How to Get EPF Statement Online

To get your EPF statement online, log in to the EPFO member portal using your UAN and password. You can also download it anytime through the UMANG app under the ‘View Passbook’ option.

What is an EPF statement?

An EPF statement contains a record of your approved transactions of advances, settlement, transfer-in and transfer-out across various organizations in India where you have worked.

It is a kind of e –passbook, an online version of your PF status. All transactions done as per month and date will be included in statement or e-passbook. Apart from offering updated status of your PF account, the EPF statement will also include your personal details such as your name and date of birth.

How to download my e-passbook/statement online

EPF contributors can download their e-passbook as and when required. In fact, it can be downloaded multiple times in a month. The Employee Provident Fund Organization does not provide any hard copy of annual provident fund statement.

Employees can download their EPF account statement online by using the new e-passbook facility available on the EPFO website.

In order to view and download your e-passbook, you need to register with EPFO.

You need to enter the following information to register with EPFO:

- Mobile number

- Date of birth

- Any of the following KYC documents (PAN Card, Voter ID Card, Passport and Driving License etc.) and the number appearing on it.

- Name

- Email ID

Once, you are registered, you can view and download your EPF statement online. The facility of e-passbook or e-statement will be available for active PF contributors only.

Check your EPF balance online with e-passbook

EPFO (Employees Provident Fund Organisation) has introduced a new e-passbook facility on its portal to enable its members to check their EPF balance online. The facility will allow subscribers to get details of their updated PF Status online.

The facility is called the EPF Account Passbook through which you can download your e-passbook any number of times in a month. You can no longer avail the hard copy of the annual PF statement from the PF department.

You can access the e-passbook from the EPFO website only if you are registered on the site. The e-passbook can be downloaded online by entering the PF number, member name, and establishment code as mentioned in your PF slip.

What is an e-passbook?

e-passbook is an online PF status book which records an employee's PF transactions and status. Date wise as well as month-wise transactions made in the EPF account of an employee can be tracked as it is displayed on the online e-passbook. Additional details such as name and date of birth of the employee is also available on the e-passbook.

Some of the features of an e-passbook are:

- It is available to active members only.

- E-passbooks cannot be availed for negative balance, inoperative, or settled EPF accounts.

- E-passbooks are not available for exempted establishments.

- Availing an online passbook requires its members to register themselves by providing all the required details.

Online registration:

The facility of e-passbook is presently only available to members who have uploaded the Electronic Challan Cum Return for the wage of May 2012 onwards. Registering on the EPFO portal does not require to create an id or password.

All you need to do is use your mobile number and any identity proof such as PAN Card, Voter ID, Passport, Driving License, etc., to register and login. Once you enter your EPF account number and name, you must click on 'Get PIN'.

Upon clicking, the PIN is sent via SMS on your mobile. Authorisation via PIN is required every time you check your EPF balance or download your EPF balance.

However, only a registered employee can use the EPFO portal to download an online passbook. If an employee has left service or has retired before March 2012, he or she can an e-passbook upon request on the EPFO portal.

How to obtain your i-Akaun activation code

Given below are the steps you will have to follow to obtain your I-Akaun activation code:

- The first step will require you to register for EPF I-Akaun. You can complete this process at any EPF counter.

- Once you complete the registration process, you will receive a temporary login id and password which you can use to activate your I-Akaun account. The process must be completed within 30 days of receiving the login ID and password.

Steps to activate your i-Akaun

- The first step to activating your I-Akaun account is to click on the link https://www.kwsp.gov.my/en/.

- Click on 'Login to Member (i-Akaun)'.

- Enter the temporary user ID and click on 'Next'.

- Enter the password and click on 'Login'.

- Read the terms and conditions, tick the box, and click on 'Next'.

- You will have to create a new user ID and password. Your user ID must be alphanumeric and must have anything between 8-16 digits.

- Create a strong password.

- Choose an online image and enter a secret phase with a maximum of 10 characters. Click on 'Next'.

- A message stating that your activation has been successful will be displayed on your screen. You can then login using your user ID and password.

Steps to generate e-passbook

- Login to the EPFO site at the following address - http://members.epfoservices.in.

- Register on the site by giving the required details.

- Mention important information such as mobile number and date of birth.

- Add other details as prompted by the website.

- Click on the 'Get Pin' tab.

- The PIN is sent as an SMS to your mobile number for authorisation.

- Enter the same PIN on the link.

- You can login using your mobile number or document number.

- Click on download e-passbook.

- Select PF office state as per your respective state.

- Select PF office from the list given on the site.

- Select or enter the company PF code on the given tab.

- Mention your PF account number.

- Mention your name as per office records.

- Click on 'Get PIN'.

- The PIN is sent to your mobile number.

- Update the same PIN on the link.

- You can get your e-passbook on the page after three working days.

FAQs on How to Get EPF Statement

- What is the EPF account statement?

The employer's and employee's monthly contributions in rupees will be divided in detail in the EPF statement or passbook. Additionally disclosed separately in the statement is the amount devoted to the Employees' Pension Scheme, or EPS.

- What is a voluntary provident fund?

The voluntary provident fund is listed under the 'Voluntary Provident Fund' column and allows employees to contribute more than the minimum 12 percent required for PF. Employee voluntary donations are shown individually. One must remember that the employer is not required to match the VPF payment, hence there may be no number provided.

- How to use your EPF account statement?

EPF account is a very important document which can be used for various purposes. Firstly, it can be used for retirement planning. You can use the EPF account statement to plan for retirement since it gives you an in-depth overview of your retirement funds. It can also be used to file Income Tax Return (ITR). If you want to claim tax benefits under Section 80C of the Income Tax Act, you can provide your EPF account statement as proof of investment. Apart from this, it can also be used to file a loan application. For loan applications, your EPF account statement can serve as proof of income.

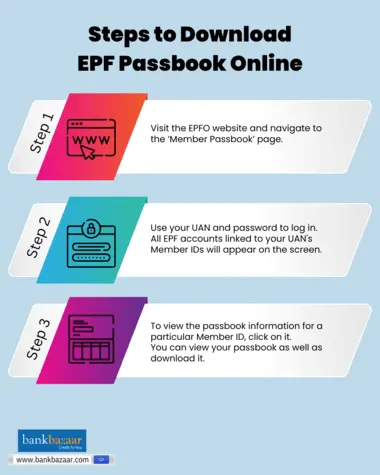

- How to download my EPF account statement for the year 2023?

To download your EPF account statement for the year 2023, you need to visit the official website of the EPFO https://www.epfindia.gov.in/. Then, go to the ‘For employees’ after which you will be redirected to a new page. Now, go to the ‘Member Passbook’ on this page. Enter your UAN and password and login to your passbook. Once you are logged in, you can easily download your EPF account statement.

- What are the other ways through which I can download my EPF account statement?

Apart from checking the EPF account statement online, you can check your EPF account statement by sending an SMS to 7738299899 from your registered mobile number. However, you need to write the message in a following format: EPFOHO UAN ENG. Here, 'ENG' denotes the language in which you want to get the statement such as Hindi, English, or any other regional language.

- What to do if there are any discrepancies in the EPF Account Statement 2023?

It is extremely crucial to check your EPF account statement in an in depth manner in order to ensure that all the details that you have entered are correct. However, if there is any sort of discrepancies in your EPF account statement, you can get in touch with your employer and let them know about the discrepancies. Your employer will go through your details and rectify the errors. In case your employer fails to rectify the errors, you can lodge a complaint with the EPFO through the 'Register Grievance' link available on the website of EPFO.

- Can I check my EPF statement for free?

Yes, you can check your EPF statement for free.

Annie Jangam is a financial writer with a unique background in biotechnology and eight years of genomics research experience, culminating in 6 international publications. Her three-year experience in SEO-based content writing spans diverse topics. She combines her analytical skills with a talent for clear communication to simplify complex financial concepts. She delivers informative, engaging content with scientific precision and creative flair in the fintech industry. She covers various financial products such as banking, insurance, credit cards, tax, commodities, and more. Her research background demonstrates her dedication, attention to detail, and problem-solving skills, making her a valuable asset in the data-centric world of fintech. |

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.