Postal Life Insurance Plans

"Postal Life Insurance is one of the earliest insurance schemes to have been launched in India. The most striking feature of a PLI scheme is that it fetches high returns (with bonus) for its policyholders at extremely low-priced premiums."

Postal Life Insurance represents a dependable and cost-effective insurance option.

What is Postal Life Insurance (PLI)?

Postal Life Insurance (PLI) was introduced on 1 February 1884 with the approval of the Secretary of State for India to benefit postal employees. Proposed by Mr. F.R. Hogg in 1881, it extended to Telegraph employees in 1888 and covered female employees from 1894, becoming the first insurer to do so. Initially, the insurance limit was Rs.4,000, now raised to Rs.50 lakh. PLI has grown from a few policies in 1884 to over 46 lakh by 2017. It covers government employees, PSU staff, defense personnel, and more. PLI also manages a Group Insurance Scheme for Gramin Dak Sevaks and is exempt under the Insurance Act, 1938 and LIC Act, 1956.

PLI Statistics

Year | Metric | Value |

2014–2015 | Policies Procured | 3,24,022 |

Sum Assured (New Policies) (₹ Cr) | 14,276.91 | |

Active Policies (Year-End) | 52,42,257 | |

Overall Sum Assured (₹ Cr) | 1,09,106.93 | |

Premium Income (₹ Cr) | 5,963.46 | |

2015–2016 | Policies Procured | 1,98,606 |

Sum Assured (New Policies) (₹ Cr) | 9,644.97 | |

Active Policies (Year-End) | 49,30,838 | |

Overall Sum Assured (₹ Cr) | 1,09,982.09 | |

Premium Income (₹ Cr) | 6,657.03 | |

2016–2017 | Policies Procured | 2,13,323 |

Sum Assured (New Policies) (₹ Cr) | 11,096.67 | |

Active Policies (Year-End) | 46,80,013 | |

Overall Sum Assured (₹ Cr) | 1,13,084.81 | |

Premium Income (₹ Cr) | 7,233.89 | |

2017–2018 | Policies Procured | 2,13,000 |

Sum Assured (New Policies) (₹ Cr) | 11,096.68 | |

Active Policies (Year-End) | 46,80,000 | |

Overall Sum Assured (₹ Cr) | 1,13,084.81 | |

Premium Income (₹ Cr) | 7,233.89 | |

2018–2019 | Policies Procured | 2,88,000 |

Sum Assured (New Policies) (₹ Cr) | 17,048.92 | |

Active Policies (Year-End) | 44,03,000 | |

Overall Sum Assured (₹ Cr) | 1,37,895.74 | |

Premium Income (₹ Cr) | 7,978.35 | |

2019–2020 | Policies Procured | 2,46,000 |

Sum Assured (New Policies) (₹ Cr) | 15,049.67 | |

Active Policies (Year-End) | 63,08,000 | |

Overall Sum Assured (₹ Cr) | 1,79,150.61 | |

Premium Income (₹ Cr) | 7,035.50 | |

2020–2021 | Policies Procured | 2,45,000 |

Sum Assured (New Policies) (₹ Cr) | 15,776.00 | |

Active Policies (Year-End) | 78,31,000 | |

Overall Sum Assured (₹ Cr) | 2,09,190.06 | |

Premium Income (₹ Cr) | 8,087.91 | |

2021–2022 | Policies Procured | 3,08,000 |

Sum Assured (New Policies) (₹ Cr) | 18,546.32 | |

Active Policies (Year-End) | 63,57,000 | |

Overall Sum Assured (₹ Cr) | 2,12,546.59 | |

Premium Income (₹ Cr) | 6,576.10 | |

2022–2023 | Policies Procured | 15,78,960 |

Sum Assured (New Policies) (₹ Cr) | 20,483.42 | |

Active Policies (Year-End) | 66,97,000 | |

Overall Sum Assured (₹ Cr) | 2,43,454.00 | |

Premium Income (₹ Cr) | 7,468.51 | |

2024–2025 | Policies Procured | 4,75,962 |

Sum Assured (New Policies) (₹ Cr) | 26,085.25 | |

Active Policies (Year-End) | 74,83,073 | |

Overall Sum Assured (₹ Cr) | 3,04,399.70 | |

Premium Income (₹ Cr) | 9,456.23 |

Features of Postal Life Insurance Policy

A policyholder can avail the following benefits:

- Nomination facility: The policyholder can nominate his/her beneficiary, and can also make changes to the nomination.

- Loan facility: A Loan facility is offered in accordance with this policy. When an Endowment Assurance policy reaches three years of maturity, or when a Whole Life Insurance policy reaches four years of policy period, the policyholder can pledge the policy as collateral to the Heads of the Region or Circle on behalf of the President of India. Under this plan, assignment facilities are also offered.

- Policy Revival: A policyholder can revive a lapsed policy. The policy can be revived when policy has lapsed under the following conditions -

- Policy has lapsed after six successive non-payments of premium with the policy being in effect for less than three years.

- Policy has lapsed after 12 successive non-payments of premium where policy has been in effect for more than three years.

- Duplicate Policy Document: If the policyholder misplaces the original policy paper, a duplicate will be sent to them. This also holds true if the insured requests a duplicate policy document because the original has been destroyed by fire, destruction, or mutilation.

- Conversion of Policy: It is possible to change this insurance from Whole Life Assurance to Endowment Assurance. In accordance with the rules and specifications provided by the insurer, an Endowment Assurance Policy may be converted to another Endowment Assurance plan.

Benefits of Investing in PLI

Some of the other benefits and discounts offered under the Postal Life Insurance scheme are as follows:

- The insured can avail themselves of income tax exemption as provided under Sec. 80C of the Income Tax Act.

- Additional facilities offered under this policy are Assignment, Loan, Conversion, Surrender and Paid-Up Value options.

- The policy can be transferred to any Circle within India, at no additional charges.

- Passbook facility is available to track the payment of premium and in case of loan transactions, etc.

- Premium can be paid on an annual, half-yearly and monthly basis. When the payment is due, the policyholder can make a payment on any working day.

- If you make an advance premium payment for a policy period of six months, you can avail yourself of a discount a discount on premium worth 1% of the value.

- If you make an advance premium payment for a policy period of 12 months, you can avail a discount on premium worth 2% of the value.

- Nomination facility is available.

- Since this scheme has a centralized accounting facility, the claims process is quick and easy.

Postal Life Insurance Eligibility

- Central Government

- Defence Services

- Paramilitary forces

- State Government

- Local Bodies

- Government-aided Educational Institutions

- Reserve Bank of India

- Public Sector Undertakings

- Financial Institutions

- Nationalized Banks

- Autonomous Bodies

- Extra Departmental Agents in Department of Posts

- Employees Engaged/ Appointed on Contract basis by central/ State Government where the contract is extendable

- Employees (teaching/non-teaching staff) of all private educational institutions/schools/colleges etc. affiliated to recognized Boards (recognized by Centre/State Government) of Secondary/Senior Secondary education i.e. CBSE, ICSE, State Boards, Open School, etc.

- Professionals such as Doctors (including Doctors pursuing Post Graduate degree courses through any Govt/Private Hospitals, Residents Doctors employed on contract/permanent basis in any Govt/Private Hospitals etc)

- Engineers (including Engineers pursuing Master’s/Post Graduate degree after having passed GATE entrance test)

- Management ConsultantsCharted Accountants registered with Institute of Charted Accountants of India

- Architects

- Lawyers registered with Bar Council of India/States

- Bankers working in Nationalised Banks and its Associate Banks

- Foreign Banks

- Regional Rural Banks

- Scheduled Commercial Banks including Private Sector Banks etc.

- Employees of listed companies of NSE (National Stock Exchange) and Bombay Stock Exchange (BSE) in IT, Banking & Finance, Healthcare/Pharma, Energy/Power, Telecom, Infrastructure Sector etc, where employees are covered for Provident Fund/Gratuity and/or their leave records are maintained by the establishment.

- Employees of all scheduled Commercial Banks

- Employees of Credit Co-operative Societies and other Co-operative Societies registered with Government under the Co-operative Societies Act and partly or fully funded from the Central, State Government, RBI (Reserve Bank of India), SBI (State Bank of India), Nationalized Banks or NABARD (National Bank for Agriculture and Rural Development) and other such institutions notified by Government.

- Employees of deemed Universities an educational institute accredited by recognized bodies such an All-India Council of Technical Education, National Assessment and Accreditation council, Medical Council of India etc.

Advantages of Postal Life Insurance Policies

The advantages of Postal Life Insurance policies are listed below:

- Cost-Effectiveness:

- Provides significant returns (in the form of incentives) for low premium payments.

- One of the most affordable life insurance options available.

- Duplicate Policy Bond: A duplicate policy bond can be easily issued if the original is lost, damaged, or destroyed.

- Beneficiary Flexibility:

- Policyholders can designate their preferred beneficiaries.

- Beneficiary details can be updated or changed anytime during the policy term.

- Policy Conversion:

- The policy can be converted from whole life insurance to endowment assurance.

- The sum assured can be adjusted according to preset guidelines.

- Loan Facility: Policyholders can avail themselves of a loan against their policy after maintaining coverage for at least three years.

Types of Postal Life Insurance Schemes

There are seven different life insurance policies under PLI:

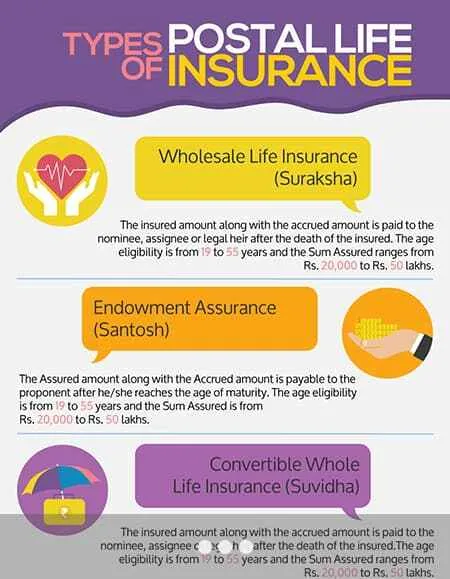

1. Whole Life Insurance (Suraksha)

The whole life insurance scheme from Postal Life Insurance has the following features and requirements:

- Scheme: Assured amount + accrued bonus is paid to nominee, assignee or legal heir, after the insured expires.

- Age Eligibility: Minimum: 19 years Maximum: 55 years

- Policy Conversion: Policy can be converted to an Endowment Assurance policy after completion of a year and before the insured turns 57 years of age.

- Minimum Sum assured: Rs.20,000

- Maximum Sum Assured: Rs.50 lakh

- Loan Facility: Available after four years of completion

- Policy Surrender: Once the policy has been completed for three years, it can be returned. Five years prior to completion, the policy will not be eligible for the bonus; however, if the policy is assigned for a loan or surrendered, a commensurate bonus on the lowered amount assured may be accumulated.

- Conversion Option: Can be converted into an Endowment Assurance Policy up to 59 years of age of the insurant.

- The date of conversion should not fall within one year of the cessation of premium payment or the date of maturity.

- Premium Paying Age Options: Can be opted for at 55, 58, or 60 years.

- Surrender Benefit: Proportionate bonus on the reduced sum assured is paid if the policy is surrendered.

- Last Declared Bonus: Rs.76 per Rs.1,000 sum assured per year.

2. Endowment Assurance (Santosh)

The endowment assurance scheme from Postal Life Insurance has the following features and requirements:

- Scheme: Assured amount + accrued bonus is paid to proponent when he or she attains the pre-decided age of maturity. The sum amount insured and bonus is payable to the assigned, nominee or legal heir in case of unprecedented death.

- Age Eligibility: Minimum: 19 years, Maximum: 50 years

- Policy Conversion: Policy can be converted to any other Endowment Assurance policy under the rules and regulations of PLI.

- Minimum Sum assured: Rs.20,000

- Maximum Sum Assured: Rs.50 lakh

- Loan Facility: Available after four years of completion

- Policy Surrender: Policy can be surrendered after three years of completion. The policy will not be eligible for the bonus if assigned or loaned five years before completion else a proportionate bonus on the reduced amount assured can be accrued if the policy is assigned for a loan or surrendered.

- Last declared Bonus: Rs.52 per Rs.1000 sum assured per year

3. Convertible Whole Life Insurance (Suvidha)

The convertible whole life insurance scheme from Postal Life Insurance has the following features and requirements:

- Scheme: Assured amount + accrued bonus is paid to proponent when he or she attains the pre-decided age of maturity. The sum amount insured and bonus is payable to the assigned, nominee or legal heir in case of unprecedented death.

- Age Eligibility:

- Minimum:19 years

- Maximum: 50 years

- Policy Conversion: Policy can be converted to Endowment Assurance after five years but must not exceed 56 years. If the option for conversion is not used, the policy will automatically turn into a Whole Life Insurance by default.

- Minimum Sum assured: Rs.20,000

- Maximum Sum Assured: Rs.50 lakhs

- Loan Facility: Available after four years of completion

- Policy Surrender: Policy can be surrendered after three years of completion. The policy will not be eligible for the bonus if assigned or loaned five years before completion, else a proportionate bonus on the reduced amount assured can be accrued if the policy is assigned for a loan or surrendered.

- Lastly declared Bonus: Rs.76 per Rs.1000 per year (for WLA policy if not converted to Endowment Assurance) and on conversion, the bonus will be payable for the Endowment Assurance.

4. Anticipated Endowment Assurance (Sumangal)

The anticipated endowment assurance scheme from Postal Life Insurance is best suited for people who expect periodical returns, and has the following features and requirements:

The anticipated endowment assurance scheme from Postal Life Insurance is best suited for people who expect periodical returns, and has the following features and requirements:

- Scheme: Money back policy

- The policy term offered is 15 and 20 years.

- Minimum age: 19 years

- Maximum age:

- For 15 years policy term: 45 years

- For 20 years policy term: 40 years

- Survival benefits are paid periodically under the following conditions:

- 15 Years Term Policy:

- On completion of 6 years, 9 years and 12 years, 20% will be provided and 40% with accrued bonus on maturity.

- 20 Years Term Policy:

- On completion of 8 years, 12 years and 16 years, 20% will be provided and 40% with accrued bonus on maturity.

- Maximum Sum Assured: Rs. 50 lakh

- Such payments, in the event of unexpected death of the insured, will not be taken into consideration and the full sum assured + accrued bonus is payable to the assignee or legal heir.

- Last bonus declared: Per Rs.1000 sum assured per year, the bonus offered is Rs.48.

5. Joint Life Endowment Assurance (Yugal Suraksha)

The joint life assurance from Postal Life Insurance requires any spouse to be eligible for PLI policies. The scheme has the following features and requirements:

- Scheme: Both spouses are covered to the extent of sum assured + accrued bonus with only one premium.

- Age Eligibility:

- Minimum: 21 years

- Maximum: 45 years

- Policy Conversion: Policy can be converted to any other Endowment Assurance policy under the rules and regulations of PLI.

- Minimum Sum assured: Rs.20,000

- Maximum Sum Assured: Rs.50 lakh

- Maximum age of elderly person: 45 years

- Minimum policy term: 5 years

- Maximum policy term: 20 years

- Loan Facility: Available after three years of completion

- Policy Surrender: Once the policy has been completed for three years, it can be returned. If the policy is assigned or lent out five years before it is completed, it will not be eligible for bonuses; but, if it is loaned out or relinquished, a commensurate bonus on the lesser amount insured may be earned.

- If the policy is surrendered, a proportionate bonus on reduced sum assured is paid.

- In the event of death of spouse or main policy holder, the policy will provide death benefits are paid to either of the survivors.

- Last bonus declared: Per Rs.1000 sum assured per year, Rs.52 is paid.

6. Scheme for Physically Handicapped Person

Any of the above -mentioned life insurance policies can be availed by physically handicapped applicants, under this scheme. However, premium prices are dependable on the nature and extent of handicap which will be determined through the mandatory medical examination.

7. Children Policy (Bal Jeevan Bima)

There is a separate policy for the children of policyholders which can be taken. Maximum two children in a family are eligible for this scheme:

- Main Policyholder Age Eligibility: Maximum: 45 years

- Children Age Eligibility: Minimum: five years Maximum: 20 years

- Maximum Sum Assured: Rs. 3 lakh or equivalent to the sum assured of the main policy holder whichever is less

- Loan Facility:Not available

- No premium is payable, in case death of main policy holder and full sum assured + accrued bonus paid after the completion of the policy term.

- Main policyholder is responsible for payments for the Children Policy.

- No mandatory medical examination required for children.

- Does not provide surrender facility.

- Policy bonus calculated at the rate applicable to Endowment Policy. The POIF Rules applicable at the time, shall be applicable to the Children Policy.

Postal Life Insurance Scheme Bonus

Here are the Postal Life Insurance Bonus rates

Type of Insurance Policy | Rate of Bonus |

Endowment Assurance (EA) | Rs.52 per Rs. 1000 of the sum assured |

Whole Life Assurance (WLA) | Rs.76 per Rs. 1000 of the sum assured |

Convertible Whole Life Policies | Whole life bonus rate is applicable. However, on conversion, the applicable rate will be equal to the endowment bonus rate. |

Anticipated Endowment Assurance | Rs. 48 per Rs. 1000 of the sum assured |

Postal Life Insurance Customer Guidelines

Here are a few guidelines to those who invest in a Postal Life Insurance policy:

- Policy Bond Importance:

- The policy bond is crucial for claim settlements and other service-related matters.

- Keep it safe and inform your loved ones about its location for easy access when needed.

- Premium Payments:

- Ensure all premium payments are made regularly and on time.

- Timely payments are essential to maintain life insurance coverage and avoid policy lapses.

- Policy Number:

- The Policy Bond contains a unique 13-digit Policy Number.

- Keep a record of this number for future reference and communication regarding the policy.

- Registration of Contact Information:

- Policyholders must register their email address and mobile number to access their policy details.

- Registration may require a visit to the nearest Post Office to provide personal details and credentials.

- Policy Portability: The Postal Life Insurance policy can be transferred to another location within India if the policyholder relocates due to work.

- Nomination:

- Ensure your PLI policy has a valid nominee.

- If no nominee is listed, the benefits of life insurance may not be properly allocated.

- You can update or add a nominee to your policy at any time.

Postal Life Insurance Forms

The following proposal forms are available online at the Postal Life Insurance website, for download:

- RPLI (Rural Postal Life Insurance) Form

- RPLI Medical Form

- Child Proposal Form

- Yugal Suraksha Form

- WLA (Whole Life Assurance), CWLA (Convertible Whole Life Assurance), EA (Endowment Assurance) and AEA Form

- Loan Application Form

- Claims Form

- Form for Revival of Lapsed Policy

- Maturity Claim Form

- Personal Bond of Indemnity

- Survival Benefit Claim Form

Postal Life Insurance Forms

The following proposal forms are available online at the Postal Life Insurance website, for download:

- RPLI (Rural Postal Life Insurance) Proposal Form

- RPLI Medical Proposal Form

- Maturity - Survival Benefit Claim Form

- Loan Application form

- Personal Bond of Indemnity for Death Claim

- Nomination Form

- Surrender Application Value

- Children Policy Proposal Form

- AEA Survival Benefit Form

- Revival Application form

- AEA Survival Benefit Form

- Death Claim Form

- CWA Conversion Form

- Personal Bond of Indemnity for Maturity or Survival Benefit Claim

- Indemnity Bond for Death Claim

- Assignment and re-assignment form

- Request form for correction/change in Policy holders’ Name or correction in Nominees’/Appointees’ Name

- Consent form for Defence Services Personnel for payment of Postal Life Insurance (PLI) renewal Premium through their Pay Recovery mode

An online premium calculator enables Postal Life Insurance policyholders to estimate their premium payments by inputting details such as age, policy type, and desired sum assured. For instance, entering a sum assured of Rs.5 lakh, date of birth, and maturity age into the calculator provides an estimated premium and maturity value. Available policy types include Endowment Assurance (Santosh), Whole Life Assurance (Suraksha), and others. After submitting the required information, the calculator displays the estimated premium amount, aiding in informed decision-making.

Postal Life Insurance Login

Before logging into the PLI website, customers need to follow the steps for customer registration and those are mentioned below:

- Click on the official website (https://pli.indiapost.gov.in/CustomerPortal/Home.action)

- Click on ‘Login’ option at the top right corner of the page.

- Click on ‘Generate Customer ID’

- Provide the necessary details

- Click on ‘Submit’

- To set the password, customers need to click on the first-time registration link received on their registered email id

- Customers can change or reset their password by clicking on ‘Forgot Password’ option.

To log into the portal after completing the registration process, follow the steps mentioned below:

- Visit the official portal of Postal Life Insurance (https://pli.indiapost.gov.in/CustomerPortal/PSLogin.action)

- Enter the customer ID and password

- Enter the code displayed

- Click on ‘Login’

Postal Life Insurance Online Payment

Customers can make payment for Postal Life Insurance through various online payment modes.

- Mobile App or Online Portal: PLI policyholders can pay premiums using the Indian Post Payments Bank (IPPB) app or through the India Post online portal.

- Net Banking: Premium payments can be made through net banking by selecting the net banking option during the payment process.

- UPI Apps: Policyholders can also use UPI apps like Google Pay, PhonePe, or Paytm to make premium payments.

Postal Life Insurance Policy Status

The steps to check the PLI policy status are mentioned below:

- Online Account Access:

- Existing Postal Life Insurance (PLI) policyholders can create an online account on the PLI website.

- After setting up the account, they can log in using their credentials to check policy status and other details conveniently.

- Phone Assistance: Policyholders can also check their policy status by calling the toll-free number 1800 266 6868.

Contact Details

The contact details for PLI are mentioned below:

Complaint e-mail id: plipg.dte@indiapost.gov.in Toll Free No. – 18002666868

Note: The individuals can contact the customer center every day except Sundays and Gazetted holidays from 9 a.m. to 6 p.m.

FAQs on Postal Life Insurance (PLI)

- What is the main differentiation between Postal Life Insurance and other Insurance?

PLI can be used only by Government and Semi-Government employees. PLI is also the only insurer that offers policyholders high bonuses at reasonably-priced premiums.

- Who are all the people, eligible to use this insurance?

The PLI policy is applicable to individuals who work for the Central Government, Defence Services, Reserve Bank of India, Public Sector Undertakings, Financial Institutions, Paramilitary Forces, State Government, Local Bodies, Nationalised Banks, Autonomous Bodies, Educational Institutions/Government-aided, and Extra Departmental Agents in Department of Post.

- Does Postal Life Insurance have any guarantor?

Yes, Government of India, guarantees Postal Life Insurance

- Do both spouses need to be Government employees to avail Postal Life insurance?

No, husband and wife can participate in the "Yugal Suraksha" plan if one works for the government. Although the initial premiums are a little hefty, both are covered under the plan.

- If the insured quits Government service, can they continue using the scheme?

Yes, he or she can, as long as the insured keeps paying the premiums in any of the post offices around the country.

- Can an insured, revive a lapsed policy?

Yes, under the following conditions: A lapsed postal insurance policy can be revived after six unpaid premiums if it remains in force for less than three years. It can also be revived after 12 unpaid premiums if it remains in force for more than three years.

- Can one surrender their life insurance from PLI?

Yes one can do that. However, the surrender value is subjective to the surrender factor, type and term of policy.

- Can an insured avail loan facility from PI?

Yes, it can do so depending upon the type of insurance scheme and the tenure of the insurance, when the insured wishes to avail the loan.

- How many child policies in a family, can a main policyholder take?

The family of the main policy holder can have up to 2 children insured under this policy.

- What is the maximum insurance amount for a policy from Postal Life Insurance?

The maximum amount that can be assured under a policy from Postal Life Insurance is Rs. 5 lakh.

- Is PLI a tax exempted insurance provider?

Yes, PLI is a tax exempted insurance provider as stipulated under Section 118 C of the Insurance Act, 1938 and also under Section 44 D of LIC Act of 1956.

- When was the Postal Life Insurance Scheme introduced?

The Postal Life Insurance (PLI) scheme was introduced in India in 1884, under the British rule. This makes it the oldest insurance provider in India

- I am an employee in a private sector enterprise. Can I avail this policy?

No, salaried individuals in the private sector are not eligible to avail the Postal Life Insurance policy.

- work in a government aided organization and my husband works in the private sector. Can be both jointly avail the PLI scheme?

Yes, A government employee and spouse can jointly get a PLI policy under the “Yugal Suraksha” scheme. An additional premium will have to be paid in order to cover the two individuals under this assurance policy.

- What is the minimum age limit for entry?

The minimum age limit for entry is 19 years.

- What is the maximum age limit for entry?

The maximum age limit for entry is 55 years.

- Where can I find my PLI policy number?

Your PLI policy number will be available in the policy document/ bond. This is a six-digit number that is required for all future transactions, including payment of premium.

- Can I pay the Postal life insurance premium online?

Yes, you can pay the Postal Life Insurance policy premium online or via ECS (Electronic Clearance System).

- What is the interest on loan availed against the policy?

The interest on loan availed against the PLI policy is 10% per annum. This is calculated based on a 6 month period.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.