How to Close a Credit Card?

When you decide to close a credit card, there are certain things that need to be taken care of. There is no one standard procedure for closing a credit card and the process generally differs from bank to bank. It's important to follow the specific steps outlined by your card issuer to ensure the closure is handled smoothly and does not negatively impact your credit score.

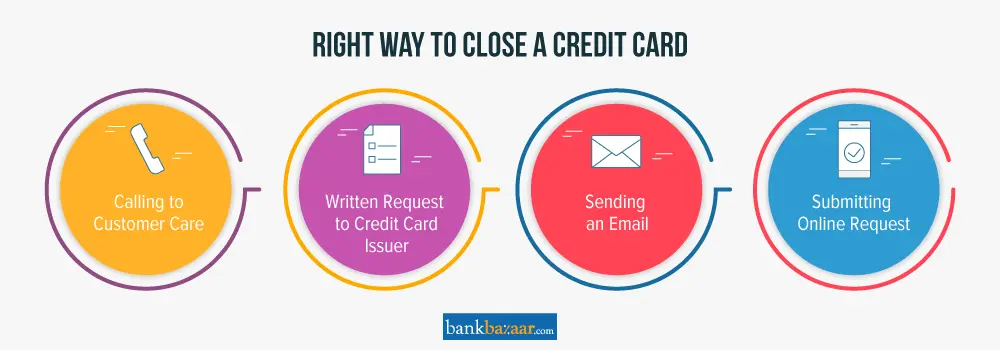

Methods to Close a Credit Card

- Cancel a credit card by calling customer care

- By submitting a written request to the credit card issuer

- Sending an e-mail to cancel the credit card

- Submitting an online request for closing the credit card

Cancel a Credit Card by Calling Customer Care

You can call the credit card customer care of the respective bank and request them to cancel the credit card that is in your name. Once the request has been raised with customer care, the bank will get back to you and discuss the details for the cancellation of the credit card.

By Submitting a Written Request to the Credit Card Issuer

You can also close a credit card by sending a written request to the credit card issuer. You need to mention all the details regarding the credit card you want to cancel and send it to the authorities of the credit card issuer by ordinary post or registered post. You can get the postal address on the official website or by calling the customer care executives.

Sending an E-mail to Cancel the Credit Card

You can raise a request for closing a credit card by sending an e-mail to the credit card issuer. If the facility is available, you will find a dedicated e-mail address to which requests for the cancellation of credit cards can be sent. In the e-mail, you need to provide the details of the credit card that needs to be closed, your personal details, etc.

Submitting an Online Request for Closing the Credit Card

Some banks offer customers the option of raising a credit card cancellation request online. To raise an online request, you need to visit the bank’s website, fill up the form and submit the request. Once the request has been made, a representative of the bank will call to confirm the cancellation request.

Is it Better to Close Unused Credit Cards?

Experts advise against closing unused credit cards as it can harm your credit score. Your credit score has five components. Unused credit cards impact your credit history length and credit utilization.

If you have had a credit card for about 2-3 years, closing it might be a bad idea. Closing the card, though, will not have a major effect on your credit score if you owned it for a few months. An unused credit card retains a significant credit limit locked in, enhancing the credit utilisation ratio and your credit score. Here are a few circumstances when you should consider closing an unused credit card:

- If the credit card does not provide any benefits.

- When you have an excessive number of credit card accounts.

- If the credit card’s annual fee is very high.

What are the Things to Consider When Cancelling a Credit Card?

There is no standard procedure for cancelling a credit card, but following certain guidelines can minimize damage to credit score. Note the points listed below:

- Clear the outstanding balance on the card: Before deciding to close the credit card, you need to clear the outstanding balance on the card. Without doing this, you cannot raise a request to cancel the credit card.

- Read about the closing procedures and possible penalties that you may need to pay: Read about the closing procedures that the credit card issuer might offer when it comes to cancelling a credit card. Doing this makes you aware of things which you might not have known such as penalties.

- Use up all the outstanding rewards that you may have on the card: When you use a credit card to purchase things, you end up earning reward points. These reward points need to be used up before deciding to close the credit card.

- Make sure to cancel automatic bill payments and transfers: Automatic bill payments and transfers need to be cancelled before closing the credit card. In case, you forget to do this, you might end up paying the fees associated with the card if the bank does not follow up on your cancellation request.

- Ensure that no last-minute charges pop up before cancelling the card: Check the last statement of the credit card properly to make sure that no last-minute charges show up. Pay off all the charges before deciding to close the credit card.

- Talk to the customer care executives and get the exact date when the card would be cancelled: When you raise a request for cancelling the credit card make sure to follow up with the credit card issuer and get the exact date on which the credit card will be cancelled. This way, you don’t pay any extra fees and charges.

- Get a written confirmation from the credit card issuer stating that the credit card was closed: This is very important because as mentioned earlier it helps to keep a tab as to when the credit card was closed by the issuer. So, make sure to get a written confirmation from the issuer.

Other Things to Keep in Mind

- When a credit card is cancelled, any add-on credit cards linked to the card will also be automatically cancelled.

- You would not be able to apply for a balance transfer to another bank once the request to cancel the credit card has been raised.

Customer Care Numbers to Cancel a Credit Card for Top Credit Card Issuers

Bank | Customer Care Number |

State Bank of India | 1800 180 1290 |

Axis Bank | 1800 209 5577 |

Kotak Mahindra Bank | 1860 266 2666 |

HSBC | 1860 500 2277 |

HDFC | 1800 266 4332 |

YES Bank | 1800 103 6000 |

IndusInd Bank | 1860 500 5004 |

American Express | 1800 419 1092 |

Bank of Baroda | 1800 225 100 |

IDBI Bank | 1800 200 1947 |

RBL Bank | 1800 121 9050 |

Bank of India | 1800 220 229/ 1800 103 1906 |

How to Close a Credit Card without hurting the Credit Score?

Closing a credit card can hurt your credit score. That is why it is important to follow a process while cancelling it.

- Pay off your balance: To cancel your card, your balance must be paid in full. Otherwise, you'll need to keep it open until the balance is zero.

- Redeem any existing rewards: Any rewards points you earned while using your card will often vanish once you close a card. Depending on the card, you might be able to transfer your points to another card or cash-back rewards program. So enjoy those reward points before you cancel.

- Call the credit card company: To cancel your credit card, call the bank and talk to customer service. They may offer to keep your card open. Remember your reasons for closing your account.

To officially cancel, call the number on the bank of your card and talk to someone from the credit card company or bank that issued that card. The customer service representative will most likely try to entice you with attractive offers to keep your card open. Stay strong, and remember your reasons for closing your account.

FAQs

- Is it better to cancel unused credit cards?

Yes, it is better to close an unused credit card.

- What happens if you cancel a credit card with a balance?

You can’t close a credit card with an outstanding balance. In case, you want to close the credit card, you will have to clear the balance that may be on the card.

- Will closing a credit card affect your credit score?

Closing a credit card might affect your credit score. You can however minimize the effect by ensuring that you follow all the necessary formalities.

- Is it better to close a credit card or leave it open with a zero balance?

The best thing is to close the credit card the right way.

- Do I need to submit my credit card to the bank once it is cancelled?

It depends on the bank’s terms and conditions. While some banks require the cardholder to send the cut credit card to the bank to initiate the cancellation request, other banks recommend the customers to cut the card into pieces once it is cancelled instead of discarding it as it is.

- What do I do with an unused credit card, should I cancel it?

If used in a strategic manner, closing your unused credit card can actually help in improving your credit score. One reason for closing an old account and cancelling your credit card is to avoid any annual fee that you may incur.

- Is it bad to cancel a credit card?

This entirely depends on the credit that is available on your card. When you close a credit card account which has a high credit limit, it might affect your credit score in a negative way, especially if you have a high balance on your other cards and loans. In order to ensure that cancelling your credit card does not hurt your credit score, you should pay off all balances on other cards.

- Can I cancel my credit card by writing a letter?

Yes, you can cancel your credit card by sending a written letter of request to your credit card company. You will have to note down details like the name of the credit card that needs to be cancelled and then send this to your credit card issuer. This can be done by post.

- When I cancel a credit card, will my add-on card also be cancelled?

Yes, when you cancel a credit card, your supplementary credit cards and add-on credit cards which are linked to the main card will be cancelled.

Types of Credit Card

- Top 10 Credit Cards in India

- Fuel Credit Cards

- Lifetime Free Credit Cards

- Kisan Credit Card

- Student Credit Cards in India

- Shopping Credit Cards

- Contactless Credit Cards

- Travel Credit Cards

- Co-Branded Credit Cards

- Lifestyle Credit Cards

- Rewards Credit Cards

- Business Credit Cards

- NRI Credit Cards

- Cashback Credit Cards

- Lounge Access Credit Cards

Credit Card by Banks

- Axis Bank Credit Card

- HDFC Bank Credit Card

- Kotak Bank Credit Card

- Federal Bank Credit Card

- SBI Credit Cards

- HSBC Credit Card

- IndusInd Bank Credit Card

- RBL Bank Credit Card

- Standard Chartered Credit Card

- YES Bank Credit Card

- Canara Bank Credit Card

- Punjab National Bank Credit Card

- Bank of Baroda Credit Card

- IDBI Credit Card

- Union Bank of India Credit Card

- Bank of India Credit Card

Articles on Credit Card

- How to Check Credit Card Status

- How to Manage Multiple Credit Cards

- Best Credit Card for Poor Credit

- How to get Credit Card without Job

- Credit Card Insurance Benefits

- How to Apply for Lost Credit Card

- Reasons for Credit Card Rejection

- Advantages & Disadvantages of Credit Card

- Difference between Credit Card & Debit Card

Credit Card Customer Care

- SBI Credit Card Customer Care

- HDFC Bank Credit Card Customer Care

- Axis Bank Credit Card Customer Care

- Federal Bank Credit Card Customer Care

- IndusInd Bank Credit Card Customer Care

- PNB Credit Card Customer Care

- RBL Bank Credit Card Customer Care

- Kotak Credit Card Customer Care

- Yes Bank Credit Card Customer Care

- Standard Chartered Credit Card Customer Care

- Canara Bank Credit Card Customer Care

- HSBC Credit Card Customer Care

- Indian Bank Credit Card Customer Care

- Bank of Baroda Credit Card Customer Care

- Bank of India Credit Card Customer Care

- Union Bank of India Credit Card Customer Care

Credit Card Bill Payment

- Credit Card Bill Payment

- SBI Credit Card Bill Payment

- HDFC Credit Card Bill Payment

- Federal Bank Credit Card Bill Payment

- Axis Bank Credit Card Bill Payment

- IndusInd Credit Card Bill Payment

- Kotak Credit Card Bill Payment

- Standard Chartered Credit Card Bill Payment

- RBL Bank Credit Card Bill Payment

- HSBC Credit Card Bill Payment

- PNB Credit Card Bill Payment

- Canara Bank Credit Card Bill Payment

- Bank of Baroda Credit Card Bill Payment

- Bank of India Credit Card Bill Payment

- Union Bank Credit Card Bill Payment

Credit Card Eligibility

- Credit Card Eligibility

- SBI Credit Card Eligibility

- HDFC Credit Card Eligibility

- Federal Bank Credit Card Eligibility

- Axis Bank Credit Card Eligibility

- Yes Bank Credit Card Eligibility

- IndusInd Bank Credit Card Eligibility

- HSBC Credit Card Eligibility

- Kotak Credit Card Eligibility

- Canara Bank Credit Card Eligibility

- Standard Chartered Credit Card Eligibility

- RBL Bank Credit Card Eligibility

- Bank of Baroda Credit Card Eligibility

- Union Bank Credit Card Eligibility

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.