EPF UAN KYC Update - Easy Steps to Upload and Verify Documents Online

The UAN and Aadhaar can be linked to upload documents. Although it is not required, having your KYC information included in the EPF UAN site speeds up processes that require verification.

For more information, Check out related articles: UAN registration, UAN Login, PF Passbook & EPF Claim Status

How to Upload KYC Details in EPF UAN

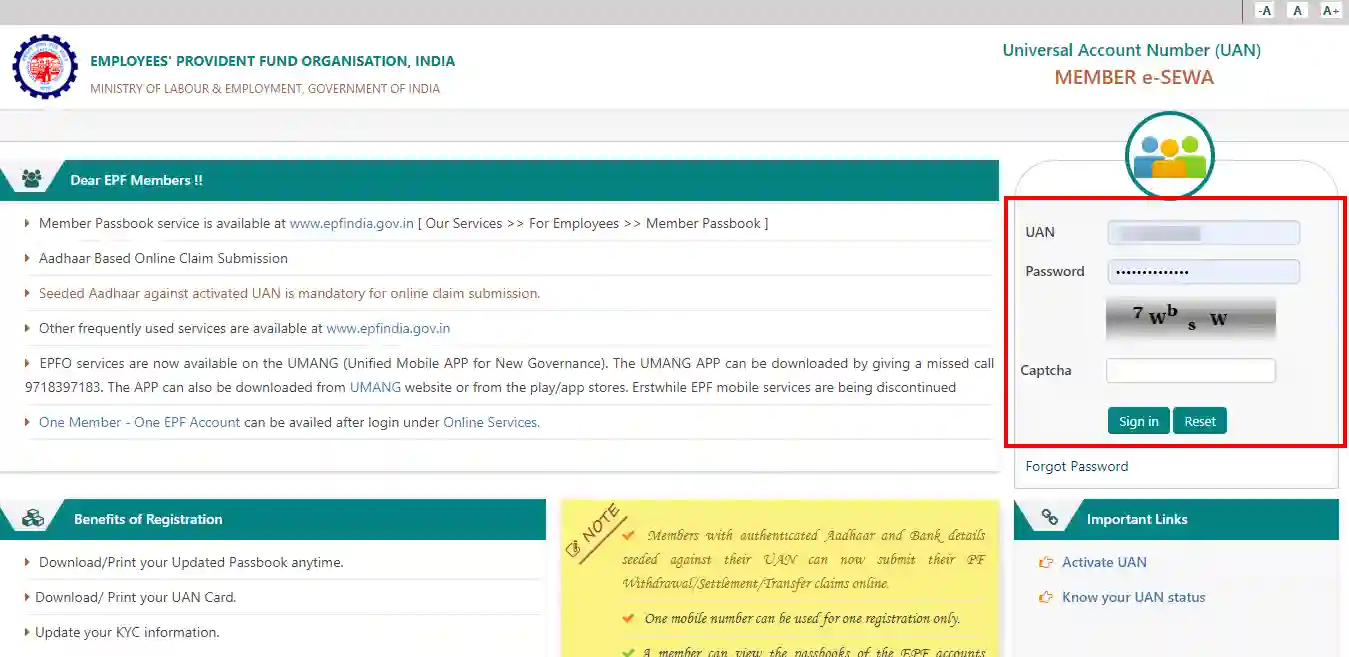

Step 1: Visit the EPFO's member portal https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Use your UAN and Password and fill up the Captcha to log in to the portal.

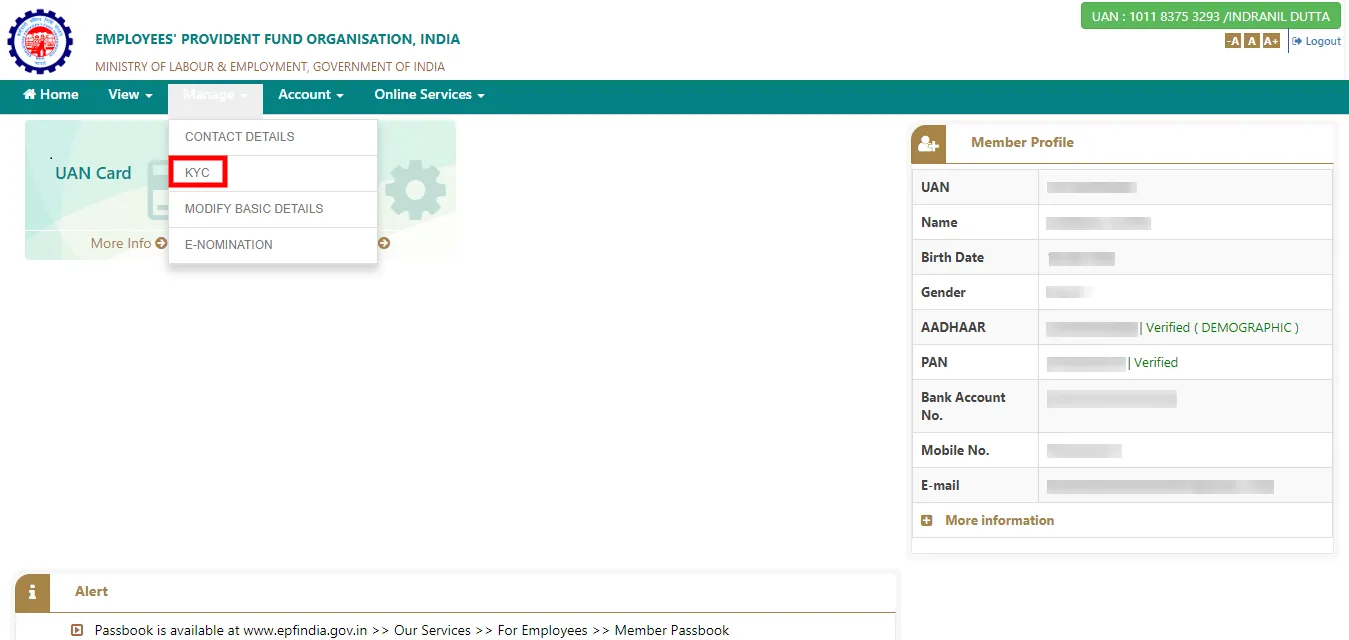

Step 3: Then click on the 'Manage' option from the top menu bar.

Step 4: Next, select the 'KYC' option from the drop-down menu.

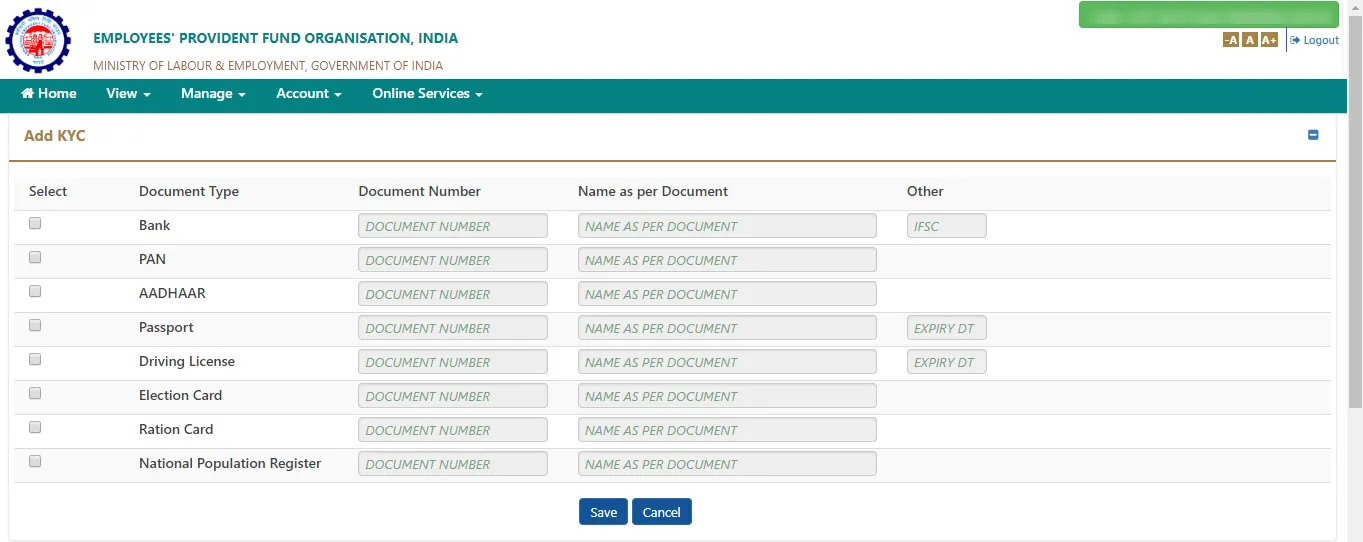

Step 5: You will be redirected to a new page that contains a list with different 'Document Type.'

Step 6: Click on the checkbox next to the document type you want to update.

Step 7: Fill in the details of the document in the respective field.

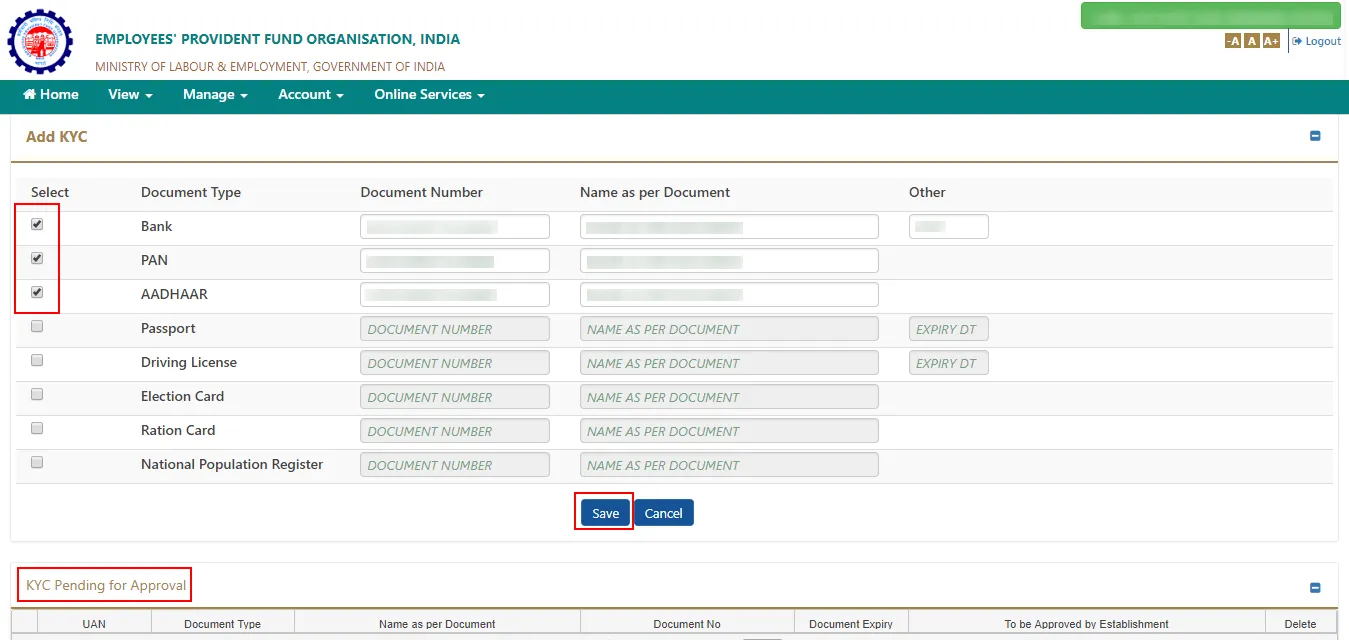

Step 8: Click on 'Save' option after updating the details.

Step 9: Once the details are updated, your KYC document status will be shown under the 'KYC Pending for Approval' column.

Step 10: The status will appear under the 'Digitally Approved KYC' after approval from your employer.

Step 11: You will be notified through SMS, once your employer approves your document.

Process of Embedding KYC Details in EPF UAN

- Once your employer has verified and found the details matching and legitimate, he/she will digitally attest the document.

- Once your document has been approved, authorities of the EPFO will then verify your approved document to see if there is any mismatch, discrepancies and so on.

- If your documents have not been approved, you can contact the EPFO's helpline - 1800 118 005 or mail them at uanepf@epfindia.gov.in..

- Once this is all done, if you raise a claim, the verification process will be done in no time, and your KYC details will be embedded in the EPF UAN system.

Process of Updating Contact Details in EPF Account

In case you have to update your contact details in your EPF acocunt, you can do it following the online process mentioned below:

Step 1: Visit the EPFO member portal and log in using your credentials.

Step 2: From the main menu, click on the 'Manage' section.

Step 3: Click on the 'Contact Details' option from the drop-down menu.

Step 4: Check the box against the 'Change mobile number' and/or 'Change email ID' options.

Step 5: Enter the new contact details which are to be updated.

Step 6: Click on the 'Get authorisation PIN' button.

Step 7: Enter the OTP sent to your registered contact details to validate the same and change the details as per requirement.

Step 8: Once the OTP is verified, the contact details will be recorded and the same will be updated within some stipulated time.

Key Points to Note

- While filling the details of your KYC document, you have to make sure that there are no discrepancies with regard to the details that you have entered from your KYC documents such as Aadhaar card, Passport, PAN card, driver's license and so on.

- After you have uploaded your document, the process of approval from your employer will take 2-3 days roughly.

EPF members who have their KYC details embedded in the portal usually get their claims, withdrawals, transfers, etc., approved much faster and the process is simpler for both the employee and the employer.

Documents Required to Update KYC for EPF UAN

The documents needed to update KYC for EPF UAN are mentioned below

- PAN card

- Aadhaar card

- National Population Register (NPR)

- Valid passport

- Bank account details

- Valid driving license

- Valid election card

EPF KYC Update Benefits

The various benefits of EPF KYC update are mentioned below

- It is straightforward to file a claim withdrawal online if the KYC records are current and linked to the UAN.

- A modified KYC ensures the smooth transition of employee provident fund EPF accounts.

- A 10% tax is taken from the total if a person withdraws their PF before serving for five years. For this, the PAN information in the EPF account needs to be updated. If the PAN data is left unchanged, the TDS ratio is also 34.608%.

- Users who successfully complete the KYC process receive information on their account activity and monthly PF balance.

How to Track EPF KYC Status?

You can track your EPF KYC status through below mentioned methods

- UAN Portal - To access the "UAN card" option, go into your member e-Sewa Portal account and choose the "View" page. If your EPF account's KYC has already been completed, a "Yes" will be displayed in front of the KYC information row on the UAN card.

- Through Documents Under KYC Tab - Another technique to determine whether the EPF account is KYC-compatible is to check the papers that have been accepted and reviewed in the EPFO archives. This can be reviewed in the 'KYC' option under the 'Manage' page of the Member e-Seva Portal. EPF account holders can examine the records under the "Digitally Authorized KYC"

EPFO UAN Helpline to Register KYC Related Issues

EPFO has its helpdesk which deals with UAN related issues. The helpdesk is available both offline as well as online. The users can either meet the UAN helpdesk official to solve their issues offline or they can resolve their issues online. In online, the queries are resolves through toll free number and email.

EPFO helpdesk resolves the following types of issues or queries for its subscribers:

- Knowing UAN

- Unavailability of passbook

- Problems while allotting more than one UAN

- Changing contact details

- Unavailability of passbook

- Updating of KYC details

- Technical glitches in the portal and UMANG app

- One Time Password (OTP) related issues

- EPF transfer

- EPF transfer

Contact Details of EPFO Helpdesk

- Toll Free Number: 1800 11 8005

- Email: employeefeedback@epfindia.gov.in

Who Approves the KYC Documents and How?

Once the KYC documents are successfully submitted in the UAN EPFO portal, the EPFO officials or the employer needs to give the approval of the KYC details. In general, employers gives the approval of KYC requests. In case they fail to approve the details, you can get in touch with the EPF Grievance Portal.

This process will take from three to five working days to get the approval. You can track the changes online on the portal at the ‘KYC pending for approval’ option. If you need any technical help, you can email at dd.caiu@epfindia.gov.in.

FAQs on Steps to Upload KYC in EPF UAN

- How can I check the status of my EPF KYC?

To check the progress of your PF KYC, go to the EPFO member e-Sewa portal. Enter your UAN, password, and captcha to log in. After successfully login in, select the 'KYC' option from the drop-down menu under the 'Manage' header. The documents are available to EPF account holders on the 'Digitally Approved KYC' website. A list of documents that have been accepted and reviewed will be displayed on the tab.

- What are the advantages of updating your KYC information?

It's not necessary for people to update their KYC data. However, if the KYC information for your EPF account is up to date, you can benefit from a number of benefits. Daily SMS notifications, making it simple to access your balance, quick and easy transactions, cheaper TDS fees, and so on are just a few of them. As a result, one can update their KYC for straightforward statements.

- How to check my PF KYC status?

You can check your PF KYC status by visiting the Member e-Sewa portal.

- How long does it take to approve the KYC documents?

Within three to five business days, the KYC data is often verified. After the approval has been completed successfully, an SMS will be issued to the registered mobile number.

- Is it mandatory to update KYC details online?

No, it is not mandatory to update KYC details online. However, updating KYC will keep your data up to date. It will also help in reducing the time required for transfer of EPF money from one account to another and for EPF withdrawal amount.

- Do I need to upload documents on the EPFO Portal?

No, you are not required to upload documents on the EPFO Portal. Just the name as per the document and the document number must be specified.

- Is uploading papers to the EPFO Portal required?

No, it is not necessary to upload the KYC records. Along with the document name, they must also type the document number. The document's expiration date may also be stated in some situations. It is crucial to upload KYC data for UAN since it enables a smooth transition from one activity to the next. Reduces the employee's dependency on the prior employer while shifting PF money.

- Who can I get in touch with if I have questions about the UAN KYC update?

You should contact the EPFO Helpdesk at 1800 118 005 if you have any questions. For technical support, contact them at dd.caiu@epfinida.gov.in.

- How long does it take for KYC documents to be approved?

It generally takes 3 to 5 working days for the documents to be reviewed and approved.

- To view the status of the documents, am I required to visit the UAN Portal daily?

No, you are not required to visit the UAN portal every day. You will be notified by SMS once the documents are reviewed and approved.

- Whom should I contact for any queries regarding the UAN EPFO portal?

Regarding queries, you can contact EPFO Helpdesk on their number, which is 1800 118 005. For Technical support, you can contact them on dd.caiu@epfinida.gov.in.

- How much time is needed to get my KYC documents approved in EPFO portal?

It takes around three to five working days to verify all your KYC documents. Once your details are approved, you will receive an SMS regarding the same at your registered mobile number.

- Is it mandatory to update KYC details on the EPFO portal?

No, it is not mandatory to update KYC details on the EPFO portal but if all your details are up to date on the portal, you will be able to certain benefits such as SMS alerts, lower TDS charges, hassle fee transfers, etc.

- Whom shall I contact regarding any issues related to the UAN KYC update?

You need to call EPFO Helpdesk at 1800 118 005 or email at dd.caiu@epfindia.gov.in for any kind of help related to the UAN KYC update.

News on EPFO KYC Update

Mandatory KYC Update: EPFO Rejects Requests for Additional Time to Link Aadhaar With UAN

The Employees' Provident Fund Organization (EPFO) has cancelled the extension of the deadline for Aadhaar connection with UAN in order to file ECR before 31 October, according to a circulation dated 1 December 2025. ECR filing will be available only for members whose Aadhaar numbers have been issued and authenticated with UAN beginning in November 2025.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.