Credit Card Fees and Charges

It is said that nothing in life is free. But everyone of us clamour to procure products and services that come with the term 'free'. However, there are a few terms and conditions that come with each of these 'free products'. Similarly if anyone is enticed into purchasing a credit card for free, they must understand that there a few fees and charges attached to it and in effect, are not completely free. Most of these additional charges may not be revealed upfront to customers but will be charged nevertheless.

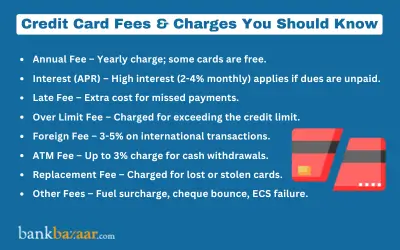

Various Fees and Charges Applicable to Credit Card

Prior to acquiring credit cards, customers must first be aware of the following fees and charges that may be applicable.

1. Annual Fee

This is the annual maintenance fee that is applicable for a credit card. In most cases, when individuals are offered free credit cards, it may mean that the joining fee and the annual charge has been waived for a period of one year but may be applicable from the following year. Prior to procuring the card, customers must confirm if their annual maintenance charge is waived for a year or for life.

2. Interest Rate (APR)

Credit card bill for every month will show the total amount that is due and the minimum amount that is payable. Many individuals choose to only pay the minimum payable amount assuming that the rest can be paid later. But this practise will only result in their falling into a debt trap. Also, 2% to 4% interest rate is charged per month on this remaining amount.

The monthly rate of interest is generally annualised to arrive at an APR or annualised percentage rate of 36% to 38%, which is very high. In addition to the nominal rate of interest, this annualised percentage rate can result in quite a burden for the individual. Hence, all potential credit card holders will have to strive to pay their bills in full and not just the minimum amount due.

GST: All credit card transactions are subject to GST as per prevailing GST laws.

3. Late Payment Fee

In case a cardholder does not pay his/her due in time, additional charges will be levied which is called the late payment charge. This is applicable when the customer defaults in their payment of monthly credit card due post the due date. This is a flat fee amount and is not dependent on the interest charges.

Statement Balance | Late Payment Fee |

Less than Rs. 100 | Nil |

Rs. 100 to Rs. 500 | Rs. 100 |

Rs. 501 to Rs. 5,000 | Rs. 400 |

Rs. 5,001 to Rs. 10,000 | Rs. 500 |

Rs. 10,001 and above | Rs. 750 |

4. Overdraft Fee

When customer exceeds the monthly credit limit that is applicable on their credit card, these charges are applicable.

5. Foreign Transaction Fee

In case customers make an overseas transaction using their credit cards, foreign transaction charges are levied. This is around 3% to 5% of the overseas transaction and is then converted to INR based on the exchange rate depending on the date of transaction.

6. Fee on Purchasing Petrol

Purchasing rail tickets or petrol using credit cards attracts additional charges. This is a set percentage of the amount that is spent.

7. Outstation Cheque Fee

In case individuals use outstation cheques to settle credit card bills, additional charges would be levied. This is a fixed percentage based on the slab within which the bill amount falls under.

8. Dishonour of ECS Charges/Cheque Bouncing

In case a cheque that has been issued for the payment of credit card bills bounces, additional charges will be applicable.

9. Lost Card Fee

In case a customer has lost his/her credit card, a new card will be issued once penalty charges have been paid.

10. ATM Withdrawal Fee

Customers have the option of withdrawing money from the ATM using their credit card. However, the transaction charges applicable would be around 2.5% of the cash advance. In addition to this, interest on the cash from the date of withdrawal will be due and this interest cost may vary from 24% to 46% per year.

Therefore, although credit cards come with numerous advantages, customers must ensure that they understand all the hidden charges that come with it, prior to availing one.

FAQs on Credit Card Fees and Charges

1.Are there any hidden charges for credit charges?

In general, there are no hidden charges. The card issuers are transparent about the fees and charges are that are applicable to a credit card.

2.Can my credit card be charged even without the CVV number?

Your credit card will not be charged without the CVV number if you are making online transactions. However, if you are using it at POS terminals or swiping it, you will not be required to provide the CVV number. You will not be required to use your CVV number in the case of contactless payments as well.

3.Do I get charged for using my credit card?

No, there are no direct fee which is charged for using your credit card. However, a credit card might come with annual fees.

4.Is it possible to get a credit card for free?

Yes, it is possible to get a credit card for free. Many card providers offer lifetime free credit cards where you will not be required to pay any annual fee for the cards. If you are eligible for a lifetime free credit card, it can be availed free of cost.

5.How is the credit balance decided when I apply for a credit card?

The card issuers consider a number of factors before setting up the credit balance on a credit card. Your eligibility for the card along with your credit history, loan repayment history, credit score, etc. are taken into consideration for the purpose of deciding the credit balance.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.