in India serve various purposes and come in different forms. Below are the common types of cheques and their descriptions:

- Open Cheque: A cheque that can be encashed at the bank or deposited into an account. It can also be transferred to another person.

- Depositing Cheque: Used to deposit funds into a bank account, with processing time varying based on the bank's procedures.

- Bearer Cheque: A cheque where payment is made to the person holding it, often requiring the word 'bearer' on it.

- Self-cheque: Issued by the account holder in their own name for withdrawal from their bank.

- Post-dated Cheque: A cheque with a future date, valid for up to three months from issuance.

- Traveller's Cheque: Used for safe transactions while travelling, allowing currency exchange overseas.

- Banker's Cheque: A cheque issued by a bank to guarantee payment.

- Crossed Cheque: Also called an 'account payee' cheque, ensuring funds are credited only to the specified recipient's account.

- Order Cheque: A cheque payable only to the person whose name is mentioned on it.

- Stale Cheque: A cheque that becomes invalid if not deposited within three months of the issue date.

- Blank Cheque: A signed cheque with no details filled in, allowing the bearer to enter an amount.

- Dishonoured Cheque: A cheque that is rejected by the bank due to insufficient funds or other reasons, with a 'Cheque Return Memo' issued.

- Ante-dated Cheque: A cheque dated before the actual date of issuance but still valid until it becomes stale.

- Mutilated Cheque: A cheque that is damaged or torn, making it unreadable or unusable for processing.

Features of Cheque

- Cheques can be issued against savings or current accounts

- A cheque is always drawn on a specified banker

- It is an unconditional order

- The payee of a cheque is fixed and certain and cannot be changed

- The payment will only be made in the name of the payee/beneficiary

- It is an instrument that is payable on demand

- A cheque will be considered invalid if does not contain the date

- Only the maker's signature should be made on the exchequer.

What is a Cheque Number?

A cheque number is a unique identifier printed on each cheque leaf. It helps track the status of a cheque. You can find the cheque number by checking the first six digits at the bottom of the cheque.

What is a Cheque Leaf?

A cheque leaf refers to an individual cheque from a chequebook. It acts as a written directive to a bank to transfer a specified amount to the payee. A cheque leaf can be used for withdrawals, deposits, or fund transfers between accounts.

Key Features of a Cheque Leaf

- Written Instruction: A cheque serves as a written directive from the drawer to the bank, authorising payment to the specified payee.

- Unconditional Payment: Once validated, the bank is obligated to pay the specified amount without any additional terms.

- Bearer or Order Instrument: A cheque can be either a bearer cheque payable to the holder or an order cheque payable only to the named recipient.

- Banking Instrument: Recognised by financial institutions, cheques facilitate secure fund transfers between parties.

- Payable on Demand: The bank must honour the cheque immediately upon presentation, provided all conditions are met.

- Fixed Payment Amount: Clearly specifies the amount to be paid, ensuring transparency in transactions.

- Mandatory Details: Essential elements such as date, payee's name, and amount (in words and numbers) must be included for validity.

- Issued to Account Holders: Only individuals or entities with a bank account can issue cheques, reducing fraud risks.

- Unconditional Order: The bank is legally bound to process the payment without requiring further approval.

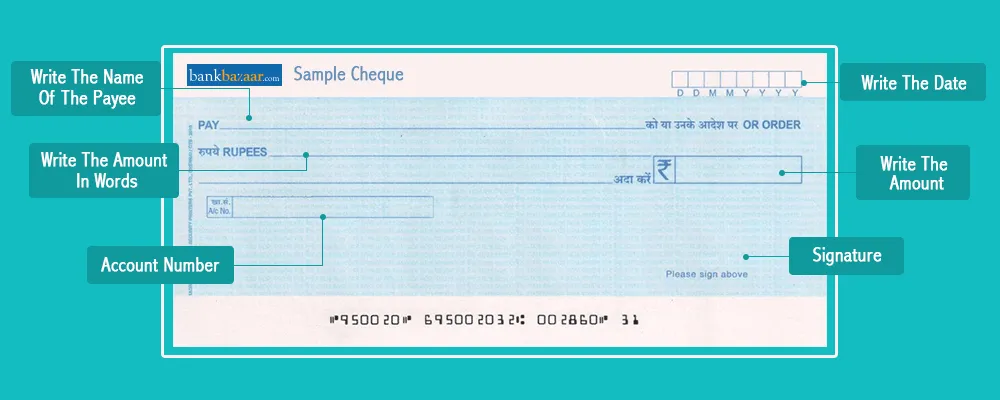

Essential Details on a Cheque Leaf

- Date of Issue: Specifies when the cheque was written and determines its validity, typically within three months from the issue date.

- Payee's Name: Identifies the recipient of the payment; accuracy is crucial to prevent processing issues.

- Bearer Clause: Allows anyone holding the cheque to encash it, providing convenience but reducing security.

- Amount in Numbers: Displays the payment amount numerically; must be accurate to avoid discrepancies.

- Amount in Words: Serves as a backup for the numerical amount, preventing fraud and ensuring clarity.

- Drawer's Signature: Mandatory for cheque validity; must match the bank's recorded signature to avoid rejection.

- Cheque Number: A unique identifier printed at the bottom, essential for tracking and record-keeping.

- MICR Code: A 9-digit Magnetic Ink Character Recognition code that aids in fast cheque processing and clearance.

- Account Number: Specifies the account from which funds will be debited, ensuring correct transaction execution.

- IFSC Code: Identifies the issuing bank and branch, which is crucial for electronic fund transfers.

Cheque Leaf Format

The format of a cheque leaf includes several key elements:

- A unique six-digit cheque number is located at the bottom-left corner.

- The MICR (Magnetic Ink Character Recognition) code which helps identify the bank and branch where the cheque was issued.

- QR Code: Now mandatory on all cheques (contains account number, IFSC, and cheque details for instant verification).

- Enhanced MICR: 9-digit code now includes a fraud prevention suffix (e.g., MUM001XXX-F1).

- Security Features:

- Watermark with "CTS 2024" visible under UV light.

- Heat-sensitive ink (disappears when rubbed).

- Validity: 6 months (extended from 3 months under RBI’s 2024 circular).

Steps to Write a Cheque

When writing a cheque, follow these steps:

Step 1: Crossing the Cheque

If required, draw two parallel lines on the top left corner to make it a crossed cheque.

Step 2: Filling in Details

Enter the date and write the payee's name in the 'Pay' field.

Step 3: Writing the Amount

Mention the amount in words, followed by the word 'only' to prevent alterations. Then, write the amount in numbers, ending with '/-'.

Step 4: Signature

Sign at the designated space at the bottom of the cheque to authorise the payment.

Important Points to Remember Before Writing a Cheque

Before filling out a cheque, keep these key points in mind:

- Avoid overwriting or making corrections on the cheque.

- Ensure there are no gaps between numbers or words to prevent alterations.

- Do not leave any field blank on the cheque.

- Refrain from folding or stapling the cheque to maintain its integrity.

- Use a consistent and clear signature to avoid discrepancies.

Dos and Don'ts for Filling Out a Cheque

Dos | Don'ts |

Write the Date Clearly: Ensure the date is in the correct format (DD/MM/YYYY) tomaintainthe cheque's validity.Fill in All Details Before Signing: Verify the payee's name, amount, and other fields to prevent errors and rejection.Use a Consistent Signature: Your signature must match the one registered with the bank to avoid dishonouring the cheque. | Do Not Leave Any Fields Blank: Blank spaces can lead to tampering or fraud. Always complete every section.Avoid Corrections or Erasable Ink: Alterations may result in the cheque being rejected. Always use permanent ink.Do Not Issue a Cheque Without Sufficient Funds: Bounced cheques may lead to penalties and impact your banking credibility. |

Pros and Cons of Using Cheques

Pros of Using Cheques | Cons of Using Cheques |

Enhanced Security: Chequesprovide a safer alternative to carryinglarge amounts of cash, reducing the risk of theft or loss.Transaction Record: Each cheque transaction is recorded by the bank, making it easy to track payments for personal or business financial management.Convenience for New Businesses: Cheques offer a simple payment solution for businesses that are newly established and may not have electronic payment systems in place.Scheduled Payments: Post-dated cheques allow payments to be scheduled for a future date, making them useful for recurring expenses such as rent and loan repayments.Payment Control: Funds are withdrawn only when the cheque is deposited and cleared, giving better control over cash flow management.Increased Security with Crossed Cheques: Crossed or account payee cheques ensure payments are deposited directly into the payee's account, reducing the risk of misuse.Business Flexibility: Cheques can serve as a reliable payment method for suppliers and vendors, helpingmaintain strong business relationships while managing cash flow efficiently.Payment Correction Flexibility: If an error is found in a cheque, payment can be stopped before clearance, flexibility is not always available in electronic transactions. | Possibility of Non-payment: Cheques can be returned due to insufficient funds or payment stops, leading to potential losses if goods or services were provided before clearance.Manual Record-keeping: Tracking cheque transactions requires maintaining manual records, which can be time-consuming compared to instant electronic payment confirmations.Fraud Risk: Cheques are vulnerable to forgery and fraud, posing a higher risk for organisations handling large payments.Slow Clearance Process: Depositing and processing cheques can take several days, making them inefficient for businesses needing instant payments.Chequebook Replenishment: When a chequebook runs out, applying for a new one can be inconvenient and may involve additional administrative steps.Limited Acceptance: Not all businesses or service providers accept cheques, which can restrict payment options.Physical Handling and Storage: Cheques must be stored securely and physically deposited at a bank, adding to administrative efforts.Risk of Bouncing: If sufficient funds are not available in the drawer's account, the cheque will bounce, resulting in penalties and reputational damage. |

Essential Components of a Cheque

The key element of a cheque is given below:

- Drawer: This is the person who writes the cheque and the account of which the fund is to be withdrawn.

- Drawee: The bank who is supposed to pay the amount to the payee.

- Payee: The entity or the individual who is supposed to receive the amount.

- Amount: The sum of money payable.

- Date: The date on which the cheque was written.

- Signature: The signature of the drawer to make it legal for the drawee to pay the sum mentioned to them.

What is a Crossed Cheque?

A crossed cheque is a cheque marked with two parallel lines, which signifies that it can only be deposited into a bank account and cannot be cashed immediately. The lines are usually drawn either across the whole cheque or through the top left-hand corner. This feature enhances security for the payer by ensuring that funds must go through a collecting bank, reducing the risk of fraud or theft. By preventing direct encashment, crossed cheques create a clear transaction record, ensuring that the money reaches the intended recipient securely. This extra step makes the payment process safer, offering greater control over how funds are handled.

Crossing a cheque ensures greater safety and control over payments by preventing unauthorised cashing. It also ensures that the funds are traceable and can only be processed through proper banking channels. This makes the payment process more secure for both the payer and the payee, reducing the risk of fraud or error.

Different Ways to Cross a Cheque

A crossed cheque contains specific instructions from the drawer (the issuer) to the drawee bank. These instructions ensure the cheque is paid only to a person through a bank, rather than over the counter. The main purpose of crossing a cheque is to improve security by making the payment traceable. In India, there are different methods used to cross cheques, each serving a distinct purpose:

1. General Crossing

A general crossing requires two parallel lines to be drawn on the cheque. These lines can be placed anywhere on the cheque, though it is common to place them in the top left corner. The purpose of general crossing is to ensure the cheque is deposited into a bank account rather than being cashed directly at the bank counter. This adds an extra layer of security, as the cheque can only be processed through a bank and not exchanged for cash immediately.

2. Special Crossing

A special crossing includes the name of a specific bank written between the two parallel lines. This means the cheque can only be paid into an account held at that bank. The cheque cannot be deposited into another bank, ensuring tighter control over how and where the payment is handled. Unlike general crossing, special crossing cannot be converted into a general crossing. This adds another level of security, as it restricts the cheque's handling to a specific banking institution.

3. Not Negotiable Crossing

In a ‘not negotiable’ crossing, the cheque contains these exact words along with the two parallel lines. This crossing can be either general or special. The key feature of this crossing is that the cheque becomes non-negotiable, meaning it cannot be transferred to another party. Even if it is transferred, the person receiving the cheque does not have any greater right to the funds than the previous holder. This limits the possibility of fraud or unauthorised transfer, as the cheque can only be deposited into the bank account of the person whose name is on the cheque.

4. Uncrossing a Cheque

Once a cheque has been crossed, the payee cannot uncross it. A crossed cheque is considered non-transferable, meaning it cannot be endorsed to a third party. The payee must deposit the cheque into an account in their own name. Although a payer can technically write ‘Crossing Cancelled’ on the cheque to remove the crossing, this action is generally not recommended. Removing the crossing eliminates the security measures that were initially in place to protect the payer and the transaction.

What is a Blank Cheque?

A cheque which has all the fields blank except for the drawer's signature, it is called a blank cheque.

Dishonour of Cheque: When a bank fails to deposit the payment specified on a cheque into the payee's account, this is known as cheque dishonour. A 'Cheque Return Memo,' detailing the reasons for the dishonour, is typically issued by the drawee's bank to the payee's bank. The payee's bank then provides the dishonoured cheque and the memo to the payee. The payee can resubmit the same cheque within three months of its issuance. Additionally, the payee should notify the drawer, requesting that the payment be made within 15 days of receiving the notice.

Understanding Positive Pay in Cheque Transactions

- For Cheques ≥₹50,000: Issuers must pre-register cheque details (number, amount, payee, date) via:

- SMS to bank’s designated number.

- Net banking/mobile app.

- How It Works:

- Bank matches presented cheque details with registered data.

- Mismatch = automatic rejection (+ SMS alert to issuer).

- Penalty: ₹500 per unregistered cheque (as per RBI 2024).

Depositing vs. Cashing a Cheque

The differences between depositing and cashing a cheque are as given below:

- Depositing a Cheque: Adding a specified amount to your bank account through the cheque. Depending on the bank process, it may take a few days for the money to reflect in your account to be withdrawn.

- Cashing a Cheque: This is being offered the cash in hand.

Cheque Validity

- Standard Cheques: 6 months from issue date (RBI/2023-24/45 circular).

- Exceptions:

- Government cheques: 3 months.

- Post-dated cheques: Valid only from the written date.

What is a Cancelled Cheque?

A cancelled cheque is a cheque that has been invalidated for payment. This is usually done by drawing two parallel lines across the face of the cheque and writing the word "CANCELLED" between the lines.

Reasons for cancelling a cheque include:

- When opening a new bank account or an investment account , a cancelled cheque acts as proof of your ownership of the account.

- To ensure a payment is stopped which has been issued but not yet encashed.

- For other electronic payments or direct deposit, a cancelled cheque can be used to verify your bank details.

How to Apply for a New Cheque Book?

- Online:

- Log in to net banking → "Services" → "Request Chequebook".

- New: Video KYC required for first-time requests (5-min process).

- Mobile Apps:

- SBI/HDFC apps now allow customization (e.g., 10/25 leaves, premium security variants).

- Charges:

- Free for most savings accounts (private banks may charge ₹50–100 per book).

Understanding Post-Dated Cheques

A post-dated cheque (PDC) is one that has a future date written on it. The bank will not process it until that date.

Uses:

- Loan repayments

- Rent agreements

- Installment purchases

Important: Issuing a post-dated cheque without sufficient balance can result in cheque bounce penalties.

Common Mistakes to Avoid While Writing a Cheque

Writing a cheque may seem simple, but small errors can lead to rejection. Here are some common mistakes to avoid:

- Leaving blank spaces – Always draw lines after writing names and amounts to prevent tampering.

- Incorrect date format – Use the correct format (DD/MM/YYYY) and avoid post-dated or stale-dated cheques unless intended.

- Mismatch in amount (words vs. figures) – Ensure the amount written in words and figures match exactly.

- Signature mismatch – Use the registered signature with the bank.

- Overwriting – Avoid corrections or overwriting; it may lead to cheque rejection.

How to Stop Payment on a Cheque

If you’ve issued a cheque but want to prevent it from being encashed:

- Contact your bank immediately – Call customer care or visit your branch.

- Use internet banking – Most banks allow cheque stop payment requests online.

- Submit a written request – Include cheque number, date, payee name, and reason.

- Pay applicable charges – Some banks may levy a nominal stop payment fee.

FAQs on Cheque

- What is a cheque number?

A cheque number is a unique number that is printed on each cheque leaf. This consists of six-digits.

- What is the purpose of an MICR code on a cheque leaf?

The nine-digit MICR code is an essential and important feature on all cheques. It helps banks process cheques without any error and in a speedy fashion.

- Where is the MICR number printed on a cheque leaf?

This number is generally printed at the bottom of the cheque. However, this may sometimes vary from bank to bank.

- Is a cheque paid only during banking hours?

Yes. A bank is liable to pay only during working hours.

- What are the consequences if a banker makes a wrong payment on a crossed cheque?

The bank will be liable for the loss occurred.

- Who has the right to cross the cheque?

The drawer, holder and then banker have the right to cross a cheque.

- Who governs cheque transactions in India?

The Negotiable Instruments Act along with the Reserve Bank of India.

- What if a cheque gets lost during the clearing process?

The bank will inform the customer that is the issuer of the cheque, at the earliest and the customer is also entitled to reimbursement.

- What is an IFSC code? Is it printed on all cheques?

Indian Financial System Code, abbreviated as IFSC, is defined as an 11-digit alphanumeric code that acts as a unique identity for a specific bank branch. Yes. IFSC code is printed on all cheques issued by banks and this code helps in the identification of bank branches and clearing of cheques in an error-free manner.

- When does a bank have a right to refuse to make a payment?

A bank has a right to refuse to make a payment if the cheque is undated, if six months have passed since the issuance of the cheque, and if a postdated cheque is presented before its due date.

- What is a bounced cheque?

There are several reasons why a cheque could bounce, but inadequate cash in the account is the most frequent cause. A mismatched signature, an inaccurate account number, and a damaged or outdated cheque are among more reasons why a cheque bounces.

- When a cheque bounces, what happens?

If there is not enough money in the account for the issuer or if the signatures on the cheque do not match perfectly, the cheque may bounce. When this happens, the bank rejects the cheque and sends it back to the issuer, who can then be subject to banking restrictions and overdraft fines.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.