PAN Card Correction Form - Process, Fees, and Required Documents

PAN Card correction is the process of updating incorrect information on your Permanent Account Number (PAN) Card. This could include errors in your name, address, date of birth, etc.

What is PAN Card Correction

PAN Card correction refers to the process of updating or rectifying incorrect information, such as name, date of birth, and other details on a PAN Card. This can be done by submitting the PAN correction form either online through the Protean (NSDL) portal or offline via physical application.

How to Apply for a PAN Card Correction Online?

Step 1 - Visit the official website of Protean.

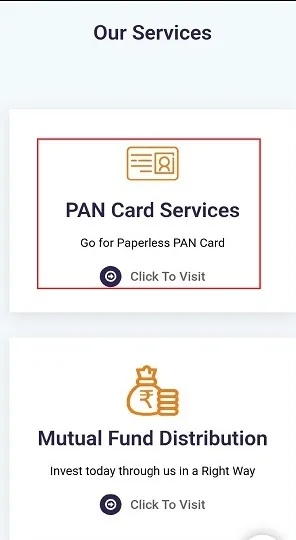

Step 2 -Go to the Our Services and click on PAN Card Services.

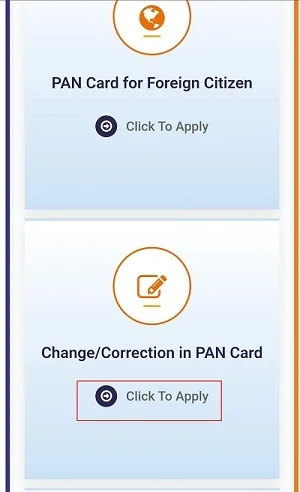

Step 3 - In PAN Card Services click on Change /Correction in PAN Card.

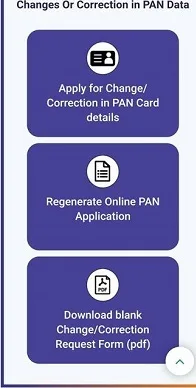

Step 4 - Now, click on 'Apply for Change/Correction in PAN Card details (CSF)'

Step 5 - This will take you to a page wherein you will be allowed to enter details you would like to change.

Step 6 -Upload the documents as requested in the form and click on 'Submit'.

Step 7 -Your changes will then be reflected in a few days.

How to Apply for a PAN Card Correction Offline?

You can also get details on your PAN Card changed offline. All you have to do is download and print the PAN Card correction form.

Step 1 - Fill it and submit it to your nearest Protean e-Gov Technologies Limited or UTIITSL center.

Step 2 - submit required documents.

Step 3 - While filling in the details, remember to tick the box on the left margin for details that you would like changed on your PAN Card.

Download PAN Correction Form Online

You can easily download the PAN Card correction form from the Income Tax Department Website or any authorized agencies such as Protean and UTIISL . You have to simply search new online for Request for New PAN Card or Change /Correction in PAN data.

Click Here>> Download PAN Card Correction Form in PDF Format

Documents Required for PAN Card Correction

Here is a list of documents that individuals and companies need to submit if they wish to make changes or correct details on their PAN Card:

Indian Citizens and Hindu Undivided Family (HUF)

Identity Proof | Address Proof | Date of Birth Proof |

Copy of | ||

Aadhaar card | Aadhaar card | Aadhaar card |

Voter ID | Voter ID | |

Driving license | Driving license | Driving license |

Passport or spouse's passport | Passport | |

Ration card with the applicant's photo | Post office passbook with the applicant's address | Mark sheet or m articulation certificate from a recognised board |

Arm's license | Latest property tax assessment order | Birth certificate |

Any photo identity card issued by the central government, state government, or a public sector undertaking | Allotment letter of accommodation not more than three years old (issued by the state or central government) | Any photo identity card issued by the central government, state government, or a public sector undertaking |

Pensioner's card which has a photo of the applicant | Central government issued domicile certificate | Central government issued domicile certificate |

Central government health service scheme card/ex-servicemen contributory health scheme card (with photo) | Property registration document | Central government health service scheme card/ex-servicemen contributory health scheme card (with photo) |

Electricity bill, landline bill, broadband connection, water bill, piped gas bill (not more than 3 months old) | Pension payment order | |

Bank account statement, credit card statement (not more than 3 months old) | Affidavit sworn before a magistrate | |

Gas connection card (not more than 3 months old) | Marriage certificate issued by Registrar of Marriages | |

Original of | ||

Certificate of identity signed by an MP, MLA, MLC, or a gazetted officer | Certificates of address signed by an MP, MLA, MLC, or a gazetted officer | - |

Bank certificate on the bank's official letterhead with the name and stamp of the issuing officer (must also contain an attested photograph and bank account details) | Employer certificate | - |

For HUF | ||

An affidavit made by the Karta stating name, father's name, and address of all members on the date of application | ||

For Foreign Citizens

Identity Proof | Address Proof |

Copy of | |

Passport | Passport |

Person of Indian Origin (PIO) card | Person of Indian Origin (PIO) card |

Overseas Citizen of India (OCI) card | Overseas Citizen of India (OCI) card |

Citizenship identification number of the applicant (if they are a citizen of another country) | Citizenship identification number of the applicant (if they are a citizen of another country) |

Tax payer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorised officials of scheduled banks registered in India which have branches overseas | Tax payer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorised officials of scheduled banks registered in India which have branches overseas |

Bank account statement (in the country of residence) | - |

NRE bank account statement in India | - |

Certificate of Residence in India | - |

Registration certificate issued by the Foreigner's Registration Office (must show an Indian address) | - |

Visa, appointment letter from an Indian company, and original certificate of Indian address issued by the employer | - |

Indian Companies

Indian companies require

Type of Company | Documents (Copy of) |

Company | Certificate of registration |

Partnership | Certificate of registration or partnership deed |

Limited Liability Partnership | Certificate of registration issued by the Registrar of LLPs |

Association of Persons (Trust) | Trust deed, certificate of registration number issued by Charity Commissioner |

Artificial Juridical Person, Body of Individuals, Local Authority, or Association of Persons | Agreement copy, certificate of registration number issued by Charity Commissioner registration of cooperative society, or any other document provided by a central or state government department |

Companies with a Registered Office Outside India

Identity Proof | Address Proof |

Tax payer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorised officials of scheduled banks registered in India which have branches overseas | Tax payer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorised officials of scheduled banks registered in India which have branches overseas |

Registration certificate issued in India or approval granted by Indian authorities to set up an office in India | Registration certificate issued in India or approval granted by Indian authorities to set up an office in India |

Supporting Documents for Changes in PAN

Applicant Type | Document Applicable for Change in Name |

Married ladies (change name on account of marriage) | Marriage certificate |

Marriage invitation | |

Passport showing husband's name | |

Publication of changed name in an official gazette | |

Certificate issued by a gazetted officer | |

Applicants other than married ladies | Publication of name in an official gazette |

Certificate issued by a gazetted officer | |

Companies | ROC's certificate for name change |

Firms, Limited Liability Partnerships | Revised partnership deed |

Registrar of frim or LLP's certificate for name change | |

AOP/Trust/BOI/Local authority/AJP | Revised deed or agreement |

Revised registration certificate |

Additional Documents Required to Change your Name in PAN Card Correction Form

The following are the documents required to change your name in the PAN Card:

- Aadhaar card

- Voter ID

- Driving license

- Newspaper advertisement with changed name

- Passport

- In case of surname change after marriage, husband's passport

Who Can Sign PAN Card Correction Form?

The following is the list of entities who needs to sign the PAN Card correction application:

- In the case of a company, the sign of director is necessary

- In the case of HUF (Hindu Undivided Family), the sign of Karta is required

- The sign of trustee is required if it is a trust

- In case of minor, the sign of representative assessee

- The applicant

- In the case of a partnership firm or Limited Liability Partnership (LLP), the sign of partner is required for PAN Card correction application

- In case of local authority, artificial juridical person, Association of Persons (AOP), and Body of Individuals (BOI) sign of authorised signatory is necessary

PAN Correction Fees and Charges

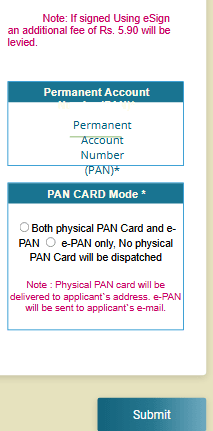

The following are the details for PAN Card update or correction:

- PAN Card correction offline: ₹110

- The additional dispatch fee if PAN Card dispatched outside India: ₹910

- Physical dispatch of PAN Card if PAN application submitted using physical mode:

- Physical PAN Card dispatched in India: ₹107

- Physical PAN Card dispatched outside in India: ₹1,017

- Physical dispatch of PAN Card if PAN application submitted through paperless modes:

- Physical PAN Card dispatched in India: ₹101

- Physical PAN Card dispatched outside in India: ₹1,011

- PAN application submitted using physical mode for e-PAN Card and dispatched at the email address of the applicant: ₹72

- If Pan application submitted through paperless modes for e-PAN Card download and dispatched at the email address of the applicant: ₹66

Check More About - PAN Card Fees

How to Check PAN Card Correction Status?

Step 1- Go to UTIISL or NSDL

Step 2- Select 'Track PAN Card' or Know the Status of Application.

Step 3- Enter the Acknowledgement Number and Click on Submit and track the status of the change.

Video Guide - PAN Correction

Also Know About PAN Card Corrections

FAQs on PAN Card Correction

- How can I find my PAN application status via SMS?

If you have applied for a correction of PAN details on the Protean eGov Technologies Limited portal, send Protean eGov Technologies Limited PAN

acknowledgement number and send it to 57575. - How do I contact the UTIITSL office?

You can call UTIITSL on 033 40802999.

- What is the fee to change the details on a PAN Card?

In case of offline application, the fee for PAN Card correction is Rs.110. An extra dispatch fee of Rs.910 must be paid by the applicant if the PAN Card is to be sent abroad.

- What is the CSF form?

The CSF form is the form you need to fill and submit if you want any change made to your PAN details.

- How can I check the status of my PAN Card correction?

You can check the status of your PAN Card correction application by visiting the UTIITSL website or the NSDL PAN website. Go to the 'Know Status of PAN Application' or 'Track PAN Card' option. Click on the ‘Submit’ option after entering the ‘Acknowledgement Number’ and the captcha code. You will be able to view the status of your PAN Card correction application.

- Do I have to submit proof of PAN along with other documents?

Yes, you will have to submit proof of PAN along with other documents. This could either be your PAN Card or a copy of the PAL allotment letter.

- How long does it take for PAN Card correction?

Typically, it takes about 15 days for PAN Card correction. When your PAN Card is sent out via post, a text message will be sent to the registered mobile number you provided.

- What are the documents needed to change PAN Card information?

To change the details on your PAN Card, you will need a copy of your PAN Card, proof of date of birth, proof of address, and proof of residence.

- How to correct the Invalid Surname Error on e-filing Portal?

To correct the invalid surname errors on the e-filling portal, visit the NSDL portal and note your 10-character alphanumeric PAN number. Enter the surname on the portal along with PAN, date of birth, and name to complete the registration process on the e-filing portal.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.