All About TAN Verification

A TAN number is used to identify your Tax Deduction Account. It stands for Tax Deduction and Collection Account Number. The TAN number is a 10-digit alphanumeric code. The first 4 digits are capital letters of the alphabet. The 5th to the 9th digit is numerical.

The 10th digit is again a capital letter. For example, a TAN number should look like PDES03028F. Anyone liable to deduct TDS from their payments must get a TAN Card, which they must then quote when issuing payments or getting TDS returns.

How to Verify TAN Number Online?

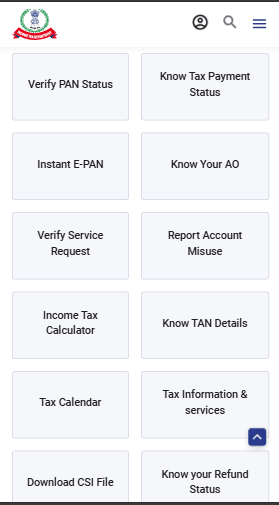

Step 1 - To verify your TAN, simply log on to the e-Filing website of the Income Tax Department and follow these instructions.

Step 2 - Under the "Quick Links" section, select "Know TAN Details" from the dropdown menu.

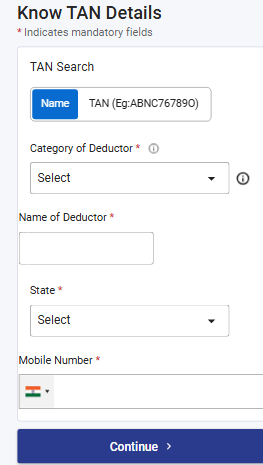

Step 3 - Select the Category of Deductor.

Step 4 - You can choose from the following list: Central/State Government/Statutory Bodies/Autonomous Bodies/Local Authorities Companies/Firm/AOP/BOI/AJP/AOP(Trust) and Branches Individual/HUF Including Business.

Step 5 - You can then opt to search via Name or TAN Enter your name or the TAN number according to your preference Enter the captcha code as it appears onscreen Click on "Submit" to generate your results.

TAN Verification by Name

Steps to verify TAN by name of the deductor:

Step 1 - Visit the Income Tax Department's e-filing website .

Step 2 - Under the "Quick Links" section, select "Know TAN Details" from the dropdown menu

Step 3 - Select the category of the Deductor from the drop-down menu.

Step 4 - Enter the state from the drop-down menu.

Step 5- Enter the name of the deductor and the registered mobile number. Choose the correct company from the list of names in the drop-down menu.

Step 6 - The TAN details associated with the deductor's name will be displayed onscreen.

TAN Verification by Number

The steps for verifying TAN by number are as given below:

Step 1 - Go to the Income Tax Department e-filing website.

Step 2 - Click on the 'Know Your TAN | AO' tab

Step 3 - Log in to the website with your user ID and password.

Step 4 - Choose 'TAN' from the options provided under the 'TAN Search' tab.

Step 5 - Select the category of the deductor from the drop-down menu.

Step 6 - Choose the relevant state from the drop-down menu.

Step 7 - Enter the 10-digit TAN and the deductor's registered mobile number

Step 9 - Company information relating to the TAN number will be displayed onscreen.

Check for Other Verifications

FAQ's on TAN Verification

- What happens if I deduct TDS without a TAN?

The TAN is required in all cases of TDS. The number must be quoted in your communications with the IT department of India. If you do not get a TAN, you are liable to pay a fine of ₹10,000. Furthermore, any TDS returns and payments will not be received by the banks if the TAN is missing.

- How do I get a TAN?

You can apply for a TAN online and offline. Fill in the application form 49B which is available on the Apply for PAN Online on Protean eGov Technologies Limited website. Submit it and make the payment as per the instructions. Offline, you can apply at the TIN-FC centres.

- What are the charges for TAN application?

The charges are ₹62 only.

- What modes of payment are accepted for TAN application?

You can make the payment via credit card, debit card, net banking, demand draft or cheque.

- Can I check the TAN of the person who deducted TDS from my payment?

Yes, you can verify the TAN of anyone who deducts TDS. You simply need their TAN or their full name. It is good to verify TDS deductions from your payment to ensure it was rightfully and legally done.

- I have a PAN number. Do I need a TAN or can I just quote the PAN number?

You cannot quote PAN in place of TAN. The two numbers serve two different purposes. The TAN is meant for people who collect Tax Deducted at Source on behalf of the IT department. The PAN Card is meant for individuals, companies, and so on, to pay their taxes.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.