Difference Between NEFT, RTGS & IMPS

In today’s digital age, electronic fund transfers have become the norm, revolutionizing the way we transact money. Among the plethora of options available, NEFT, RTGS, and IMPS are popular choices for transferring funds securely and swiftly.

Different Methods to Transfer Funds Online

The three different methods by which money can be transferred online are mentioned below:

IMPS

The transfer of funds is completed immediately via IMPS. You can transfer money 24x7 by using this method. IMPS can be completed by using internet banking or mobile banking.

Various digital banks in India use IMPS services to transfer money, Depending on the bank, the transaction charges may vary.

NEFT

Under NEFT, you can transfer funds from one bank branch to another bank branch that is under the scheme. However, NEFT transactions take longer when compared to IMPS.

RTGS

Another payment mode that occurs in real-time and on a gross basis is RTGS. RTGS is mainly used for higher value transfers that require immediate clearance. RTGS transactions can be completed only during banking hours.

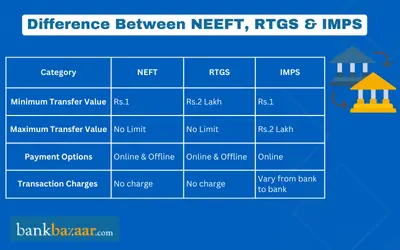

Differences Between NEFT, IMPS and RTGS

Category | NEFT | RTGS | IMPS |

Minimum transfer value | Rs.1 | Rs.2 lakh | Rs.1 |

Maximum transfer value | Depends on the customer segment | No upper limit | Rs.5 lakh |

Type of settlement | Batches | One-on-one settlement | One-on-one settlement |

Speed of settlement | 2 hours (subject to cut-off timings and batches) | Immediately | Immediately |

Service availability | 24/7 | Depends on the bank | 24/7 |

Online/Offline | Both | Both | Online |

Mode of the process | Online and Offline | Online and Offline | Online |

Time Taken | Up to 2 hours | 30 minutes | Instantly |

Transaction Charges | No charge is levied for inward transaction and online process. |

For outward transactions:

| Charges vary from bank to bank |

Process Speed | Slow | Faster | Faster |

Reliability | Yes | Yes | Yes |

Advantages and Disadvantages of NEFT, IMPS, and RTGS

Transfer Method | Advantages | Disadvantages |

NEFT | - Cost-effective for small to medium transfers- Available 24x7 including holidays- Secure and RBI regulated | - Not instant; funds are settled in half-hourly batches- No facility for real-time processing |

IMPS | - Instant fund transfer, even on holidays and weekends- Available 24x7- Suitable for urgent low to mid-value transfers | - Lower transaction limit compared to RTGS- May not be supported by all banks |

RTGS | - Ideal for high-value transfers (₹2 lakh and above)- Real-time settlement reduces processing time- Highly secure | - Not suitable for small-value transfers- Used primarily during business hours in some bank interfaces |

NEFT, IMPS, and RTGS Transfer Limits and Charges

Transfer Method | Minimum Limit | Maximum Limit | Transfer Charges |

NEFT | ₹1 | No maximum limit (depends on bank) | Most banks now offer NEFT free of charge post RBI directive (from Jan 2020) |

IMPS | ₹1 | ₹5 lakh (may vary by bank) | Nominal charges: ₹2.50 – ₹25 + GST (varies by amount and bank) |

RTGS | ₹2 lakh | No maximum limit | Many banks offer RTGS for free; earlier charged ₹25 – ₹50 + GST (mostly discontinued) |

Note: RBI has waived off charges for NEFT and RTGS transactions initiated online. However, charges may still apply for branch-based transactions. Always verify with your bank for the latest fee structure and transfer limits.

Features of NEFT, RTGS, and IMPS Payment Systems

The features of Payment systems are discussed below:

- Fund Transfer Limit: Fund Transfer Limit defines the range of amounts that can be transferred through a payment system, varying by system and financial institution. For example, the National Electronic Funds Transfer (NEFT) system does not generally impose a specific limit per transaction. Instead, it may have daily cumulative limits, which are set by individual banks. In contrast, the Real-Time Gross Settlement (RTGS) system is designed for high-value transactions and usually enforces a minimum limit (such as Rs.2 lakh) while not imposing a maximum cap. On the other hand, Immediate Payment Service (IMPS) supports a range of transaction values from low to high, with limits set by banks, typically between Rs.1,000 and Rs.2 lakh.

- Service Availability: Service Availability refers to whether a payment system is accessible around the clock or only during specific hours. The NEFT system operates 24x7, including on weekends and holidays. However, transactions are processed in hourly batches, meaning they are settled at regular intervals throughout the day. RTGS is available only during bank working hours on weekdays and occasionally on Saturdays, and is generally not available on public holidays. In contrast, IMPS is available 24x7, including holidays, facilitating instant transfers at any time.

- Fund Transfer Charges: Fund Transfer Charges encompass the fees associated with making a transfer using a particular payment system. These charges vary based on the speed of the transfer, the amount involved, and the policies of the financial institution. For instance, RTGS often entails higher fees due to its real-time processing capability, compared to NEFT or IMPS. Fees may be either fixed or percentage-based, and while IMPS might have a nominal fee per transaction, NEFT might be free or carry lower fees, depending on the transfer amount and the specific terms set by the bank.

- Fund Settlement Speed: Fund Settlement Speed indicates how quickly the transferred funds are available in the recipient’s account after the transaction has been initiated. NEFT processes transactions in batches at designated intervals throughout the day, which means the settlement can occur within a few hours but may vary depending on the timing of the transaction. RTGS offers real-time settlement, ensuring that funds are transferred and settled instantly once the transaction is processed. Similarly, IMPS provides immediate settlement, allowing funds to reach the recipient in real-time, often within minutes of initiating the transfer.

NEFT (National Electronic Funds Transfer)

The full form of NEFT is National Electronic Funds Transfer. This system is used for transferring funds electronically between banks. NEFT processes transactions in a batch mode rather than in real-time, meaning transfers are not instant but are settled periodically throughout the day. The system is designed for relatively smaller transactions and is widely used due to its convenience and broad acceptance.

- Minimum Transfer Amount: NEFT allows transfers starting from as low as Rs.1, making it accessible for a wide range of transactions.

- Maximum Transfer Amount: There is no upper limit on the amount that can be transferred through NEFT, except in specific cases such as the Indo-Nepal Remittance Scheme. Under this scheme, the maximum amount for cash-based remittances is capped at Rs.50,000 per transaction for transfers within India and Nepal.

- Inward Transactions: NEFT does not levy charges for inward transactions, i.e., when funds are credited to the beneficiary’s account. This makes it cost-effective for receiving money.

- Outward Transactions: Charges for outward NEFT transactions (initiated by the sender) may vary depending on the bank. Some banks offer free NEFT transactions, while others might charge a nominal fee, which generally increases with the transaction amount.

- Timings: NEFT is available 24x7, allowing transactions to be initiated at any time of day or night. However, the actual settlement of transactions occurs in hourly batches during the operational hours of the banks. This means that while transactions can be initiated at any time, the actual credit to the beneficiary’s account might happen within a few hours, depending on the time of initiation and the bank's processing schedule.

RTGS (Real-Time Gross Settlement)

RTGS stands for Real-Time Gross Settlement. This payment system is designed for high-value transactions and provides immediate settlement. Unlike NEFT, RTGS transfers are processed in real-time, which means that once a transaction is initiated, the funds are transferred and credited to the recipient's account instantly. This system is preferred for large value transactions that require immediate settlement.

- Minimum Transfer Amount: To use RTGS, the minimum amount that can be transferred is Rs.2,00,000. This higher minimum limit reflects its use for larger transactions.

- Maximum Transfer Amount: There is no maximum limit for RTGS transactions, making it suitable for very high-value transfers. This feature makes RTGS a preferred option for substantial transactions that need immediate processing.

- Inward Transactions: RTGS does not impose charges on inward transactions (i.e., when funds are credited to the recipient’s account).

- Outward Transactions: For outward transactions, banks typically charge a fee based on the amount transferred. The charges are Rs.25 for transactions ranging from Rs.2,00,000 to Rs.5,00,000, and Rs.50 for amounts exceeding Rs.5,00,000. Additionally, Goods and Services Tax (GST) is applicable on these fees.

- Timings: RTGS operates 24x7, including weekends and holidays. This continuous availability ensures that high-value transactions can be processed and settled immediately, regardless of the time or day.

IMPS (Immediate Mobile Payment Service)

IMPS stands for Immediate Mobile Payment Service. This system allows for instant, real-time inter-bank transfers through mobile phones and online platforms. IMPS is designed to provide 24x7 accessibility, making it one of the most flexible and convenient payment systems available.

- Minimum Transfer Amount: The minimum amount that can be transferred via IMPS is Rs. 1, catering to both small and large transactions.

- Maximum Transfer Amount: The upper limit for IMPS transactions is generally capped at Rs.2,00,000. This limit ensures that IMPS can handle a wide range of transactions, from everyday payments to more substantial fund transfers.

- Transaction Charges: The charges for IMPS transactions are determined by individual banks and Prepaid Payment Instrument (PPI) providers. These charges can vary based on the financial institution's policies. Typically, IMPS transaction fees are nominal, reflecting the service's efficiency and real-time processing capability.

- Timings: IMPS operates 24x7 throughout the year, including bank holidays. This round-the-clock availability ensures that users can perform transactions at any time, making IMPS highly convenient for immediate transfers.

When to Choose NEFT, RTGS, or IMPS

Deciding between NEFT, RTGS, and IMPS depends on your specific needs and circumstances. Each payment system offers distinct benefits suited to different types of transactions.

When to Choose NEFT

NEFT (National Electronic Funds Transfer) is ideal if:

- You need to transfer money at non-urgent times: NEFT operates 24x7 but settles transactions in hourly batches. It is suitable for transactions that do not require immediate settlement.

- You are transferring smaller amounts: NEFT has no minimum limit for transactions and is often used for routine or less urgent transfers.

- You prefer offline options: NEFT supports offline transactions, allowing you to complete transfers by visiting a bank branch and filling out a transfer form.

When to Choose RTGS

RTGS (Real-Time Gross Settlement) is the best choice if:

- You need immediate and real-time settlement: RTGS provides instant fund transfers, making it suitable for high-value transactions that require immediate processing.

- You are transferring a large sum: RTGS is designed for high-value transactions with a minimum limit (e.g., Rs.2 lakh) and no maximum cap.

- Timing is critical: RTGS operates 24x7 but availability can depend on bank working hours and location. Choose RTGS if the transaction needs to be settled quickly within banking hours.

When to Choose IMPS

IMPS (Immediate Mobile Payments Services) is the optimal option if:

- You need a transfer at any time, including holidays: IMPS is available 24x7, including on weekends and public holidays, making it ideal for transactions that need to be completed outside regular banking hours.

- You require instant transfers: IMPS offers immediate settlement of funds, suitable for urgent transactions of any size up to Rs.2 lakh.

- You prefer online transactions: IMPS supports online transactions at any time, providing flexibility and convenience.

Key Considerations Before Initiating a Fund Transfer

- Timings: Depending on the bank, the timings for each transfer will vary. In the case of RTGS, depending on the bank and the location, the operating hours will vary. IMPS and NEFT payment modes are available 24x7.

- Transaction Fee: A separate fee is levied for the transfer of money. However, in case you are receiving the money, no fee is levied.

- GST: As per the latest norms, GST will be applicable on the transaction fee.

- Network: Both the banks must be part of the scheme for the transfer to take place.

Important Terms

Given below are some of the important things to know when using the different methods to transfer money:

- Fund Transfer Charges: Any transfer of money will involve certain charges. According to the Reserve Bank of India (RBI), the banks decide the charges that are levied for different fund transfers.

- Fund Settlement Speed: Depending on the type of transfer, the fund settlement speed will be different. The amount of time that is required to transfer money from one bank account to another bank account is the fund settlement speed.

- Service Availability: Depending on the type of transfer, the timings will vary. IMPS and NEFT are available 24x7, while RTGS operates only during banking hours.

- Fund Transfer Limit: The amount of money that can be transferred is the fund transfer limit. The limit will be different for different payment methods.

FAQs on Difference Between IMPS, NEFT & RTGS

- What is the minimum amount for an IMPS transfer?

The minimum amount transferable through an IMPS transfer can be as low as Re.1.

- Are there any extra charges for an IMPS transfer?

The Finance Ministry of India, in order to encourage digital transactions, has removed any kind of additional fee for an IMPS mode of money transfer.

- Which mode of payment between NEFT or RTGS is faster?

The faster form of payment depends on the urgency and the amount of your transaction. If you have a transaction above Rs.2 lakh, RTGS is a faster and more effective mode of payment. However, for any payments which are of lower amounts, NEFT is a more efficient mode of payment.

- Is RTGS mode of payment safe?

RTGS is a highly safe and secure mode of payment which is monitored by the government. It is even more secure as it is used majorly for money transfers of higher amounts.

- For which transactions is RTGS best to use?

RTGS is best suited for transactions having a minimum amount of Rs.2 lakh.

- Is IMPS a better mode of transfer than NEFT and RTGS?

IMPS allows immediate transfer of funds and this service can be accessed on bank/public holidays. That is why this service is considered better than NEFT and RTGS.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.