VPA - Virtual Payment Address

What is VPA?

Virtual Payment Address also referred to as a VPA, is similar to an email ID, which is given to an individual using the Unified Payment Interface (UPI) service to send or receive money. With UPI, fund transfers can be initiated without an IFSC code or bank account number. Therefore, VPA is essentially the only piece of information required for all transactions.

The UPI interface gives users the privilege to send money to any bank account holder with UPI on a 24/7 basis, instantaneously. To successfully start using UPI, it is mandatory to have a valid username, which is nothing but a VPA. The VPA is specifically mapped to the user’s bank account and is a unique ID.

How to Create VPA?

When you sign up for an app that supports UPI, your VPA is created by default. You just link your registered mobile number to your bank account.

As an alternative, you may create your own special VPA. The procedure to create a VPA are as follows:

Step 1: Open a UPI-enabled app on your smartphone.

Step 2: Link your bank account by entering the registered mobile number.

Step 3: Provide the necessary information.

Step 4: The option to select UPI ID or VPA will be displayed.

Step 5: Make your own ID or select the option you want.

Step 6: After setting up your six- or four-digit UPI PIN and creating your VPA, you will be able to initiate UPI transactions.

Uses & Benefits of VPA

The main uses and benefits of UPA are mentioned below:

- Money can be sent and received even on bank holidays and weekends

- Funds can be transferred from anywhere, anytime on a 24 by 7 basis

- There is no need to go through the tedious process of registering a beneficiary/payee

- There is no need to use the IFSC code or provide the bank account number of the payee to send money. Only the VPA is required.

- Economical and easy-to-use

- User-friendly and speedy transfers

- Pay using any account linked to your mobile phone that has enough money in it to cover the transaction.

- When you want to transfer money to any bank account, you can use the 'Pay with VPA' option. Entering the recipient's VPA, the payment amount, and remarks is all that is required.

- While several banks charge users for using RTGS, IMPS, and NEFT, VPA transactions using the UPI platform are practically free.

- The UPI links all your bank accounts. A single bank UPI app allows you to generate VPA for all of your UPI-enabled bank accounts.

Sending money via VPA

The arrival of the VPA and the UPI app has made fund transfers a much easier business than it used to be. To send money to someone using the UPI app, you must have the person’s VPA.

Follow the below-mentioned procedure to transfer money using VPA:

- Enter your PIN and log in to your UPI app.

- Select fund transfer through UPI as your preferred option.

- Enter the beneficiary's VPA, the amount to be transferred and remarks.

- If you have multiple VPAs, choose the one linked with the bank account you would like to pay from and click Submit.

- Confirm the details and type your MPIN to validate.

Receiving Money via VPA

Instead of being handed over cash or a NEFT, anyone can request to receive money via UPI.

The procedure to receive money using VPA are as follows:

- Download and log in to any UPI-based mobile app.

- Select UPI, then click on 'Collect via UPI'.

- Type the VPA address of the individual whom you are requesting money from.

- Give the amount requested and add remarks.

- Choose the VPA address/account to which you need the money transferred.

- Submit the details requested and await approval from the other end.

- Once approved by the individual you are requesting money from, the amount gets credited to your chosen account.

Format of VPA

Here are the required details regarding the format of VPA:

- VPA follows a particular syntax

- The username and password can be chosen as per the user followed by ‘@’ at the end

- Example of VPA is efgh@abcbank, where ‘efgh’ can be user’s name, the first half of user’s email address, or even mobile number

- ‘abc’ is the bank’s initial to which the VPA is linked.

Features of VPA

The main features of VPA are mentioned below:

- Protects Your Bank Account Information: Your VPA serves as a shield for your bank account number, allowing you to keep it confidential. Opting for a VPA enables you to withhold your actual bank account number, ensuring privacy regarding the nature of your account, be it savings or current.

This way, you maintain the confidentiality of your bank account while still enjoying the convenience of making cashless transactions through UPI apps via VPA.

- Simplified Recall: Remembering your VPA is notably easier compared to grappling with a lengthy and intricate bank account number. VPA numbers are not only believed to be secure but are also designed for ease of recall.

Users often find it more convenient to remember their VPA than their physical or actual account number.

- Flexibility to Change: You have the flexibility to change your VPA to another account as needed. Changing your VPA is a straightforward process, allowing you to use a new one if required.

However, it's important to note that once a bank account is linked to a VPA, changing or removing it is not permitted. Additionally, linking a bank account to multiple VPA numbers is not allowed in adherence to banking regulations.

- 24/7 Accessibility: Your VPA is accessible round the clock, providing instant access to your account details. This accessibility ensures that you can receive payments promptly from various sources at any time, enhancing the efficiency of financial transactions.

- Enhanced Security: UPI transactions offer a secure and efficient means of making payments anytime, anywhere. The process is faster, safer, and more convenient than other modes of fund transfers, such as RTGS or NEFT. By using your VPA, you can send or receive payments instantly on a real-time basis, ensuring a higher level of security.

- User-friendly Transactions: Utilising your VPA, you can effortlessly make cashless payments to friends, relatives, children, and employees. This streamlined process eliminates the need to wait for extended periods, allowing you to send money through UPI apps without divulging your bank account details.

- Transaction Tracking Capabilities: Having a VPA number enables you to easily track all your fund transfer transactions within the UPI app. This includes valuable information such as the amount sent, transaction date and time, recipient details, and other relevant transaction information.

Unified Payments Interface (UPI) Transaction Limit in General

The National Payments Corporation of India (NPCI) allows banks and UPI apps to set their own transaction limits. As of 2024:

- Daily Limit: Rs. 5 lakh for most banks (e.g., HDFC, ICICI, Axis).

- Per Transaction Limit: Rs. 1 lakh (for apps like Google Pay, PhonePe, BHIM).

- Number of Transactions: Up to 20 per day (varies by bank).

- Exceptions:

- BHIM App: Rs. 2 lakh/day (up from Rs. 40,000).

- UPI Lite: Small-value transactions (up to Rs. 500) without PIN.

Note: Limits may differ for merchant payments and UPI AutoPay. Check with your bank for specifics.

Google Pay UPI Transaction Limit

- The users can transact a maximum of Rs.1 lakh per day across all UPI apps.

- You are allowed to do a maximum a ten transactions per day across all UPI apps.

- A user can send a request for a maximum of Rs.2,000 from an another individual.

PhonePe UPI Transaction Limit

- The users can make the maximum transaction of Rs.1 lakh per day across all UPI applications.

- You can make a maximum ten transactions per day across all UPI apps.

UPI Transaction Limit for BHIM App

The BHIM App users can transfer a maximum of Rs.40,000 per day from one bank account. The UPI transfer limit is determined on the basis of the bank account linked with BHIM.

Recently, the State Bank of India (SBI) has launched its own mobile payment app known as BHIM SBI Pay. It can be used both by SBI account holders and account holders of other banks.

How VPA Transactions Work

After installing a UPI-enabled app, you must select a UPI ID to make transactions. Your name, mobile number, or the initial part of your email address can be used as a VPA. This ensures that you remember the VPA. A UPI-enabled app may be accessed by using VPA. Before starting any UPI transaction, you must first link your VPA to a bank account.

You must also ensure that the mobile number you have registered to receive notifications is the same as the one linked to your bank account. After you enter the VPA and the amount that has to be transferred or received, you need to input the UPI PIN. This authentication is necessary to ensure that the correct person is requesting the transaction.

What are the Details of a VPA?

The following are some of the vital details that you need to know about VPA:

- Virtual Payment Address is a unique identified that enables UPI (Unified Payment Interface) to track the user’s account

- This ID does not consist of a bank account number and other details

- Through a UPI-enabled app, VPA can be used to make and request payments

- This helps users by not letting you fill bank details repeatedly

- The primary default VPA is set by the UPI application that you are working on.

- You can check the availability of the VPA you prefer to choose.

Virtual Payment Address and UPI

The biggest use of this address is to facilitate financial transactions via the UPI payment system. To do that successfully, a bank account holder who is also a UPI payment app user needs to have a VPA address linked to their account.

VPA replaces bank account details. This VPA can then be used to transfer funds from one account to another directly without ever needing to provide any other bank account details.

VPA makes the UPI payment system unique. Using VPA as its strong point, the UPI payment method is simplified. VPA makes it possible for UPI to be a friendly mobile-based app for fund transfers, making it a better system than IMPS, NEFT, digital wallets, and card payments.

Virtual Payment Address (VPA) is a digital ID used for sending and receiving money via UPI-enabled apps. During a transaction, VPA removes the requirement to manually enter information such as branch name, bank account number, and IFSC code. The payment process is made simpler with VPA because it allows senders and recipients to identify your account with just one indicator.

On UPI-enabled apps, the term UPI ID might appear rather than VPA. However, the meaning of both terms can be considered the same. These digital addresses are linked to your bank account to make money transfers easier. Continue reading to learn more about VPA.

VPA Suffixes of Popular Indian Banks

Bank/App | VPA Suffix |

SBI | @sbi |

HDFC Bank | @hdfcbank |

ICICI Bank | @icici |

Axis Bank | @axisbank |

Paytm Payments Bank | @paytm |

Amazon Pay | @amazonpay |

Google Pay | @okbank (for non-partner banks) |

PhonePe | @ybl (Yes Bank) or @axl (Axis) |

BHIM | @upi |

The VPA suffixes for some of the most popular Third-Party Application Providers (TPAP) are mentioned in the table below:

TPA | Name of Bank | VPA Suffix |

@yapl | ||

@apl | ||

Bajaj MARKETS (Finserv Markets) | @abfspay | |

CRED | Axis Bank | @axisb |

FinShell Pay | @rmhdfcbank | |

Axis Bank | @okaxis | |

@oksbi | ||

HDFC Bank | @okhdfcbank | |

Jupiter Money | Axis Bank Limited | @jupiteraxis |

Make My Trip | @indus | |

HDFC Bank | @ikwik | |

Samsung Pay | Axis Bank | @pingpay |

Timepay | @timecosmos | |

Ultracash | IDFC Bank | @idfcbank |

Axis Bank | @waaxis | |

State Bank of India | @wasbi | |

HDFC Bank | @wahdfcbank | |

CoinTab | @fbl | |

Fave (Pinelabs) | @idfcbank | |

Groww | Axis Bank | @axisbank |

JustDial | HDFC Bank | @hdfcbankjd |

Maxwholesale | @hsbc | |

YES Bank | @ybl | |

Axis Bank | @axl | |

YuvaPay | YES Bank | @yesbank |

SuperPay (Chintamoney) | @kmbl | |

tvam (Atyati) | YES Bank | @yesbank |

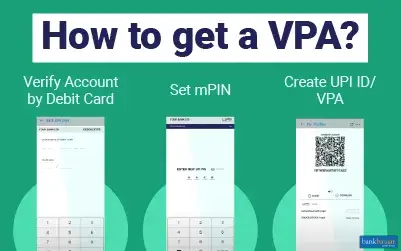

How to get a VPA?

VPA is part of the UPI payment system. So, it can be obtained from the UPI App. The process to get a VPA is as follows:

- Download the UPI app and link it to a bank account through your mobile number. Use the mobile number which is already registered at your bank.

- You'll have to go through a mobile verification process, after which follows another verification round. This verification can be a security question, a grid or any such authentication technique.

- Once the final authentication is done, create a VPA for the account you provided.

- Just as it is with an email address, you are provided with a VPA of your choice if the availability check confirms it is available. If it isn't available, try a different address.

- Once you provide a unique VPA, it gets approved instantly, and you get a virtual payment address.

Things to Remember about Virtual Payment Address

Here are some of the significant points that should be remembered about the virtual payment address (VPA):

- Choose unique VPA: It is vital that the user selects unique VPA that is easy to remember yet cannot be guessed or replicated easily. This will ensure the prevention of fraudulent transactions or loss of funds.

- Confirm receiver’s VPA is correct: Make sure that the receiver’s VPA is correct before initiating any transaction and never share your VPA with any unidentified individuals to prevent loss of funds.

- Multiple bank accounts: To set your primary account in the UPI application, you can link multiple bank accounts with a single VPA, and you can also change the primary account any time you wish. This enables the users to use a single VPA for all your transactions.

- Limits of transactions: There is a certain limit set for the amount you want to transfer via UPI using VPA. The limit varies depending on the bank and the type of account

UPI AutoPay

National Payment Corporation of India (NPCI) has introduced UPI AutoPay for making regular payments. With the help of this facility, you will be able to enable a recurring e-mandate through any of the UPI app of your choice for doing recurring payments like OTT charges, telephone bills, WiFi charges, Netflix, Equated Monthly Installments (EMIs), utility bills, etc.

The following table displays the list of the banks and their UPI partners:

Issuer Bank | UPI Apps |

Paytm Bank | Paytm, BHIM |

HSBC Bank | HSBC SimplyPay |

HDFC Bank | GPay, Paytm, PhonePe |

IndusInd Bank | BHIM |

ICICI Bank | GPay, PhonePe |

IDFC Bank | BHIM |

Bank of Baroda | BHIM, Paytm |

Axis Bank | BHIM |

Comparing UPI with Other Online Payment Methods

- UPI Payment vs Bank Account Transfer: The UPI process stands out for its simplicity compared to NEFT. Despite this, NEFT boasts higher transaction limits than UPI.

Additionally, NEFT transfers necessitate an upfront payment of at least Rs. 15, a requirement absent in UPI transactions. UPI transactions, in contrast, are entirely free, allowing users to make instant payments from any location and for any amount using a UPI-enabled app.

- UPI Payment vs Internet Banking: UPI offers the convenience of making cashless payments to friends, colleagues, and employees without requiring their bank account details. Instant fund transfers can be accomplished with a single click using the recipient's VPA.

On the other hand, Internet banking typically demands the input of account details to complete fund transfers or cash withdrawals.

- UPI Payment vs ATM Transfer: UPI payments prove to be more straightforward when compared to ATM transfers. With UPI, users only need to remember their VPA number, and payments can be made from anywhere at any time, for any amount.

Instant money transfers via UPI apps using the VPA number are also possible. In contrast, ATM transfers involve recalling details such as the bank name, account number, IFSC code, and other particulars for cash withdrawals or deposits. The VPA is specifically mapped to the user’s bank account and is a unique ID.

FAQs on VPA (Virtual Payment Address)

- What is VPA?

Virtual Payment Address (VPA) acts as an identifier that can be used for all transactions made via the UPI system through a mobile app that is UPI-enabled.

- Is it possible to link multiple bank accounts to one VPA?

Yes. This is possible. The same VPA can be linked to different bank accounts.

- If I have an existing VPA can I link the same to a new app?

Yes. This will be possible but it also depends on the type of app you are using to make the payment or initiate the fund transfer. Some banks do not allow you to use an already existing VPA.

- Will my VPA expire if I do not use it?

Even if you do not use it for a set period of time, it will not expire.

- Is any other bank account information required if you are using VPA?

No. Just the VPA is required.

- How can I block my VPA in UPI?

To block your VPA, you should open the UPI app and disable the particular VPA. You can also do this via net banking and disable the UPI.

- How can I change VPA in UPI?

You can change and edit your VPA in your UPI app. You can do this under the app settings from App Settings> VPA> Edit VPA.

- How many VPAs can I have?

You can choose to create different VPAs on different UPI apps while linking to the same bank account.

- How do I find my VPA?

You can find your VPA by checking with the bank, e-wallets, or payment apps with which you have registered. You can log in to your online banking account or contact your bank to find your VPA. Similarly, you can also log in to your e-wallets or payment apps and find the VPA in the account section.

- Is VPA a UPI ID?

Yes, a VPA and a UPI ID are the same. VPA is a UPI ID generated to do online money transactions using the UPI system.

- How can I have a VPA ID?

You can only have a VPA ID if you are a bank account holder and have registered your account on a UPI service portal or app.

- How do I find my VPA on Google Pay?

To find your VPA on Google Pay, you have to open the app and click on your photo or image box in the top right corner. Then, you have to open the QR page and find the VPA below your QR code. Simply select the account you need the VPA if you’ve registered multiple accounts on the app.

- Where is VPA on PhonePe?

The VPA is mentioned on the home page of the app. You can find a column that reads ‘My UPI ID/IDs’ highlighted in blue under the Transfer Money option, which is nothing but your VPA.

- How can I find my VPA address?

To find your VPA address, click on the ‘Profile’ tab on your home screen after installing the UPI app on your mobile. The primary VPA will be displayed, if you have already set a VPA.

- Is it possible to change the existing VPA?

Yes, it’s possible to change or edit an existing VPA and this feature can be seen under the UPI app settings.

- Can I link an existing VPA with a new app?

Yes, you can link an existing VPA to a new app only if your application supports that feature.

- Is it possible to link different bank accounts under one VPA?

Yes, it is possible to link all your bank accounts under a single VPA.

- Will VPA get lapsed when not in use?

No, VPA will not get lapsed even if not used daily or periodically.

News on VPA(Virtual Payment Address)

Report states UPI Replaced Currency in India

According to an SBI Research research, the Unified Payments Interface (UPI) has mostly replaced the cash in use in India. The RBI's decision to discontinue the Rs.2,000 note, according to SBI Research's most recent research, may enable GDP growth in FY24 to exceed the estimated 6.5% level.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.