Secured Credit Cards

A secured credit card is a card which is backed by a payment which is used as collateral. A secured credit card is usually offered to people who do not have a credit history or have a limited credit history by still require a credit card.

Banks provide these secured credit cards to their customers to help them build their credit profiles. The credit card is issued only after a certain amount is paid to the bank and that amount usually acts as the credit limit of the card.

Difference between a Secured Credit Card and a Prepaid Credit Card

The major difference between a secured credit card and a prepaid credit card is the credit history of the customer.

A secured credit card is given to a customer who has a limited credit history or none and is usually given to build up their creditworthiness. The bank offers a secured card to a customer in exchange for a certain amount of money to deposit as collateral. This deposit which is made becomes the credit limit of the provided card. The credit limit can be increased by adding sufficient funds to the account or if you have a good repayment history, the bank will add a certain amount to your monthly limit.

On the other hand, a prepaid credit card has no collateral involved. As the name suggests, it is prepaid and comes with a credit limit provided by the bank depending on a number of factors. These factors are the credit report of the customer, the credit score, and payment records which showcase the ability or inability of the customer to repay the amount spent.

If you do not have sufficient credit, a secured credit card is the safest option as they do not charge high rates of interest like an unsecured credit card and do not have a high annual or joining fee.

However, for an unsecured credit card, it is advised to keep your expenses low and pay it back in full at the end of the month. The credit utilization ratio must be between 10%-20% at the most. Having a secured credit card means spending wisely and not more than you can pay off.

Applying for a Secured Credit Card

Applying for a secured credit card is not any different than applying for an unsecured one. It is a fast and simple process as most major banks just check your credit score and do not conduct any other inquiries on your credit history or report.

Even though it is a simple process, there are a few things which must be kept in mind before applying for a secured credit card.

Credit Limit

It is very important to make sure that you do not go overboard with your credit card limit. It is advised to start with a lower credit limit and then increase it only when you will be able to pay it off in full at the end of the month. If you deposit a large sum of money, it does not mean that you should spend it all. Banks will have a constant check on your spending habits, so if you have a good repayment history, banks can allocate a certain amount of money to your credit card without you making any kind of deposit.

Eligibility

Every bank has its own eligibility criteria when it comes to a secured credit card. While some banks require a minimum deposit required for the card, other banks need you to open an fixed deposit in the bank and that amount in the fixed deposit serves as the collateral required by the bank in case you are not able to pay your dues.

Benefits

It is important to conduct thorough research on the types of secured credit cards and the ones which offer you the most benefits. Secured credit cards offer you a wide range of discounts and offer just like an unsecured card.

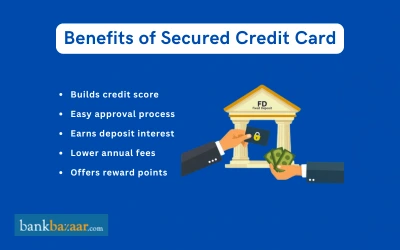

Features and Benefits of Secured Credit Cards

Secured credit cards have a number of benefits and features surrounding them and are mainly for the people who do not have enough credit history required for an unsecured or prepaid credit card.

Some of the features of a secured credit card are:

- The applicants are not required to provide additional inquiries of their credit history.

- The process of approval is fast as the banks are risk-free since the individuals are offered the cards on the back of a deposit serving as collateral.

- There are some banks which offer interest on the security deposit. This helps the applicants of secured credit cards to earn interest on their deposit along with the benefits.

- Some secured credit cards come with a grace period. This helps individuals to get a few days more to make their payments, in case of any delay.

Top Secured Credit Cards in India 2026

SBI Advantage Plus Card

This SBI Advantage Plus Credit Card is among the best secured credit cards in the market. This card offers much more benefits than a regular credit card and can be used both nationally and internationally. The card offers a credit limit of up to 85% of the amount deposited in the FD account.

Features of SBI Advantage Plus Card

- Extended credit allows the cardholders to pay the minimum amount and carry forward the remaining amount at the low interest of 2.25% per month.

- The cash withdrawal limit is up to 100% of the credit limit.

- Comes with ‘Easy Money’ facility. This enables cardholders to get a demand draft or cheque delivered to their registered address.

- Cardholders can transfer credit from other credit cards at a nominal processing fee.

- Individuals with this card become automatically eligible for an Encash facility of either Rs. 25,000 or Rs, 50,000. A Fixed Deposit is opened in their name with they are billed Rs. 2,500 or Rs. 5,000 as EMI for 11 months.

Benefits of SBI Advantage Plus Card:

- Can be used at more than 1 million Visa or MasterCard ATMs globally.

- Transactions can be converted into EMIs using the Flexipay option.

- Interest is provided on the fixed deposit after 555 days.

- Benefits of supplementary credit cards.

Axis Insta Easy Credit Card

The Axis Insta Easy Credit Card gives you a good credit limit and also offers fuel surcharge waiver.

Features of Axis Insta Easy Credit Card

- Withdraw up to 100% of your credit limit

- Get a credit limit up to 80% of your fixed deposit

- Get a 1% fuel surcharge waiver.

Benefits of Axis Insta Easy Credit Card

- Get 15% discount on dining.

- The card comes with a platinum chip.

- For transactions over Rs.2,500, you can convert them into EMIs.

SBI ELITE Credit Card

The SBI ELITE credit card offers a host of benefits, reward points, complimentary memberships, etc.

Features of SBI ELITE Credit Card:

- Can be used in over 24 million outlets worldwide which includes 3.25 lakh outlets in India.

- Save up to 1% on fuel on all transactions ranging from Rs.500 to Rs.4,000 at any petrol pump in India.

- Add-on cards for spouse, parents, children/siblings over the age of 18 years can be availed.

- Card replacement facility is available all over the world.

- Get complimentary credit card fraud liability cover worth Rs.1 lakh.

Benefits of SBI ELITE Credit Card:

- As a welcome gift, receive a gift voucher of Rs.5,000.

- Receive 5x reward points by spending on groceries, dining, and departmental stores.

- Get 2 reward points for every Rs.100 spent on all purchases other than fuel.

- Avail complimentary movie tickets worth Rs.6,000 per year.

- Get access to two domestic airport lounges per quarter and six international airport lounges per year.

- Enjoy 50,000 bonus points worth Rs.12,500 every year.

- Get 10,000 bonus reward points when you spend Rs.3 lakh or Rs.4 lakh per year.

SBI SimplySAVE Credit Card

The SBI SimplySAVE credit card is a secured card that comes with several benefits like reward points, annual fee waiver, and more.

Features of SBI SimplySAVE Credit Card:

- As a welcome gift, get Rs.100 cashback on making your first ATM cash withdrawal within 30 days of card issuance.

- This credit card is accepted in over 24 million outlets worldwide which includes 3.25 lakh outlets in India.

- Add-on cards for spouse, parents, children/siblings over the age of 18 years can be availed.

- Use the ‘Easy Bill Pay’ facility to pay your utility bills.

- With the SBI SimplySAVE credit card, you get 1 reward point for every Rs.150 spent.

Benefits of SBI SimplySAVE Credit Card:

- Receive 2,000 reward points on spending Rs.2,000 and above within 60 days of card issuance.

- The annual fee is waived if you spend Rs.1 lakh or more in the previous year.

- Get 10x reward points on every Rs.150 you spend on groceries, movies, department stores, and dining.

- Get a 1% fuel surcharge waiver at all petrol pumps across India for making transactions between Rs.500 to Rs.3,000.

SBI Prime Credit Card

The SBI Prime credit card provides a host of benefits including welcome gifts, reward points, birthday benefit, etc.

Features of SBI Prime Credit Card:

- This credit card can be used in over 24 million outlets worldwide which includes 3.25 lakh outlets in India.

- Emergency card replacement facility is available worldwide.

- Add-on cards for spouse, parents, children/siblings over the age of 18 years can be availed.

- Cash can be withdrawn from over 1 million Visa/Mastercard/American Express ATMs all over the world.

- Use the 'Easy Bill Pay' facility to pay your utility bills.

Benefits of SBI Prime Credit Card:

- As a welcome gift, receive an e-gift voucher worth Rs.3,000 from select partner brands.

- Receive credit card Fraud Liability Cover worth Rs.1 lakh.

- Get 20 reward points for every Rs.100 you spend on your birthday.

- Get 10 reward points for every Rs.100 you spend on movies, groceries, departmental stores, and dining.

- Get Trident Privilege Red Tier Membership for free.

- Get complimentary access to four international airport lounges and eight domestic airport lounges every year.

- Get Club Vistara Silver membership for free.

- Get an annual fee waiver for spending Rs.3 lakh in a year.

SBI SimplyCLICK Credit Card

The SBI SimplyCLICK credit card offers a wide range of benefits like e-shopping rewards, milestone rewards, annual fee waiver, etc.

Features of SBI SimplyCLICK Credit Card:

- Can be used in over 24 million outlets worldwide which includes 3.25 lakh outlets in India.

- Avail add-on cards for spouse, parents, children/siblings over the age of 18 years.

- Use the ‘Easy Bill Pay’ facility to pay your utility bills.

- Transfer the outstanding debts of other banks' credit cards to your SimplyCLICK SBI Card and pay back in EMIs at a reduced interest rate.

Benefits of SBI SimplyCLICK Credit Card:

- Get 10x reward points on shopping online at Amazon, BookMyShow, Lenskart, etc.

- Enjoy a gift card worth Rs.500 on paying the annual fee of Rs.499 plus taxes.

- The annual fee is reversed if you spend Rs.1 lakh in a year.

- Get a 1% fuel surcharge waiver at all petrol pumps across India for making transactions between Rs.500 and Rs.3,000.

- Receive an e-voucher worth Rs.2,000 for spending Rs.1 lakh and Rs.2 lakh in a year.

SBI Unnati Credit Card

The SBI Unnati credit card is issued against a fixed deposit of more than Rs.25,000 and itcomes with a lot of benefits along with reward points, milestone rewards, fuel surcharge waiver, and much more.

Features of SBI Unnati Credit Card:

- This credit card is accepted in 24 million outlets all over the world which includes 3.25 lakh outlets in India.

- Add-on cards for your parents, spouse, siblings or children above the age of 18 years can be availed.

- Transfer the outstanding debts of other banks' credit cards to your SBI Unnati credit card and pay back in EMIs at a reduced interest rate.

- Use the ‘Easy Bill Pay’ facility to pay your utility bills.

Benefits of SBI Unnati Credit Card:

- The annual fee for this credit card is zero for the first four years.

- Get 1 reward point for every Rs.100 you spend.

- Get cashback worth Rs.500 for spending Rs 50,000 or more in a year.

- Get a 1% fuel surcharge waiver at all petrol pumps across India for making transactions between Rs.500 and Rs.3,000.

Bank of Baroda Prime Credit Card

The Bank of Baroda Prime credit card is issued against a fixed deposit of Rs.15,000 or more.

Features of Bank of Baroda Prime Credit Card:

- The annual fee for this credit is zero.

- Convert your purchases of more than Rs.2,500 into EMIs.

- Enjoy up to three free lifetime add-on cards for your spouse, parents, siblings, or children above the age of 18 years.

- Enjoy interest-free credit for up to 50 days from the date of purchase.

Benefits of Bank of Baroda Prime Credit Card:

- Receive 4 reward points on every Rs.100 you spend.

- Get a 1% fuel surcharge waiver at all petrol pumps across India for making transactions between Rs.400 and Rs.5,000.

- Secure your family’s finances with free Personal Accidental Death Coverage.

- Reward points can be redeemed as cash and other options.

Flipkart Axis Bank Credit Card

The Flipkart Axis Bank credit card offers cashback across various categories such as lifestyle, shopping, travel, etc.

Features of Flipkart Axis Bank Credit Card:

- Convert your purchases of more than Rs.2,500 into EMIs.

- Get a 1% fuel surcharge waiver at all petrol pumps across India for making transactions between Rs.400 to Rs.4,000.

- Get joining and activation benefits worth Rs.1,100.

Benefits of Flipkart Axis Bank Credit Card:

- Receive 5% cashback on Flipkart and 4% cashback on other select merchants.

- Get 50% discount up to Rs. 100 on your first transaction on Swiggy.

- Get free access to four domestic airport lounges per year.

- With Axis Bank Dining Delights, enjoy up to 20% discount at select restaurants in India.

Kotak Mahindra Bank 811 #DreamDifferent Credit Card

Kotak Mahindra Bank’s 811 #DreamDifferent credit card has no annual fee and comes with various benefits like reward points, interest free cash withdrawals, and more.

Features of Kotak Mahindra Bank 811 #DreamDifferent Credit Card:

- Withdraw cash without paying any interest for up to 48 days.

- Add-on cards can be availed.

- Transfer outstanding balance from credit cards of other banks to your 811 #DreamDifferent credit card.

Benefits of 811 #DreamDifferent Credit Card:

- Get 2 reward points for every Rs.100 you spend on online purchases.

- Get 1 reward point for every Rs.100 you spend on other purchases.

- If your credit card is stolen, you are covered for Rs. 50,000 for fraudulent usage up to 7 days prior to reporting.

- Get a 1% fuel surcharge waiver at all petrol pumps across India for making transactions between Rs.500 and Rs.3,000.

- Get 500 bonus reward points when you activate your card and spend Rs. 5000/- in the first 45 days.

- Get a railway surcharge waiver of 1.8% for making transactions on irctc.co.in and 2.5% on Indian railway ticketing counters.

IDBI Bank Imperium Platinum Credit Card

The IDBI Bank Imperium Platinum credit card is a VISA-branded secured credit card that is offered against fixed deposits.

Features of IDBI Bank Imperium Platinum Credit Card:

- This credit card is accepted in over 29 million outlets worldwide and 9 lakh Indian merchants.

- Withdraw cash up to 70% of your credit limit.

- Get up to 48 days of interest-free credit on your purchases and manage your payments at your convenience.

- Avail add-on cards for your parents, spouse, siblings or children above the age of 18 years.

Benefits of IDBI Bank Imperium Platinum Credit Card:

- Get 500 delight points as a welcome bonus.

- Get 2 delight points for every Rs.150 you spend on movies, travel, shopping, etc.

- Enjoy free delight points for making a minimum single transaction of Rs. 1500 within 30 days of card issuance.

- If your credit card is lost or stolen, you can block it by contacting IDBI Bank’s customer care.

- Enjoy exclusive offers on car rentals, hotels, airport shopping, and more.

YES Bank ACE Credit Card

The YES Bank ACE credit card provides lifestyle benefits, extra reward points, and several other privileges.

Features of YES Bank ACE Credit Card:

- With the ‘Instant EMI’ facility, convert your purchases into Equated Monthly Installments (EMIs).

- YES Bank’s card protection plan offers coverage in case of card loss, theft, fraud, or an emergency.

- Credit Shield coverage is provided in the event of the accidental death of the primary cardmember.

Benefits of YES Bank ACE Credit Card:

- Get 12,000 bonus points on spending Rs.3.6 lakh in a year.

- Earn 2 reward points for every Rs.200 you spend on select categories.

- Earn 4 reward points for every Rs.200 you spend on all categories except select categories.

- Get a 1% fuel surcharge waiver at all petrol pumps across India for making transactions between Rs.400 and Rs.5,000.

- Enjoy a reduced foreign currency markup fee of 3.50%.

- Enjoy exclusive offers across categories like shopping, travel, dining, wellness, etc.

Axis Bank ACE Credit Card

The Axis Bank ACE credit card is a secured credit card that offers unlimited cashback on your purchases.

Features of Axis Bank ACE Credit Card:

- Convert your purchases of Rs.2,500 and above into EMIs.

- Enjoy accelerated cashback on all your purchases.

Benefits of Axis Bank ACE Credit Card:

- Get 5% cashback on mobile recharges, DTH, and utility bills paid on Google Pay.

- Enjoy 4% cashback on Ola, Swiggy, and Zomato.

- Enjoy 2% cashback on all other purchases.

- Get a 1% fuel surcharge waiver at all petrol pumps across India for making transactions between Rs.400 and Rs.4,000.

- Get a discount up to 20% across 4,000+ partner restaurants all over India.

- Get access to domestic airport lounges for free four times in a year.

FAQs on Secured Credit Card

- What is a secured card?

A secured credit card is a card which has been backed by a cash deposit. The deposit will serve as collateral on your account, and will provide the credit card issuer with security in case you are unable to make the payments.

- What is a good secured credit card?

A good secured credit card helps you build credit and contributes highly to your credit score as well. The credit card requires a certain amount of money to be paid as a deposit and that deposit is usually considered the credit limit of your card. Timely repayment of dues results in the building of good credit which can help you apply for a prepaid credit card.

- How do secured cards work?

A secured credit card is always backed by a deposit that you would make when you open your account. This deposit will be the same as your credit limit. Hence, if you deposit Rs.15,000, you will have a Rs.15,000 limit. This deposit will reduce the risk for the card issuer.

- Will a secured card build credit?

A secured credit card is offered by the bank for the sole reason of building credit for people who do not have enough credit to apply for a prepaid credit card.

- Does closing a secured credit card hurt?

Closing any credit card will hurt your credit score. It is always advised to keep a credit card open even if you are not using it. It can always be kept for emergencies. Closing or cancelling a card can reflect poorly on your spending habits. To know more it is advised you get in touch with the bank.

- How fast can you build credit with a secured credit card?

Building credit with your secured credit card can only happen if you are spending wisely and not more than you can afford. By having a secured credit card, only the money you put in as a deposit will be available to you as a credit limit. However, it is always better to start with smaller purchases which are easy to pay off. If you are increasing your expenditure gradually on a monthly basis, it will help you build your credit score faster.

- How long should I keep a secured credit card?

You can keep a secured credit card as long as required. To know more it is advised you get in touch with the representative of the bank.

- Do I get my deposit back from a secured credit card?

No, once you have given the money as a deposit to the bank, it is used as collateral for the bank in case you are not able to pay your dues. In most cases, the money as your credit limit comes from the deposit and is subtracted as and when you wish to increase your limit. Once you cancel or close your card, only then will the bank make the calculations and return the remainder of the money, if any.

- How can I increase my secured credit card limit?

You can increase your credit limit on your secured credit card by requesting the bank by contacting customer care of the bank or by visiting the bank branch. The credit limit will be increased depending on the amount you have deposited in the bank as collateral.

- Do secured cards really help your credit?

Having a secured credit card can help you in establishing and re-establishing your credit. This is because the payments will be included in your credit report, and when you pay on time and also manage the balance, it will help you improve your credit score.

- How fast do secured cards build credit?

Once you have opened your secured credit card, it will take around 30-45 days for this account to be reported to the credit bureaus. This is when your credit score will start building.

Types of Credit Card

- Top 10 Credit Cards in India

- Fuel Credit Cards

- Lifetime Free Credit Cards

- Kisan Credit Card

- Student Credit Cards in India

- Shopping Credit Cards

- Contactless Credit Cards

- Travel Credit Cards

- Co-Branded Credit Cards

- Lifestyle Credit Cards

- Rewards Credit Cards

- Business Credit Cards

- NRI Credit Cards

- Cashback Credit Cards

- Lounge Access Credit Cards

Credit Card by Banks

- Axis Bank Credit Card

- HDFC Bank Credit Card

- Kotak Bank Credit Card

- Federal Bank Credit Card

- SBI Credit Cards

- HSBC Credit Card

- IndusInd Bank Credit Card

- RBL Bank Credit Card

- Standard Chartered Credit Card

- YES Bank Credit Card

- Canara Bank Credit Card

- Punjab National Bank Credit Card

- Bank of Baroda Credit Card

- IDBI Credit Card

- Union Bank of India Credit Card

- Bank of India Credit Card

Articles on Credit Card

- How to Check Credit Card Status

- How to Manage Multiple Credit Cards

- Best Credit Card for Poor Credit

- How to get Credit Card without Job

- Credit Card Insurance Benefits

- How to Apply for Lost Credit Card

- Reasons for Credit Card Rejection

- Advantages & Disadvantages of Credit Card

- Difference between Credit Card & Debit Card

Credit Card Customer Care

- SBI Credit Card Customer Care

- HDFC Bank Credit Card Customer Care

- Axis Bank Credit Card Customer Care

- Federal Bank Credit Card Customer Care

- IndusInd Bank Credit Card Customer Care

- PNB Credit Card Customer Care

- RBL Bank Credit Card Customer Care

- Kotak Credit Card Customer Care

- Yes Bank Credit Card Customer Care

- Standard Chartered Credit Card Customer Care

- Canara Bank Credit Card Customer Care

- HSBC Credit Card Customer Care

- Indian Bank Credit Card Customer Care

- Bank of Baroda Credit Card Customer Care

- Bank of India Credit Card Customer Care

- Union Bank of India Credit Card Customer Care

Credit Card Bill Payment

- Credit Card Bill Payment

- SBI Credit Card Bill Payment

- HDFC Credit Card Bill Payment

- Federal Bank Credit Card Bill Payment

- Axis Bank Credit Card Bill Payment

- IndusInd Credit Card Bill Payment

- Kotak Credit Card Bill Payment

- Standard Chartered Credit Card Bill Payment

- RBL Bank Credit Card Bill Payment

- HSBC Credit Card Bill Payment

- PNB Credit Card Bill Payment

- Canara Bank Credit Card Bill Payment

- Bank of Baroda Credit Card Bill Payment

- Bank of India Credit Card Bill Payment

- Union Bank Credit Card Bill Payment

Credit Card Eligibility

- Credit Card Eligibility

- SBI Credit Card Eligibility

- HDFC Credit Card Eligibility

- Federal Bank Credit Card Eligibility

- Axis Bank Credit Card Eligibility

- Yes Bank Credit Card Eligibility

- IndusInd Bank Credit Card Eligibility

- HSBC Credit Card Eligibility

- Kotak Credit Card Eligibility

- Canara Bank Credit Card Eligibility

- Standard Chartered Credit Card Eligibility

- RBL Bank Credit Card Eligibility

- Bank of Baroda Credit Card Eligibility

- Union Bank Credit Card Eligibility

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.